CARPE DIEM

Professor Mark J. Perry's Blog for Economics and Finance

Friday, November 30, 2007

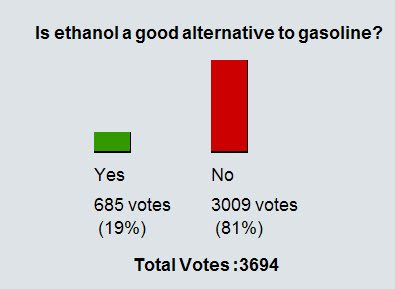

81% of Public Are Ethanol Atheists, Thank God

Results above are from the Wall Street Journal's online poll, accompanying Wednesday's article "Ethanol Craze Cools As Doubts Multiply."

Results above are from the Wall Street Journal's online poll, accompanying Wednesday's article "Ethanol Craze Cools As Doubts Multiply." As Jerry Taylor of the Cato Institute said, "The closest thing we have to a state religion in America today isn't Christianity. It's corn. It's hard to think of a more wrongheaded and ruinous policy than the program to subsidize ethanol. It's time for the voters to rethink their membership in this political cult."

Apparently, 81% of WSJ readers are corn atheists, and have resigned from their membership in the Church of Corn Ethanol, if in fact they ever actually did worship at the altar of ethanol the way politicians, corn farmers and lobbyists do.

(HT: Clover Aguayo)

$14,000,000,000,000 Is A Lot of Economic Output

Greg Mankiw has an interesting post "A Quick Quiz," which made me think of the map above (click to enlarge) that was featured on a previous CD post and other blogs and websites about 9 months ago. The map shows the 50 U.S. states renamed for countries that have similar economic output, measured by GDP.

Greg Mankiw has an interesting post "A Quick Quiz," which made me think of the map above (click to enlarge) that was featured on a previous CD post and other blogs and websites about 9 months ago. The map shows the 50 U.S. states renamed for countries that have similar economic output, measured by GDP.Bottom Line: The $14 trillion of GDP in the U.S. is a LOT of economic output.

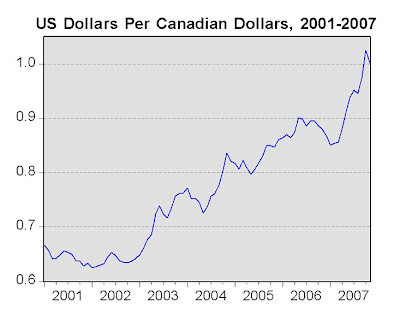

"Dollar Punishes Exporters"

No, not the U.S. dollar, which is stimulating our exports to record levels. This story is about the Canadian dollar, which has appreciated by about 50% since 2001 vs. the U.S. dollar, and has started to choke off Canadian exports.

Current account surplus plunges to a 4-year low as the mighty loonie crimps Canada's performance

TORONTO -- Canadians were given fresh evidence yesterday the soaring loonie is wreaking havoc on this country's trade performance after Statistics Canada reported our current account surplus with the rest of the world plunged by $5.3 billion in the third quarter to $1 billion.

The current account is the broadest measure of Canada's trade performance and includes trade, services and investments. This latest July-September snapshot shows the higher dollar, averaging about 95.7 cents (U.S.) during the period, pummelled exports and shoved this country's current account surplus down to its lowest level in four years.

Since the currency only reached parity with its U.S. counterpart during the tail end of the period, some economists are warning what's left of that surplus could disappear entirely during the current quarter.

We Educate Foreign Students, Then Deport Them

A mere 65,000 H-1B visas for foreign professionals are allocated in the U.S. each year. And this year, as in the previous four, the quota was exhausted almost as soon as the applications became available in April. This effectively means that more than half of all foreign nationals who earned advanced degrees in math and science in 2007 have been shut out of the U.S. job market.

It makes little sense for our universities to be educating talented foreign students, only to send them packing after graduation. Current policies have MIT and Stanford educating the next generation of innovators -- and then deporting them to create wealth elsewhere.

~From today's WSJ editorial American Brain Drain

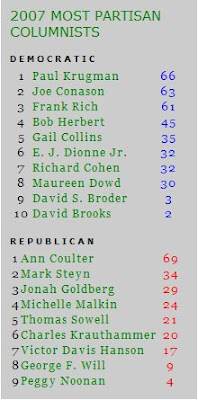

Partisan Columnists: #1 Coulter, #2 Krugman

Lying in Ponds is a website that tracks and ranks the Democratic and Republican biases of a selection of regular political columnists. The top graph above for 2007 shows that Paul Krugman is the most partisan liberal columnist and Ann Coulter is the most partisan conservative columnist.

Lying in Ponds tries to draw a fundamental distinction between ordinary party preference and excessive partisanship. The presence of an excessive partisan bias transforms journalism into advertising, too distorted and unreliable to be useful in any serious political debate. Political parties are a healthy, essential part of American democracy; excessive partisanship is not. The methods used here are an attempt to quantify only partisanship, and are not intended as a more general guide to the quality of a columnist.

For example, an analysis of columns in 2007 by Ann Coulter shows that she has had 463 negative comments about Democrats, and only 10 positive comments (about a 46:1 ratio). Paul Krugman has had 603 negative comments so far this year about Republicans, and only 31 positive comments (almost a 20:1 ratio). In comments about Republicans, Coulter's positive comments outnumber negative comments by about 2.5 to 1, and Krugman's positive comments about outnumber negative comments by about 3.5 to 1 (see bottom chart, click to enlarge).

According to Lying in Ponds, "A partisan pundit is one whose opinions nearly always break down along party lines. Assuming that it's unlikely that a partisan columnist is actually formulating the party platform, then the partisan columnist's opinions must therefore derive from allegiance to the favored party or hostility to the other party rather than from independent thought. The views of pundits who are excessively partisan cannot be taken seriously, because their ulterior motives or uncontrolled biases are certain to frequently contaminate their judgements."

Conclusion: Don't take Krugman and Coulter too seriously.

Lying in Ponds tries to draw a fundamental distinction between ordinary party preference and excessive partisanship. The presence of an excessive partisan bias transforms journalism into advertising, too distorted and unreliable to be useful in any serious political debate. Political parties are a healthy, essential part of American democracy; excessive partisanship is not. The methods used here are an attempt to quantify only partisanship, and are not intended as a more general guide to the quality of a columnist.

For example, an analysis of columns in 2007 by Ann Coulter shows that she has had 463 negative comments about Democrats, and only 10 positive comments (about a 46:1 ratio). Paul Krugman has had 603 negative comments so far this year about Republicans, and only 31 positive comments (almost a 20:1 ratio). In comments about Republicans, Coulter's positive comments outnumber negative comments by about 2.5 to 1, and Krugman's positive comments about outnumber negative comments by about 3.5 to 1 (see bottom chart, click to enlarge).

