Click to enlarge. From the American Booksellers Association letter to the Antitrust Division of the U.S. Department of Justice:

From the American Booksellers Association letter to the Antitrust Division of the U.S. Department of Justice:

We ask that the Department of Justice investigate practices by Amazon.com, Wal-Mart, and Target that we believe constitute illegal predatory pricing that is damaging to the book industry and harmful to consumers.

As reported in the consumer and trade press this past week, Amazon.com, WalMart.com, and Target.com have engaged in a price war in the pre-sale of new hardcover bestsellers, including books from John Grisham, Stephen King, Barbara Kingsolver, Sarah Palin, and James Patterson. These books typically retail for between $25 and $35. As of writing of this letter, all three competitors are selling these and other titles for between $8.98 and $9.00.

The retailers are, in fact, taking orders for these books at prices far below cost. (In the case of Mr. King's book, these retailers are losing as much as $8.50 on each unit sold.) We believe that Amazon.com, Wal-Mart, and Target are using these predatory pricing practices to attempt to win control of the market for hardcover bestsellers.

Authors and publishers, and ultimately consumers, stand to lose a great deal if this practice continues and/or grows. If left unchecked, these predatory pricing policies will devastate not only the book industry, but our collective ability to maintain a society where the widest range of ideas are always made available to the public, and will allow the few remaining mega booksellers to raise prices to consumers unchecked.

We urge that the DOJ investigate and request an opportunity to come to Washington to discuss this at your earliest convenience.

MP: In other words, according to the booksellers, the "sky is falling," and the very foundations of our civilization are about to be destroyed by the rapacious book pricing policies of Amazon, Wal-Mart and Target. Where to start?

1. How exactly are low book prices "harmful to consumers?" Consumers love low prices, but have several remedies at their disposal to combat "predation" whenever they feel harmed by low prices: a) refuse to buy the book from Amazon or Wal-Mart for $9 and instead pay full price from an independent bookseller, b) refuse to buy the book at all, or c) offer to pay more than the "predatory" price from the "predator." That last option might not work so well at Amazon or Wal-Mart (if the book is priced at $9, it might be hard to actually pay $20 instead - how would the cashier ring it up?), but there might be some cases where a consumer could pay more than the listed price to combat "predation."

2. Keep in mind that about 90% of antitrust investigations involve one firm or group of firms complaining about one of their more efficient, low-cost competitors, like in this case.

3. Assuming that the predation worked and Amazon, Target and Wal-Mart were able to successfully drive all of the independent booksellers out of the market, there would be two problems:

a) They would still have to compete against each other and it could remain an intensely competitive book market even without the independents, to the continued benefit to consumers and

b) if the three oligopolists (Amazon, Target and Wal-Mart) did conspire to raise book prices to "book scalping" or "book gouging" levels, they could then: i) face antitrust charges, this time for high anti-competitive "monopoly" prices, and/or ii) face new competition from firms re-entering the market from the attractive "smell of profits" emanating from the monopoly pricing.

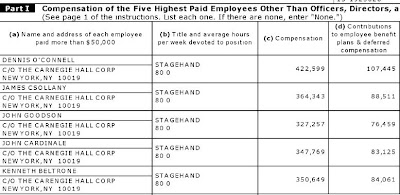

4. Notice in the Amazon listing above (click to enlarge) that Amazon offers "free shipping" on orders over $25, which is obviously below its actual cost. Isn't that then "predatory shipping?" Should that be investigated by the Dept. of Justice?

5. Also notice in the Amazon listing that there are more than 30 new copies of the Grisham book available from small, private booksellers at prices starting at $4.25, or more than 50% below Amazon's price of $9.59. Aren't those small booksellers engaged in predatory pricing AGAINST Amazon?

Bottom Line: "Predatory pricing," as the ABA describes it, is a myth and fairy tale, with virtually no real-world examples of it ever being successful, harmful to consumers, or leading to anti-competitive behavior in the long run.

It's only in the bizarre world of antitrust that any price you charge can be considered illegal. If your price is lower than your competitors, you could be charged with being a "predator" for anti-competitive "predatory pricing." If your price is "too high" you could be charged with anti-competitive monopoly pricing, "price gouging," or "ticket scalping." And if your price is the same as your competitors, you could be charged with collusion and anti-competitive price-fixing.

See Jeff Jacoby's excellent column about this issue "The War Against Affordable Books," which concludes that:

The ABA does its members no favors by painting them as helpless victims, undone because Amazon, Wal-Mart, and Target are discounting some popular books. The best neighborhood booksellers inspire affection and allegiance from customers that no online superstore can match. Prices are important, but they aren't all-important. And not everyone is looking for the latest Stephen King.