In Euros and UK Pounds, Oil Prices Aren't That Bad

Rising oil prices, measured in dollars, get all of the media attention, largely because oil is priced and sold in dollars in world oil markets. What has gotten much less attention is the price of oil in other currencies like British pounds and Euros, which have both appreciated vs. the USD by 16-18% over the last few years, helping to offset the higher price of oil in dollars for Europeans.

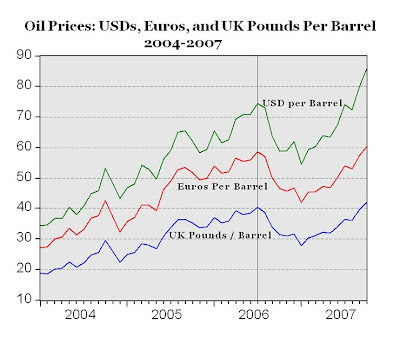

Rising oil prices, measured in dollars, get all of the media attention, largely because oil is priced and sold in dollars in world oil markets. What has gotten much less attention is the price of oil in other currencies like British pounds and Euros, which have both appreciated vs. the USD by 16-18% over the last few years, helping to offset the higher price of oil in dollars for Europeans.The chart above (click to enlarge) shows that oil prices in dollars have almost tripled since 2004, whereas oil prices in pounds and euro have only doubled during this period. Since July 2006, oil prices in dollars have risen more than 15% (see vertical line above), compared to modest increases over the same period of only 2.74% in euros and 4% in pounds.

Further, consider that $100 oil today is only 67.4 euros per barrel at today's exchange rate of $1.4828/euro, compared to 114 euros per barrel at the exchange rate 5 years ago of $0.8766/euro. The double-digit appreciation of major currencies (pound, euro, Canadian dollar, Swiss franc, etc.) vs. the USD might be another factor that explains why the world economy has been able to absorb the shock of $100 oil.

From the NY Times, "Throughout Europe, the rise of the euro has acted as a hedge against fluctuations in the dollar-denominated oil market."

3 Comments:

The double-digit appreciation of major currencies (pound, euro, Canadian dollar, Swiss franc, etc.) vs. the USD...

...so are you saying that the U.S. dollar remained static in value as the other mentioned currencies appreciated?

Of course, the flip side of your title is that, for the oil E+P companies, the 'prices aren't that good'. This probably explains the fact that oil company stock prices are very much lagging the increase in oil price.

The price of oil isn't up ... the value of the dollar is down. Another piece of the Bush Legacy.

Post a Comment

<< Home