According to Lying in Ponds, "A partisan pundit is one whose opinions nearly always break down along party lines. Assuming that it's unlikely that a partisan columnist is actually formulating the party platform, then the partisan columnist's opinions must therefore derive from allegiance to the favored party or hostility to the other party rather than from independent thought. The views of pundits who are excessively partisan cannot be taken seriously, because their ulterior motives or uncontrolled biases are certain to frequently contaminate their judgements."

Conclusion: Don't take Krugman and Coulter too seriously.

Thursday, November 29, 2007

GM's India Market Share Rises, Sales Up By 150%

NEW DELHI: General Motors Corp. opened its first design studio in India on Thursday, a move intended to support the U.S. automaker's efforts to expand its presence in the country.

The studio in the southern Indian city of Bangalore, where GM already has a research and development center, will "contribute to the mid-cycle enhancement of existing models and the advanced design of future products," the company said.

The studio, which will initially have about 60 employees, comes at a time when GM is having some success after struggling for years to penetrate the Indian car market.

The company introduced the low-cost Chevrolet Spark this year (pictured above), which is proving popular among young buyers. In the past seven months, the U.S. automaker has sold nearly 2 1/2 times the number of cars it sold in the country in the same period last year.

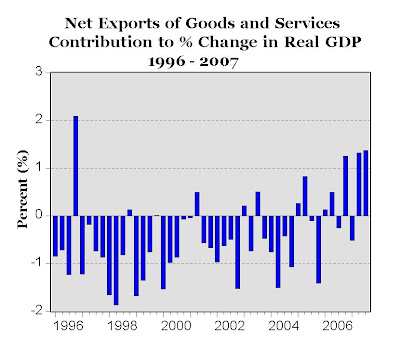

Net Exports Contribution to GDP Highest in 10 Yrs.

The contribution of net exports of goods and services to real GDP growth in the third quarter was revised upward to 1.37% (from the original estimate of 0.90%), and contributed to half of the 1% upward revision of real GDP growth from 3.9% to 4.9%. Further, it was the largest percent contribution to real GDP growth since the fourth quarter of 1996 (see chart above). Further, without the -1.03% decline in housing, real GDP growth would have been 5.93% in the third quarter. Read more here from First Trust Advisors.

The contribution of net exports of goods and services to real GDP growth in the third quarter was revised upward to 1.37% (from the original estimate of 0.90%), and contributed to half of the 1% upward revision of real GDP growth from 3.9% to 4.9%. Further, it was the largest percent contribution to real GDP growth since the fourth quarter of 1996 (see chart above). Further, without the -1.03% decline in housing, real GDP growth would have been 5.93% in the third quarter. Read more here from First Trust Advisors.Summer Real GDP Growth Highest in 4 Years

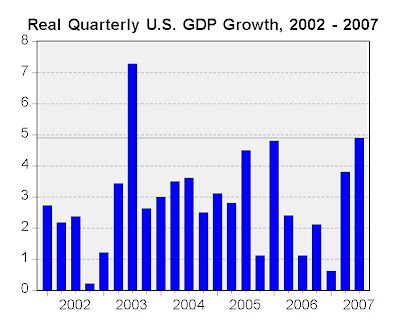

WASHINGTON (MarketWatch) -- The U.S. economy expanded at the fastest pace in four years during the third quarter, growing at a real annual rate of 4.9%, the Commerce Department reported today in making its second estimate of growth for the three-month period.

The 4.9% growth rate during the summer of 2007 was only the second time in the last 29 quarters that the economy expanded at close to a 5% rate, and it was the strongest growth rate for the economy in 4 years (see chart above).

The 4.9% growth rate during the summer of 2007 was only the second time in the last 29 quarters that the economy expanded at close to a 5% rate, and it was the strongest growth rate for the economy in 4 years (see chart above).

End All Government Involvement in Education

Prayers in school, sex education and "intelligent design" are contentious school issues. I believe parents should have the right to decide whether their children will say a morning prayer in school, be taught "intelligent design" and not be given school-based sex education. I also believe other parents should have the right not to have their children exposed to prayers in school, "intelligent design" and receive sex education.

The reason why these issues produce conflict is because education is government-produced. That means there's either going to be prayers or no prayers, "intelligent design" or no "intelligent design" and sex education or no sex education. If one parent has his wishes met, it comes at the expense of another parent's wishes. The losing parent either must grin and bear it or send his child to a private school, pay its tuition and still pay property taxes for a school for which he has no use.

The solution is to take the production of education out of the political arena. The best way is to end all government involvement in education. Failing to get government completely out of education, we should recognize that because government finances something it doesn't follow that government must produce it. Government finances F-22 Raptor fighter jets, but there's no government factory producing them. The same could be done in education. We could finance education collectively through tuition tax credits or educational vouchers, but allow parents to choose, much like we did with the GI Bill. Government financed the education, but the veterans chose the school.

~From George Mason economist Walter Williams' latest column

Quote of the Day II

The writers' strike basically shapes up as a couple of third cousins at Thanksgiving dinner arguing over who gets a slightly larger slice of the billion dollar pumpkin pie: the writers who create the movies and shows, or the corporations who actually take all the financial risk that allows us Hollywood writers to write in Hollywood in the first place.

~John Ridley's NPR's "Visible Man"

Quote of the Day; Blogging is Like Being Married...

There's an old newspaper saying, attributed to Lewis Grizzard, that "Being a newspaper columnist is like being married to a nymphomaniac. Every time you think you're through, you have to start all over again."

I think the same could be said for being a blogger.

Wednesday, November 28, 2007

FDIC Report Suggests Banks Are Surviving Well

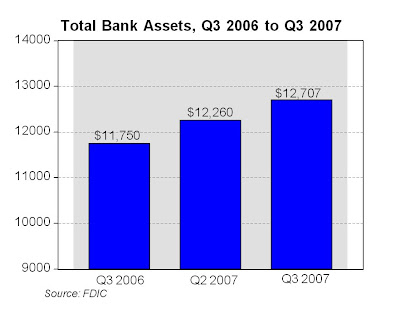

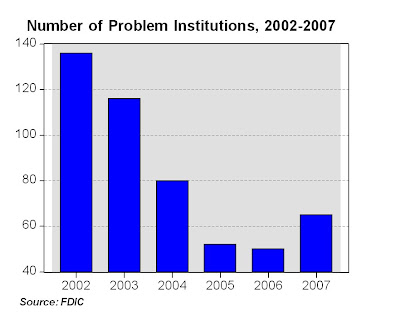

The charts above were created using the most recent banking data from 8,560 FDIC-insured banks, throughout the third quarter 2007, showing that:

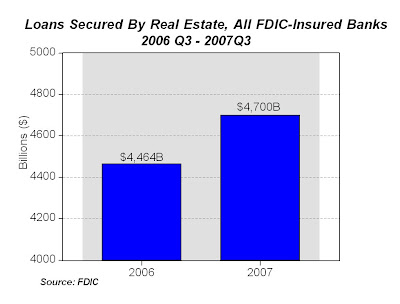

The charts above were created using the most recent banking data from 8,560 FDIC-insured banks, throughout the third quarter 2007, showing that:1. Total assets of commercial banks increased by a record $446.3 billion (3.6%) to $12,707 billion, eclipsing the previous quarterly high of $331.6 billion set in the first quarter of 2006 (top chart above). Loans secured by real estate at commercial banks were up by 5.3% in the third quarter 2007 vs. the same quarter last year (see second chart above), suggesting that credit tightening in response to the subprime troubles is not a problem for U.S. banks.

