Multiple Refinancing Contributed to Mortgage Crisis

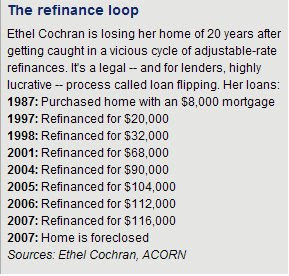

The chart above is from an article in today's Detroit News, illustrating how one Detroit homeowner got into foreclosure trouble: Ethel Cochran refinanced her home 7 different times within a ten-year period at adjustable rates, pulling out more and more equity each time.

The chart above is from an article in today's Detroit News, illustrating how one Detroit homeowner got into foreclosure trouble: Ethel Cochran refinanced her home 7 different times within a ten-year period at adjustable rates, pulling out more and more equity each time.30-year fixed-rate mortgages were available in 1987 for about 10%, which would mean that Ethel's original monthly house payment was only about $83 (principal and interest), and her mortgage balance today would be less than $6,000 with only ten years left to pay off the mortgage. Now she has a $116,000 mortgage that she can't pay, and is being evicted from her house.

What happened to the old-fashioned idea of making payments on your original mortgage, paying it off and having a "mortgage burning party?"

There's a perception that it was first-time howeowners who got in trouble with subprime adjustable-rate mortgages, but this story suggests that there were also many existing homeowners who also got in trouble with multiple refinancings, and have probably contributed to the current subprime mortgage crisis.

7 Comments:

People often make poor financial choices, but there are good reasons not to pay off a mortgage for prudent investors. For example, I have a 5.125% interest rate on my mortgage, and since I itemize my deductions, all of my mortgage interest is tax deductible every year. Accordingly, my effective interest rate is around 4%.

I can easily make more money by investing any extra money than paying off my mortgage. Sure, it takes discipline to invest instead of spend; however, everyone makes their own choices and has to live with them. I think I will enjoy my gas fireplace logs bought with my investment earnings instead of worrying about burning my mortgage.

From the same article...

The United States is struggling with an all-time high rate of one foreclosure filing for every 80 households in the country

So much for the Goldilocks economy...oh well she was only a character in a childrens fairy tale.

1 in 80 means 1.25%.

@Walt g.

You leave out the factor of Risk and Taxes. Sure I can take my 4.875% mortgage and invest extra money into a money market fund (safe and conservative) at 5%, a bond fund at 7% (a little riskier), or the S&P 500 at 10% (even more risky). Take out Taxes, and that 5 point spread from the stock market vs. mortgage narrows. Take into account Risk, and what is it really worth to you.

Sorry, but I have little sympathy for someone who refinanced seven times. I have no sympathy for the people who took advantage of Ethel, nor for the banks with their billion dollar losses.

What did Ethel do with all that money she took out during refinancing? I will bet there is more to the story that we will not get to hear.

Colin said...

1 in 80 means 1.25%.

No matter how you try to spin it 1 in 80 homes foreclosing is still an all time record high rate of foreclosures.

Um, that means that for as long as records have been kept the foreclosure rate has never been this bad.

Paul,

I agree. People must determine their own risk tolerance level and live within their means. That’s not always easy to do, and let’s face it, some people just don’t know any better. Although I don’t always like rules and regulations—and have gotten in trouble for breaking quite a few—sometimes they are necessary.

I believe the self-selected group of people who read this blog does not reflect an average person who obtains a home loan. Maybe if you can’t find any sympathy for these people, a little empathy will do. It is a Darwinian world out there.

Beyond dealing with loans that have already been made, the federal regulators need to keep working on standards that will reshape future bad credit mortgages lending and avoid the mistakes of the past.

The banking regulatory agencies have already issued guidelines applicable to banks that address risky practices in non-traditional and subprime lending. These guidelines also shore up consumer protections that can help borrowers make better-informed decisions on their own.

Post a Comment

<< Home