FDIC Report Suggests Banks Are Surviving Well

The charts above were created using the most recent banking data from 8,560 FDIC-insured banks, throughout the third quarter 2007, showing that:

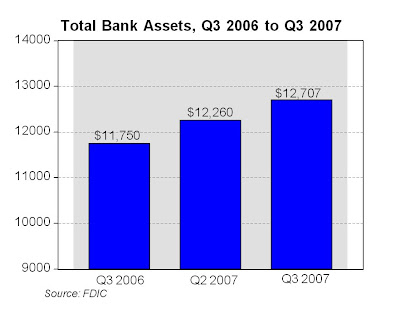

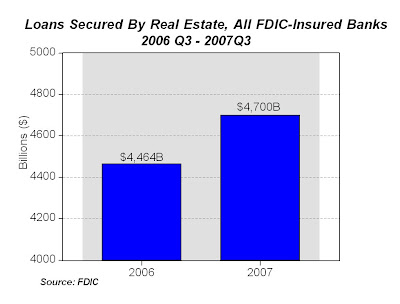

The charts above were created using the most recent banking data from 8,560 FDIC-insured banks, throughout the third quarter 2007, showing that:1. Total assets of commercial banks increased by a record $446.3 billion (3.6%) to $12,707 billion, eclipsing the previous quarterly high of $331.6 billion set in the first quarter of 2006 (top chart above). Loans secured by real estate at commercial banks were up by 5.3% in the third quarter 2007 vs. the same quarter last year (see second chart above), suggesting that credit tightening in response to the subprime troubles is not a problem for U.S. banks.

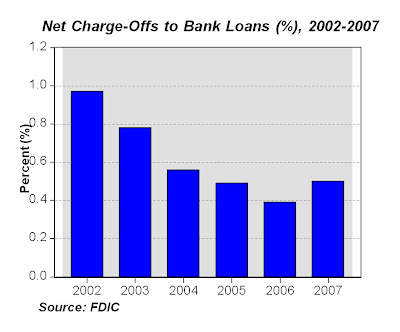

2. The "net-charge offs to FDIC banks" (loans removed from balance sheet because of uncollectibility) in 2007 has been 0.50% (or about 1 loan in 200), slightly higher than last year, but about the same as 2005 (0.49%) and much lower than 2003 (0.78%), and about half the rate in 2002 (0.97%), see third chart above.

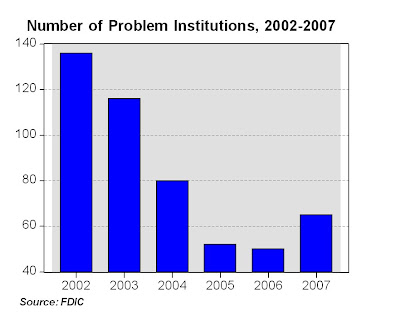

3. The number of "problem institutions" in 2007 (65 banks) is slightly higher than 2006 (50 banks) and 2005 (52 banks) as might be expected given the recent troubles in the financial sector, but lower than 2004 (80 banks), 2003 (116 banks) and about half the number in 2002 (136 banks), see bottom chart.

The FDIC report presents a picture of a U.S. banking system that is overall still very healthy, while it absorbs some of the negative effects of the subprime mortgage troubles. On the positive side, commercial loan growth set another new record in the third quarter 2007, residential mortgage loans registered the largest quarterly increase since the second quarter of 2006, "problem list" assets declined, more than 99% of insured institutions met or exceeded the highest regulatory capital requirements, more than half of all banks (51%) reported higher quarterly earnings compared to the third quarter of 2006, and net interest income increased by the best year-over-year growth rate in five years (6.5%). No credit crunch, and bank performance is healthy.

On the negative side, there are some effects of the subprime mortgage troubles: the number of banks on the FDIC's "Problem List" increased from 61 to 65 in the third quarter (probably not a big deal since there are 8,560 banks), and loan-loss provisions totaled $16.6 billion - the largest quarterly loss provision since the second quarter of 1987.

Bottom Line: As I mentioned in several recent posts, not a single U.S. bank failed in either 2005 or 2006, and only 3 banks failed in 2007 (out of 8,560 banks). The banking system today is probably much stronger than it was was in 2002 or 2003 on many dimensions (net charge-off rates, problem institutions and bank failures), and much stronger and more stable than most people give it credit for. Certainly the subprime troubles have shown some effect on banks, which is to be expected. But the fact that more than 99% of insured U.S. institutions currently meet or exceed the highest regulatory capital requirements suggests that the U.S. banking system is healthy and will absorb and survive the current turmoil in the subprime mortgage sector.

2 Comments:

as this image shows - tier one ratios for the largest banks are down quite a bit this year.

In credit union we trust.

Post a Comment

<< Home