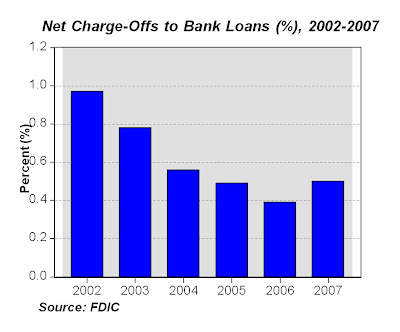

2. The "net-charge offs to FDIC banks" (loans removed from balance sheet because of uncollectibility) in 2007 has been 0.50% (or about 1 loan in 200), slightly higher than last year, but about the same as 2005 (0.49%) and much lower than 2003 (0.78%), and about half the rate in 2002 (0.97%), see third chart above.

3. The number of "problem institutions" in 2007 (65 banks) is slightly higher than 2006 (50 banks) and 2005 (52 banks) as might be expected given the recent troubles in the financial sector, but lower than 2004 (80 banks), 2003 (116 banks) and about half the number in 2002 (136 banks), see bottom chart.

The FDIC report presents a picture of a U.S. banking system that is overall still very healthy, while it absorbs some of the negative effects of the subprime mortgage troubles. On the positive side, commercial loan growth set another new record in the third quarter 2007, residential mortgage loans registered the largest quarterly increase since the second quarter of 2006, "problem list" assets declined, more than 99% of insured institutions met or exceeded the highest regulatory capital requirements, more than half of all banks (51%) reported higher quarterly earnings compared to the third quarter of 2006, and net interest income increased by the best year-over-year growth rate in five years (6.5%). No credit crunch, and bank performance is healthy.

On the negative side, there are some effects of the subprime mortgage troubles: the number of banks on the FDIC's "Problem List" increased from 61 to 65 in the third quarter (probably not a big deal since there are 8,560 banks), and loan-loss provisions totaled $16.6 billion - the largest quarterly loss provision since the second quarter of 1987.

Bottom Line: As I mentioned in several recent posts, not a single U.S. bank failed in either 2005 or 2006, and only 3 banks failed in 2007 (out of 8,560 banks). The banking system today is probably much stronger than it was was in 2002 or 2003 on many dimensions (net charge-off rates, problem institutions and bank failures), and much stronger and more stable than most people give it credit for. Certainly the subprime troubles have shown some effect on banks, which is to be expected. But the fact that more than 99% of insured U.S. institutions currently meet or exceed the highest regulatory capital requirements suggests that the U.S. banking system is healthy and will absorb and survive the current turmoil in the subprime mortgage sector.

86% Chance of Rate Cut in December

Based on 30-day Fed Funds futures trading for December at the CBOT, the chance of a Fed Fund rate cut to 4.25% in December increased today from 80 to 86%. The Dow posted its biggest 2-day gain in 5 years.

TelaDoc Market Solution: The Doctors Is Always In

Health care entrepreneurs working outside the traditional health insurance payment system are using telephone, e-mail, text messaging and innovative computer software to make medical care more accessible and convenient for patients, according to a new study by the National Center for Policy Analysis titled "Convenient Care and Telemedicine."

Approximately 1 million patients are now subscribers to a nationwide service operated by TelaDoc Medical Services. For a low $35 consultation fee, enrollees can talk to a doctor by phone, any time day or night.

Conclusion:Telemedicine provides important new opportunities to improve health care in the 21st century. Telemedicine is safe, efficient and convenient for both patients and providers. It is often the method preferred by patients who demand timely access to their doctors. And it is a method endorsed by a growing number of doctors who understand its potential. Other industries have taken advantage of information technology to benefit consumers in numerous ways. It is time that health care does the same.

Online Shopping in Nov. At All-Time Record Highs

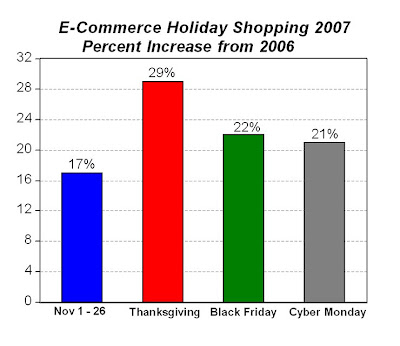

"Cyber Monday" sales set a new all-time single day record for e-commerce sales of $733 million, according to comScore, representing a 21% increase over last year. While Monday represented the first time ever more than $700 million was spent in a single day by online shoppers, comScore said that it expects spending on some days may exceed $800 million in the coming weeks.

"Cyber Monday" sales set a new all-time single day record for e-commerce sales of $733 million, according to comScore, representing a 21% increase over last year. While Monday represented the first time ever more than $700 million was spent in a single day by online shoppers, comScore said that it expects spending on some days may exceed $800 million in the coming weeks. Further, online shopping for the month of November so far is also up significantly from the same period last year by 17%, see chart above, and online shopping on Thanksgiving and Black Friday are also up by more than 20% from last year.

What recession?

Multiple Refinancing Contributed to Mortgage Crisis

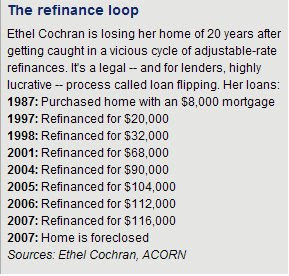

The chart above is from an article in today's Detroit News, illustrating how one Detroit homeowner got into foreclosure trouble: Ethel Cochran refinanced her home 7 different times within a ten-year period at adjustable rates, pulling out more and more equity each time.

The chart above is from an article in today's Detroit News, illustrating how one Detroit homeowner got into foreclosure trouble: Ethel Cochran refinanced her home 7 different times within a ten-year period at adjustable rates, pulling out more and more equity each time.30-year fixed-rate mortgages were available in 1987 for about 10%, which would mean that Ethel's original monthly house payment was only about $83 (principal and interest), and her mortgage balance today would be less than $6,000 with only ten years left to pay off the mortgage. Now she has a $116,000 mortgage that she can't pay, and is being evicted from her house.

