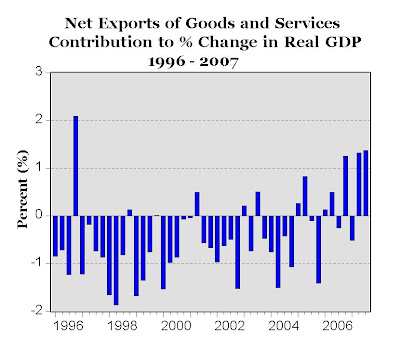

Net Exports Contribution to GDP Highest in 10 Yrs.

The contribution of net exports of goods and services to real GDP growth in the third quarter was revised upward to 1.37% (from the original estimate of 0.90%), and contributed to half of the 1% upward revision of real GDP growth from 3.9% to 4.9%. Further, it was the largest percent contribution to real GDP growth since the fourth quarter of 1996 (see chart above). Further, without the -1.03% decline in housing, real GDP growth would have been 5.93% in the third quarter. Read more here from First Trust Advisors.

The contribution of net exports of goods and services to real GDP growth in the third quarter was revised upward to 1.37% (from the original estimate of 0.90%), and contributed to half of the 1% upward revision of real GDP growth from 3.9% to 4.9%. Further, it was the largest percent contribution to real GDP growth since the fourth quarter of 1996 (see chart above). Further, without the -1.03% decline in housing, real GDP growth would have been 5.93% in the third quarter. Read more here from First Trust Advisors.

6 Comments:

This looks like the "good news" side of the beat-up US Dollar. While I am against how far and fast the dollar has sunken, I believe it is necessary to allow the greenback to weaken and start to narrow that nasty current account deficit and prove that the US can finance it.

I would like to mention that the USD sitting at 1.48/7 per € is a bit extreme and the inflationary result of that could start to covet the benefits we see in an expanding export sector.

Just a thought...I am new at blogging and still in college studying economics. I would appreciate any comments or criticism to take discussion further. Thanks!

This looks like the "good news" side of the beat-up US Dollar. While I am against how far and fast the dollar has sunken, I believe it is necessary to allow the greenback to weaken and start to narrow that nasty current account deficit and prove that the US can finance it.

I would like to mention that the USD sitting at 1.48/7 per € is a bit extreme and the inflationary result of that could start to covet the benefits we see in an expanding export sector.

Just a thought...I am new at blogging and still in college studying economics. I would appreciate any comments or criticism to take discussion further. Thanks!

Today's results from the Short Perry Strategy:

IXBK -.98%

Dow +.17%

Nasdaq +.2%

S&P500 +.05%

Woo hoo! Made money again!

NASDAQ Bank Index is up by 2%, 1:40 p.m.

Why don't you post it on the main page? Please do, then I'll know that I should short IXBK on Monday and make more money.

Even better... Then you can delete my comments (and your post) again and look like a genius the next time the IXBK bumps up on a hint of a Fed rate cut.

dcrow,

Careful with blogging....it can get addicting.

You are right, the dollar is a little beat up right now, but economic analysis can show that as our current account deficit narrows, we should see a rebound, all other things equal...

Unfortunately currency trading is volatile and a lot of speculation of many factors (central bank interest rates, GDP growth, even natural disasters can influence FX rates).

Hope this is somewhat of a help in understanding the current weak dollar.

- Matt

Post a Comment

<< Home