Commercial Bank Lending at All-Time High

This time around, much depends on how tight a rein financial institutions keep on their lending and consumers keep on their spending.

By itself, the housing slump seems unlikely to choke off U.S. economic growth. Home construction accounts for less than 5% of the nation's gross domestic product. But if banks curb their lending in response to billions of dollars of mortgage-related write-offs, or if consumers cut their spending as home values fall and gasoline prices rise, it could knock the economy out of its delicate balance.

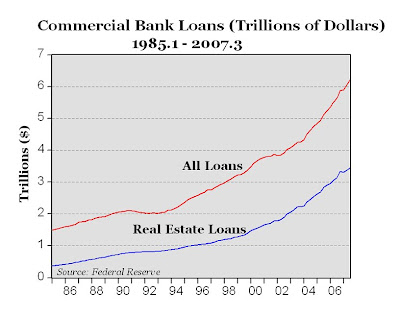

The chart above (click to enlarge) shows lending activity at all U.S. commercial banks from 1985 through the third quarter 2007, using data from the Federal Reserve Board. As the chart shows, both: a) all loans, and b) real estate loans, are at all-time highs, and there doesn't appear to be any "curbing in lending" by commercial banks, at least not yet.

5 Comments:

Sure, home construction accounts may only be 5% of GDP, but what fraction of U.S. aggregate personal wealth is owner-occupied housing? What happens if, as some have predicted, housing values decline by 20% or more? Do you honestly think that perceptions of current wealth (and expectations of lower growth of that wealth) will not have a major effect? It's not just the flow, it's also the stock that matters here.

Is this a chart of outstanding loans?

Yes, it's average loan volume for all banks during a quarter.

The recent "growth" in some real estate markets can by no means be considered normal.

That the speculation-fueled real estate bubble has burst does not mean that long term growth trends in real estate have for some reason been revoked.

Several years ago, Barrons published an article showing the 40 year growth rate of mid-western real estate to be in the neighborhood of 6% to 7%.

With recent growth rates of better than 10%, there must be a reversion to the mean.

"What ifs" and "perceptions" don't change reality.

Various asset classes go through cycles - so what's new?

Tell us something we don't already know.

Of course real estate inflation and a larger market has nothing to do with lending being at an all time high.

Post a Comment

<< Home