What happened to the old-fashioned idea of making payments on your original mortgage, paying it off and having a "mortgage burning party?"

There's a perception that it was first-time howeowners who got in trouble with subprime adjustable-rate mortgages, but this story suggests that there were also many existing homeowners who also got in trouble with multiple refinancings, and have probably contributed to the current subprime mortgage crisis.

Tuesday, November 27, 2007

Buy Houses in Detroit For $250, Monthly Pmt = $1

You can go to Realtor.com and search for homes for sale in any city in the U.S., and you can specify a certain price range. If you search for Detroit homes for sale between $0 and $1,000, you'll find that there are 74 homes for sale in that price range, including the bank owned bargain above for $250, with estimated monthly payments of $1. There are 4 homes for sale for $1. If you search for Detroit houses for less than $5,000, you'll have almost 1,000 homes to choose from!

You can go to Realtor.com and search for homes for sale in any city in the U.S., and you can specify a certain price range. If you search for Detroit homes for sale between $0 and $1,000, you'll find that there are 74 homes for sale in that price range, including the bank owned bargain above for $250, with estimated monthly payments of $1. There are 4 homes for sale for $1. If you search for Detroit houses for less than $5,000, you'll have almost 1,000 homes to choose from! See previous post on Detroit houses here.

Bank Stocks Outperform Market in The Long Run

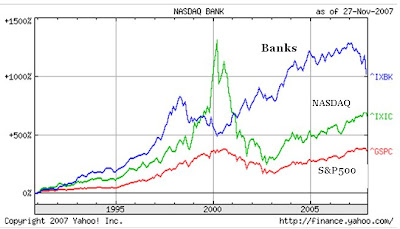

Bob Wright wrote in a recent comment "If you look at financial stocks over any meaningful period - like 10 years or more, they kill the DJIA and the S&P 500. They even out-performed over the last 5 years until this recent bit of turmoil."

Bob Wright wrote in a recent comment "If you look at financial stocks over any meaningful period - like 10 years or more, they kill the DJIA and the S&P 500. They even out-performed over the last 5 years until this recent bit of turmoil."The chart above (click to enlarge) shows the performance of NASDAQ Bank Stocks (blue line) vs. the NASDAQ Composite (green) and the S&P500 (red) from 1990 to 2007. Consider that $100,000 invested in the NASDAQ Banks stocks in 1990 would have grown to $1,137,000 today, vs. $782,292 today if you had invested $100,000 in 1990 in the NASDAQ Composite, and only $469,812 if you had invested in the S&P500. In other words, you would have almost $700,000 more today from your $100,000 investment in NASDAQ Bank Stocks in 1990 compared to the same initial investment in the S&P500.

Bob is right.

Forcing The Poor To Buy Rich Man's Toys

Closing sweatshops and forcing Western labor and environmental standards down poor people's throats in the third world does nothing to elevate them out of poverty. Instead, it forces poor people to buy a lot of rich man's toys, like clean air, clean water, and leisure time. If clean air and leisure time don't strike you as extravagant luxuries, that's because Americans - even the poorest of us - are so rich these days that we've forgotten what true poverty is like. But chances are your great-great-grandparents could have told you what it's like: when you're truly poor, you can't afford things like clean air. Nobody in 1870 America worried about the environment.

~Rochester economist Steven Landsburg in "More Sex is Safer Sex"

Barefoot Indian Steelworkers: "Help" Is On The Way

I was reminded of this cartoon while reading some of the comments on the Indian-made manhole covers in NYC.

I was reminded of this cartoon while reading some of the comments on the Indian-made manhole covers in NYC. Let me suggest an alternative caption:

"Help is on the way, barefoot Indian steelworkers. We're cancelling all orders for Indian manhole covers in the U.S., and we're also going to help shut down all of those exploitive, steel foundries in your country that fail to meet the safety standards of advanced economies like the U.S. that are 50 years ahead of you."

Carpe Diem On CNBC's "Kudlow and Company"

Thanks to Larry Kudlow for mentioning the Carpe Diem blog last night on CNBC's "Kudlow and Company," as well as featuring some Carpe Diem posts on his blog yesterday: "Perry Is On the Mark." Three Carpe Diem graphs were featured last night on the show: the two from this CD post, and the one from this CD post.

Don't miss "Kudlow and Company" at 7 p.m. on CNBC Mon.-Friday.

Moving In And Out of Those Income Brackets

Significant Income Mobility: Quintiles Not Closed Clubs

Great column today by Thomas Sowell on That "Top One Percent," here are a couple excerpts:

Americans in the top 1%, like Americans in most income brackets, are not there permanently, despite being talked about and written about as if they are an enduring "class" -- especially by those who have overdosed on the magic formula of "race, class and gender," which has replaced thought in many intellectual circles.

At the highest income levels, people are especially likely to be transient at that level. Recent data from the Internal Revenue Service show that more than half the people who were in the top one percent in 1996 were no longer there in 2005.

Among the top one-hundredth of one percent, three-quarters of them were no longer there at the end of the decade.

These are not permanent classes but mostly people at current income levels reached by spikes in income that don't last.

Among corporate CEOs, those who cash in stock options that they have accumulated over the years get a big spike in income the year that they cash them in. This lets critics quote inflated incomes of the top-paid CEOs for that year. Some of these incomes are almost as large as those of big-time entertainers -- who are never accused of "greed," by the way.

Most Americans in the top fifth, the bottom fifth, or any of the fifths in between, do not stay there for a whole decade, much less for life. And most certainly do not remain permanently in the top one percent or the top one-hundredth of one percent.

Most income statistics do not follow given individuals from year to year, the way Internal Revenue statistics do. But those other statistics can create the misleading illusion that they do by comparing income brackets from year to year, even though people are moving in and out of those brackets all the time.

Apostrophe Misuse Ending at The NY Times?

NYTimes today: In the first half of the 1990’s, she was Mr. Mitterrand’s lead aide on international trade issues.

NYTimes today: For two years in the mid-1990s, Mr. Morrissey was suspended from practicing law in New York State for mishandling a client’s escrow account.

NYTimes today: As prime minister in the 1990s, Nawaz Sharif was a religiously conservative, nationalist leader who allowed the Taliban to flourish in Afghanistan and detonated a nuclear weapon despite an American plea not to.

NYTimes today: In the past four years, he has designed collections inspired by the war in Chechnya, the boycotted 1980 Moscow Olympics, the Soviet Navy and, this season, Moscow criminal gangs of the 1990s.

Although it's not always consisent, I think the NY Times is phasing out its long-standing policy of adding an unnecessary (IMHO) apostrophe to words like "1990's" (first example above) and is moving toward the standard style guideline in use at every other major newspaper, and is now using "1990s" (most of the time), since a decade is plural, not possessive.

For example, a search of the NY Times in 2007 through November 27 shows almost 3,000 examples of the term "1990s," and only 56 examples of the term "1990's."

