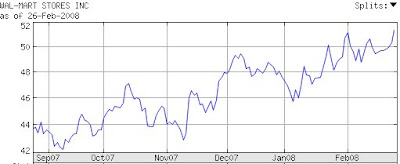

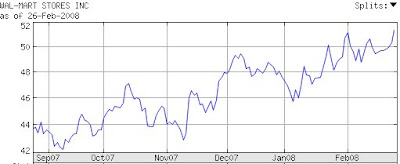

According to Daniel Gross at Slate.com, Wal-Mart's stock is at a 2-year high (see chart above) because:

1. Wal-Mart sells necessities, not discretionary items. The overwhelming majority of its sales are not impulse buys. Even in a recession, most people don't drastically reduce their spending on staple groceries, light bulbs, or diapers.

2. In a pinched economy, consumers are embracing their inner skinflint. And Wal-Mart is a penny pincher's paradise.

3. The economic-stimulus package President Bush signed earlier this month seems to have been designed to help Wal-Mart. It funnels cash to individuals making less than $75,000 or to families making less than $150,000, many of whom might shop at Wal-Mart. $300 really isn't enough to put a dent in a payment for a new car or to pay off a mortgage, but it might be enough to spur a shopper to throw a few extra goodies into the Wal-Mart shopping cart.

4. As the U.S. economy idles, the rest of the world is still growing quite rapidly. And Wal-Mart finally has meaningful international sales to report. In 2003, international sales were just 16.7% of overall revenues. But thanks to aggressive expansion in Mexico, China, and elsewhere, Wal-Mart has become an increasingly multinational corporation. In the 12 months that ended in January 2008, international sales rose 17.5% and constituted 24.2% of overall sales.