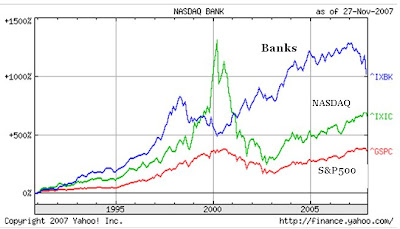

Bank Stocks Outperform Market in The Long Run

Bob Wright wrote in a recent comment "If you look at financial stocks over any meaningful period - like 10 years or more, they kill the DJIA and the S&P 500. They even out-performed over the last 5 years until this recent bit of turmoil."

Bob Wright wrote in a recent comment "If you look at financial stocks over any meaningful period - like 10 years or more, they kill the DJIA and the S&P 500. They even out-performed over the last 5 years until this recent bit of turmoil."The chart above (click to enlarge) shows the performance of NASDAQ Bank Stocks (blue line) vs. the NASDAQ Composite (green) and the S&P500 (red) from 1990 to 2007. Consider that $100,000 invested in the NASDAQ Banks stocks in 1990 would have grown to $1,137,000 today, vs. $782,292 today if you had invested $100,000 in 1990 in the NASDAQ Composite, and only $469,812 if you had invested in the S&P500. In other words, you would have almost $700,000 more today from your $100,000 investment in NASDAQ Bank Stocks in 1990 compared to the same initial investment in the S&P500.

Bob is right.

4 Comments:

10 years isn't really the "long run". How about a 20 year or 30 year "really long run" chart

The NASDAQ Bank Index only goes back to 1990.

You learn something new about the stock market every day. Thanks, didn't know there was such an bank index.

This also corresponds to the time of "easy money". Let's see how it looks 5 years from now.

Post a Comment

<< Home