A search of the same period in 2006 shows almost 3,000 examples of the term "1990's" and only 237 examples of the term "1990s."

There is a definite trend at the NY Times towards eliminating the misuse of that "puny piece of punctuation." Thank God. See previous CD posts about apostrophe abuse here and here.

Monday, November 26, 2007

New York Manhole Covers, Forged Barefoot in India

It's not just call centers that are outsourced to India.

NEW DELHI — Eight thousand miles from Manhattan, barefoot, shirtless, whip-thin men rippled with muscle were forging prosaic pieces of the urban jigsaw puzzle: manhole covers.

MP: Just wondering, to be PC, shouldn't it now be "personhole cover"? After all, "Frosty the Snowman" has been replaced by "Frosty the Snowfriend," and a "grandfather clause" has been replaced by a "grandperson clause," and I'm not making that up!

Manhole covers manufactured in India can be anywhere from 20 to 60 percent cheaper than those made in the United States.

MP: Just wondering, to be PC, shouldn't it now be "personhole cover"? After all, "Frosty the Snowman" has been replaced by "Frosty the Snowfriend," and a "grandfather clause" has been replaced by a "grandperson clause," and I'm not making that up!

Watch a slide show here about manholes made in India.

(HT: Sanil Kori)

Mad Money = Money-Losing Investment Advice

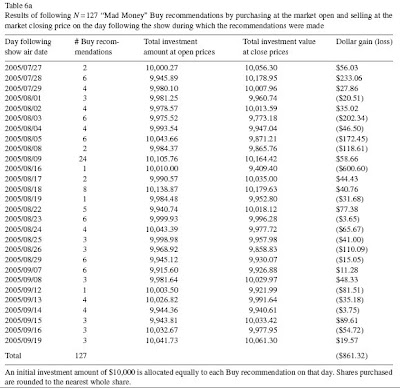

In the December 2007 issue of the Quarterly Review of Economics and Finance, there is an article "Does Mad Money make the market go mad?"

In the December 2007 issue of the Quarterly Review of Economics and Finance, there is an article "Does Mad Money make the market go mad?"From the abstract: Our analysis of returns and trading volume around stock recommendations aired on charismatic host Jim Cramer’s Mad Money program reveals statistical evidence of response to both his buy and sell opinions, with most of the full-day return following an on-air buy recommendation captured by that day’s opening price. Trading strategy analysis suggests that individuals with limited funds should be wary of short-term trading to exploit the show’s suggestions.

From the conclusion: Heightened investor activity around stocks discussed on the show is indicated by statistically significant abnormal and raw returns, as well as trading volume increases, on both the day 0 air dates of buy recommendations and the day +1 trading day, with the day +1 effects being stronger as expected. However, since almost all of the average raw return on day +1 is captured in the difference between the day 0 close price and the day +1 opening price, a change likely induced by the weight of pending buy orders placed by viewer investors before the market opens, the average investor is unable to benefit from this effect and, further, the aggregate impact is to increase the cost of acting on these recommendations for all investors.

From the text: Table 6a (shown above, click to enlarge) shows that the 127 buy recommendations are distributed across twenty-eight different show air dates within our 7/26/2005 to 9/16/2005 sample. On each day, the $10,000 is allocated equally across all of the buy recommendations. Share purchases are rounded to the nearest whole share. As a result, the amount invested on each day is never exactly $10,000 but is more than $10,100 only twice. If an investor had executed this strategy twenty-eight times on the days covered in this sample, a loss of $861.32 would have been realized, not counting the per-trade commissions.

(MP: Add in $10 per trade for 127 buy orders, and your total loss would be $2,131.)

(HT: Mike Munger)

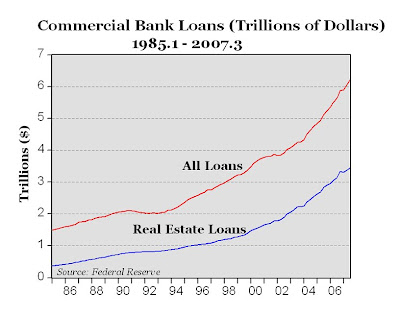

Commercial Bank Lending at All-Time High

From today's front page WSJ article "Recession Fears Weigh Heavily On the Markets":

This time around, much depends on how tight a rein financial institutions keep on their lending and consumers keep on their spending.

By itself, the housing slump seems unlikely to choke off U.S. economic growth. Home construction accounts for less than 5% of the nation's gross domestic product. But if banks curb their lending in response to billions of dollars of mortgage-related write-offs, or if consumers cut their spending as home values fall and gasoline prices rise, it could knock the economy out of its delicate balance.

This time around, much depends on how tight a rein financial institutions keep on their lending and consumers keep on their spending.

By itself, the housing slump seems unlikely to choke off U.S. economic growth. Home construction accounts for less than 5% of the nation's gross domestic product. But if banks curb their lending in response to billions of dollars of mortgage-related write-offs, or if consumers cut their spending as home values fall and gasoline prices rise, it could knock the economy out of its delicate balance.

The chart above (click to enlarge) shows lending activity at all U.S. commercial banks from 1985 through the third quarter 2007, using data from the Federal Reserve Board. As the chart shows, both: a) all loans, and b) real estate loans, are at all-time highs, and there doesn't appear to be any "curbing in lending" by commercial banks, at least not yet.

Sunday, November 25, 2007

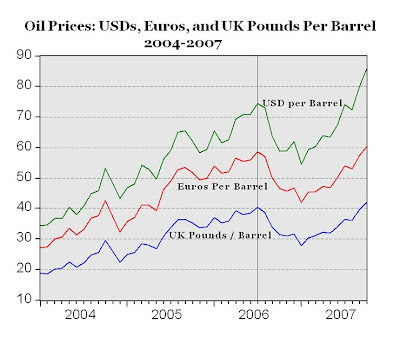

In Euros and UK Pounds, Oil Prices Aren't That Bad

Rising oil prices, measured in dollars, get all of the media attention, largely because oil is priced and sold in dollars in world oil markets. What has gotten much less attention is the price of oil in other currencies like British pounds and Euros, which have both appreciated vs. the USD by 16-18% over the last few years, helping to offset the higher price of oil in dollars for Europeans.

Rising oil prices, measured in dollars, get all of the media attention, largely because oil is priced and sold in dollars in world oil markets. What has gotten much less attention is the price of oil in other currencies like British pounds and Euros, which have both appreciated vs. the USD by 16-18% over the last few years, helping to offset the higher price of oil in dollars for Europeans.The chart above (click to enlarge) shows that oil prices in dollars have almost tripled since 2004, whereas oil prices in pounds and euro have only doubled during this period. Since July 2006, oil prices in dollars have risen more than 15% (see vertical line above), compared to modest increases over the same period of only 2.74% in euros and 4% in pounds.

Further, consider that $100 oil today is only 67.4 euros per barrel at today's exchange rate of $1.4828/euro, compared to 114 euros per barrel at the exchange rate 5 years ago of $0.8766/euro. The double-digit appreciation of major currencies (pound, euro, Canadian dollar, Swiss franc, etc.) vs. the USD might be another factor that explains why the world economy has been able to absorb the shock of $100 oil.

From the NY Times, "Throughout Europe, the rise of the euro has acted as a hedge against fluctuations in the dollar-denominated oil market."

You Can't Trust Those Big-Government Socialists

NY Times: Transparency International, an organization that tracks corruption, ranks countries from least to most corrupt, and in its 2007 index Venezuela was at 162 out of 179 countries.

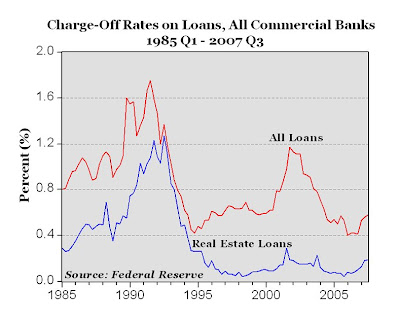

Some Historical Perspective on Commercial Banks

The charts above are based on Federal Reserve commercial banking data released on Monday and available here, with updated data on a) loan charge-off rates and b) loan delinquency rates through the third quarter 2007 for all U.S. commercial banks.

The charts above are based on Federal Reserve commercial banking data released on Monday and available here, with updated data on a) loan charge-off rates and b) loan delinquency rates through the third quarter 2007 for all U.S. commercial banks.As the charts show, despite all of the recent bad news and "gloom and doom" about the U.S. banking sector, the commercial banking sector might actually be surviving the subprime crisis quite well, at least so far. The charge-off rates for all bad loans (0.60%) has increased recently (top chart), but is about half the 1.2% rate in 2002, and about 1/3 the 1.75% rate in 1991. The charge-off rate for real estate loans (.19%, or only about 2 properties per 1,000) in the third quarter 2007 is almost half of the .29% rate in 2001, and less than 1/6th of the 1.2% rate in 1991.

Likewise, loan delinquency rates have increased recently (bottom chart), but are still far below the rates of the late 1980s and most of the 1990s.

On a previous CD post, I reported that not a single U.S. bank failed in either 2005 or 2006, and only 3 banks have failed in 2007. The loan charge-off and delinquency rates for U.S. commercial banks through the third quarter of 2007 indicate that our banking system is surviving the subprime crisis, without any danger of pending collapse.

Bottom Line: The U.S. banking system is probably stronger and more stable than most people give it credit for. Empirical data on bank charge-off rates and delinquency rates, at least through the third quarter 2007, suggest that banks are probably doing better than most people think.

Ethanol: "Dangerous, Delusional Bullshit"

Ethanol production in the United States has been steadily growing and is expected to continue growing. Many politicians see increased ethanol use as a way to promote environmental goals, such as reducing greenhouse gas emissions, and energy security goals. This paper provides the first thorough benefit-cost analysis of increasing ethanol use beyond four billion gallons a year, and finds that the costs of increased production are likely to exceed the benefits by about three billion dollars annually. It also suggests that earlier attempts aimed at promoting ethanol would have likely failed a benefit-cost test, and that Congress should consider repealing the ethanol tariff and the ethanol tax credit.

Abstract of a new research paper "The Benefits and Costs of Ethanol," by Robert W. Hahn and Caroline Cecot, both of the AEI-Brookings Joint Center for Regulatory Studies.

From Robert W. Hahn's editorial in yesterday's WSJ:

To hear the candidates tell it -- especially those on the stump in Iowa -- ethanol is the answer to America's energy-security woes. And back in Washington, politicians since 1978 have been putting your money where their mouths are: Ethanol is currently subsidized to the tune of 51 cents per gallon when blended with gasoline.

To make sure foreigners don't share the ride on the ethanol gravy train, moreover, Congress has imposed a 54-cent tariff on imported ethanol.

Saturday, November 24, 2007

Goldilocks Rocks on Black Friday, +8.3% Increase

NEW YORK (AP) -- The nation's retailers had a robust start to the holiday shopping season, according to results announced today by a national research group that tracks sales at retail outlets across the country. According to ShopperTrak RCT, which tracks sales at more than 50,000 retail outlets, total sales rose 8.3% to $10.3 billion on Friday, the day after Thanksgiving, compared with $9.5 billion on the same day a year ago. ShopperTrak had expected an increase of no more than 4-5%.

By the way, consider that gas prices last Thanksgiving were about $2.25 per gallon, and gas prices today are about $3.09. Even with gas prices 37% higher than a year ago, consumers spent a record amount this year on Black Friday. See the post below.

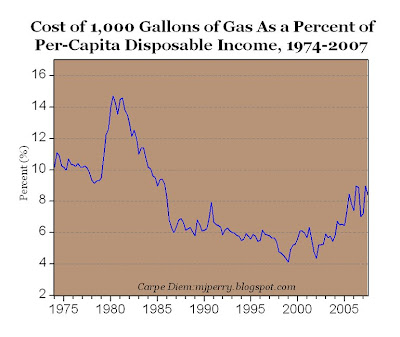

Why The Goldilocks Economy Can Handle $3 Gas

In a previous CD post "The Energy-Efficient Economy Can Handle $100 Oil," I suggested that today's economy is much better able to absorb higher energy prices than at any other time in the past, due to significant improvements in energy efficiency of the last 50 years. Compared to the early 1970s, the economy today is about twice as efficient, measured by energy consumption per dollar of real GDP. The graph in that post was featured on CNBC's "Kudlow and Company" a few weeks ago and also appeared in Larry's blog.

Here's another reason that the Goldilocks economy is able to handle $3 per gallon gas without sending consumer spending into a tailspin and without causing a recession: Even at $3 per gallon, gas is still relatively affordable for today's consumers, as a percent of disposable income, especially compared to the 1970s and 1980s.

The graph above (click to enlarge) shows the cost of 1,000 gallons of gas at the average retail price (using EIA data) as a percent of per-capita disposable income (from the BEA), from 1974-2007. Consider that since gas prices peaked in the early 1981 at about $1.40 per gallon, retail gas prices have increased by 2.21 times to $3.099 per gallon today. But per-capita disposable income has increased during that same period by more than 3.5 times, from $9591 in 1981 to $33,940 today.

In the early 1980s, it would have taken almost 15% of per-capita disposable income to buy 1,000 gallons of gas, and today it only takes only 8.5% (third quarter 2007). Even back in the "good old days" when gas sold for 50-60 cents per gallon in the mid-1970s, gas was more expensive as a share of income (10-11%) than today.

Bottom Line: Measured as a share of per-capita disposable income, gas prices would have to rise all the way to $5 per gallon today to be as expensive as gas in the early 1980s. Even if gas gets to $3.76 per gallon, it would be equivalent to 50 cent gas in the "good old days" of the mid-1970s, when measured as a share of disposable income. Goldilocks can handle $3 gas, no problem.

Here's another reason that the Goldilocks economy is able to handle $3 per gallon gas without sending consumer spending into a tailspin and without causing a recession: Even at $3 per gallon, gas is still relatively affordable for today's consumers, as a percent of disposable income, especially compared to the 1970s and 1980s.

The graph above (click to enlarge) shows the cost of 1,000 gallons of gas at the average retail price (using EIA data) as a percent of per-capita disposable income (from the BEA), from 1974-2007. Consider that since gas prices peaked in the early 1981 at about $1.40 per gallon, retail gas prices have increased by 2.21 times to $3.099 per gallon today. But per-capita disposable income has increased during that same period by more than 3.5 times, from $9591 in 1981 to $33,940 today.

In the early 1980s, it would have taken almost 15% of per-capita disposable income to buy 1,000 gallons of gas, and today it only takes only 8.5% (third quarter 2007). Even back in the "good old days" when gas sold for 50-60 cents per gallon in the mid-1970s, gas was more expensive as a share of income (10-11%) than today.

Bottom Line: Measured as a share of per-capita disposable income, gas prices would have to rise all the way to $5 per gallon today to be as expensive as gas in the early 1980s. Even if gas gets to $3.76 per gallon, it would be equivalent to 50 cent gas in the "good old days" of the mid-1970s, when measured as a share of disposable income. Goldilocks can handle $3 gas, no problem.

Friday, November 23, 2007

Libertarian Drew Carey on Medical Marijuana

One of the most outrageous consequences of the war on drugs is the federal crackdown on medical marijuana, which is used by patients to help treat the effects of cancer, glaucoma, HIV-AIDS, chronic pain and nausea, and other severe symptoms associated with serious illnesses. Medical marijuana prescribed by a physician is legal in 12 states, yet federal agents are raiding state-approved dispensaries and preventing patients from having safe access to this drug.

One of the most outrageous consequences of the war on drugs is the federal crackdown on medical marijuana, which is used by patients to help treat the effects of cancer, glaucoma, HIV-AIDS, chronic pain and nausea, and other severe symptoms associated with serious illnesses. Medical marijuana prescribed by a physician is legal in 12 states, yet federal agents are raiding state-approved dispensaries and preventing patients from having safe access to this drug.In Episode 2 of Reason.tv's Drew Carey Project, Drew takes a look at patients who need and use medical marijuana in California, and how the federal government is making their lives even worse.

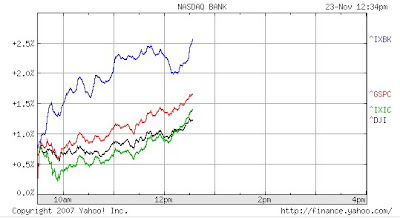

Bank Stocks Rebound by 2.5%, Keepin' Hope Alive

In some "Black Friday bargain hunting," the broader stock market indexes rebounded today by about 1.4% (see chart above, SP=red line, DJ=black and NASDAQ=green), and bank stocks rebounded at almost twice that rate (about 2.5%) as measured by the NASDAQ Bank Index (blue line above).

In some "Black Friday bargain hunting," the broader stock market indexes rebounded today by about 1.4% (see chart above, SP=red line, DJ=black and NASDAQ=green), and bank stocks rebounded at almost twice that rate (about 2.5%) as measured by the NASDAQ Bank Index (blue line above).Maybe there's hope.

(P.S. I'll probably retire from intraday prognasticatin', and wait until the market has closed to do my analyses.)

Weak Dollar = Strong Christmas Sales for Europeans

Returning to Iceland After Shopping Bender

at the Mall of America

MINNEAPOLIS -- Andrea Guðjónsdóttir arrived in Minnesota from Iceland last week with nothing but the clothes on her back. Oh, and two empty suitcases, which she promptly filled to near-bursting with clothes, toys and other gifts during a five-day shopping spree in the Twin Cities.

MINNEAPOLIS -- Andrea Guðjónsdóttir arrived in Minnesota from Iceland last week with nothing but the clothes on her back. Oh, and two empty suitcases, which she promptly filled to near-bursting with clothes, toys and other gifts during a five-day shopping spree in the Twin Cities. "Everything's so cheap," said Guðjónsdóttir, 35, who lives in Akranes, a seaport city on Iceland's west coast. "You can pay $30 for Levi's here; at home, it'd be $200."

Guðjónsdóttir joins a growing number of shoppers across the world who are coming to the U.S. -- and Minnesota -- this holiday season to take advantage of good deals against the falling dollar. At a time when the U.S. economy is sagging, retailers say foreign tourists are providing a hedge against a Christmas season that's expected to be the slowest in five years.

The Only Way to Follow People Over Time is To Follow People, Not Income Brackets or Quintiles

There are wild cards that need to be kept in mind when you hear income statistics thrown around. One of these wild cards is that most Americans do not stay in the same income brackets throughout their lives. Millions of people move from one bracket to another in just a few years.

What that means statistically is that comparing the top income bracket with the bottom income bracket over a period of years tells you nothing about what is happening to the actual flesh-and-blood human beings who are moving between brackets during those years.

Following trends among income brackets over the years creates the illusion of following people over time. But the only way to follow people is to follow people.

That is why the IRS data, which are for people 25 years old and older, and which follow the same individuals over time, find those in the bottom 20 percent of income-tax filers almost doubling their income in a decade. That is why they are no longer in the same bracket.

That is also why the share of income going to the bottom 20 percent bracket can be going down, as the Census Bureau data show, while the income going to the people who began the decade in that bracket is going up by large amounts.

~Thomas Sowell in "Income Confusion"

Thursday, November 22, 2007

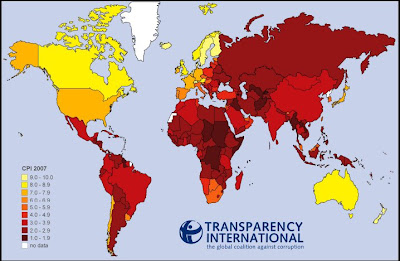

More Government Control = More Corruption

World Corruption Map

From Transparency International: The 2007 Corruption Perceptions Index (CPI) looks at perceptions of public sector corruption in 180 countries and territories - the greatest country coverage of any CPI to date – and is a composite index that draws on 14 expert opinion surveys. It scores countries on a scale from zero to ten, with zero indicating high levels of perceived corruption and ten indicating low levels of perceived corruption (see world map above, click to enlarge).

From Transparency International: The 2007 Corruption Perceptions Index (CPI) looks at perceptions of public sector corruption in 180 countries and territories - the greatest country coverage of any CPI to date – and is a composite index that draws on 14 expert opinion surveys. It scores countries on a scale from zero to ten, with zero indicating high levels of perceived corruption and ten indicating low levels of perceived corruption (see world map above, click to enlarge).A strong correlation between corruption and poverty continues to be evident. Forty percent of those scoring below three, indicating that corruption is perceived as rampant, are classified by the World Bank as low income countries. Somalia and Myanmar share the lowest score of 1.4, while Denmark has edged up to share the top score of 9.4 with perennial high-flyers Finland and New Zealand.

Notice a pattern? The greater the degree of free market capitalism, the greater the income levels and the less corruption (see the yellow and orange areas on the map). The greater the degree of government control over the economy, the lower the income levels and the greater the corruption (see the red and brown areas on the map). In other words, there appears to be a direct and positive relationship between the size of government and the amount corruption in a country.

(HT: Captain Capitalism)

Bogleheads: Stock-Picking is Evil; Boring is Good

If John Bogle is the high priest of the Bogleheads, stock-picking fanatic Jim Cramer would have to be Lucifer.

If John Bogle is the high priest of the Bogleheads, stock-picking fanatic Jim Cramer would have to be Lucifer.Meet the Bogleheads, devotees of Vanguard Group founder John Bogle, long-time advocate of the passive, low-cost, index approach to investing where you try to "meet, not beat the market."

Bogleheads adhere to the "boring is good" investment philosophy of index investing, and they are against stock picking, against high fees and against what they say is the mostly self-serving investment industry.

In defense of the Bogleheads, consider the two charts above that compare the Fidelity Magellan Fund, one of the largest and most popular actively managed mutual funds in history, vs. the S&P500 Index. Over the last 25 years (top chart, click to enlarge), the S&P500 Index rose by almost +1200% vs. only about +400% for the Fidelity Magellan fund. In other words, if you have invested in Fidelity Magellan from 1982 to 2007, you would have been paying large fees to professional investment advisors like Peter Lynch to "help" you lose lots of money, compared to a passive investment in Bogle's low-cost Vanguard S&P500 Index fund.

Lots and lots of money. $100,000 invested in Fidelity Magellan in 1982 would have grown to $500,000 by 2007, compared to $1,200,000 if you had selected the Vanguard S&P500 Index fund.

The bottom chart compares the Fidelity Magellan Fund to the S&P500 during the last 9 years of the period when legendary investment strategist Peter Lynch was managing the fund. Even a brilliant investor like Peter Lynch couldn't beat the market during the period from 1982-1990.

And consider that a previous CD post reported that the return in 2006 for a portfolio of mostly Vanguard Index funds was +20.6%, compared to a -0.20% loss for a portfolio of "Select Jim Cramer Featured Stocks."

Call me crazy, but I think the evidence is clear. Consider me a Boglehead.

(HT: Joyce Howe)

APROVECHA EL DIA!!

Finally, the first visit to Carpe Diem from the heart of Cuba (see ClustrMap above), maybe from the city of Camaguey?!! As recently as Nov. 1, there hadn't been a single visit to CD, see my post here.

From this Miami Herald article, "A meager 9 out of every 1,000 Cubans are estimated to be Internet users, most of them linked to the government. Reporters Without Borders last year denounced Cuba as one of a dozen nations with the most controlled and least accessible Internet, grouping the country with Iran and Vietnam."

From this Reuters news report, "At a downtown Havana post office, Cubans line up for hours for their turn in the "surfing room."

When users get to one of the four computers, they can send and receive e-mail and surf an Intranet of Cuban Web sites, but access to the global Internet is barred.

Getting online is not easy in communist-run Cuba, where the state strictly controls all Web servers and recently announced plans to crack down on illegal Internet access."

Aprovecha el dia!

Wednesday, November 21, 2007

Price Controls=Long Lines in Venezuela; Surprised?

Not a lot to be thankful for in Chavez's Venezuela....

Not a lot to be thankful for in Chavez's Venezuela....CARACAS, Venezuela -- The lines formed at dawn and remained long throughout the day — hundreds upon hundreds of Venezuelans waiting to buy scarce milk, chicken and sugar at state-run outdoor markets staffed by soldiers in fatigues (see photo above).

President Chavez's government is trying to cope with shortages of some foods, and the lines at state-run "Megamercal" street markets show many Venezuelans are willing to wait for hours to snap up a handful of products they seldom find in supermarkets.

The lines for basic foods at subsidized prices are paradoxical for an oil-rich nation that in many ways is a land of plenty. Shopping malls are bustling, new car sales are booming and privately owned supermarkets are stocked with American potato chips, French wines and Swiss Gruyere cheese.

Yet other foods covered by price controls — eggs, chicken — periodically are hard to find in supermarkets. Fresh milk has become a luxury, and even baby formula is scarcer nowadays.

Exhibit A: Goods not covered by price controls are plentiful.

Exhibit B: Goods covered by price controls are hard to find.

Conclusion: Kinda obvious, no?

(HT: Ben Cunningham)

Good Old Days Are Now; It Keeps Getting Better

George Mason's Russ Roberts at Cafe Hayek had this post yesterday about data from the Census Bureau's annual American Housing Survey that shows significant progress in living standards for Amercian households below the poverty level.

As Russ points out "Supposedly, over the last 20 years, all of the income gains have gone to the rich. Yet, somehow, the poorest households increased their access to appliances that make life more pleasant."

The chart above is based on data taken from in the 1985 survey and the 2005 survey, and expands on the data provided in Russ' post.

Bottom Line: Compared to 1985, today's (2005) poorest households have bigger homes and apartments by 15-20%, they are almost 3 times as likely to have central air conditioning, about two times as likely to have a dishwasher, clothes dryer and garbage disposal, more likely to have a washing machine, and more likely to be in a household with a car, or even 2 or more vehicles.

As Russ points out "Supposedly, over the last 20 years, all of the income gains have gone to the rich. Yet, somehow, the poorest households increased their access to appliances that make life more pleasant."

The chart above is based on data taken from in the 1985 survey and the 2005 survey, and expands on the data provided in Russ' post.

Bottom Line: Compared to 1985, today's (2005) poorest households have bigger homes and apartments by 15-20%, they are almost 3 times as likely to have central air conditioning, about two times as likely to have a dishwasher, clothes dryer and garbage disposal, more likely to have a washing machine, and more likely to be in a household with a car, or even 2 or more vehicles.

If those significant improvements happened overnight, it would be considered miraculous and would make headline news; but when they happen gradually over several decades, nobody notices, and the significant progress and advances in everybody's standard of living (including households below the poverty level) go largely unrecognized and unappreciated.

More evidence that "the good old days are now," and they keep getting better, see related previous CD posts here, here, here, here, here and here. There is a lot to be thankful for.

Happy Thanksgiving.