Coin Scalping? Buffalo Nickel Sells for $965 on Ebay

Professor Mark J. Perry's Blog for Economics and Finance

Economics has long been called the dismal science. The general economic outlook today is indeed dismal, but that doesn't mean job prospects in the field are. "There is no unemployment among Ph.D.s in economics," declares John Siegfried, a Vanderbilt University professor.

A commenter writes ".....with Mark running nanny patrol with comments...."

The chart above displays the decreasing median retirement age for men (data from BLS) over the last half century, from almost 67 years in 1950 to less than 62 years by 2005, a decrease of more than 5 years. During the same period, male life expectancy has increased significantly by almost 10 years, from 65.47 years in 1950 to 75.2 years in 2005 (data from CDC). As a result of those two trends, the average expected time in retirement for men has increased from 0 in 1950 to 13.5 years in 2005.

The chart above displays the decreasing median retirement age for men (data from BLS) over the last half century, from almost 67 years in 1950 to less than 62 years by 2005, a decrease of more than 5 years. During the same period, male life expectancy has increased significantly by almost 10 years, from 65.47 years in 1950 to 75.2 years in 2005 (data from CDC). As a result of those two trends, the average expected time in retirement for men has increased from 0 in 1950 to 13.5 years in 2005.

After several years of punishment, the U.S. homebuilding industry has begun to show some glimmers of hope. Earlier this month, The National Association of Home Builders reported its confidence index to be at its highest level since October. This optimism has pushed shares of the SPDR S&P Homebuilders ETF (NYSE: XHB) 18.3% higher during the past 4 weeks. Record-low interest rates and an $8,000 tax credit for new home buyers have been key factors to the XHB rebound.

After several years of punishment, the U.S. homebuilding industry has begun to show some glimmers of hope. Earlier this month, The National Association of Home Builders reported its confidence index to be at its highest level since October. This optimism has pushed shares of the SPDR S&P Homebuilders ETF (NYSE: XHB) 18.3% higher during the past 4 weeks. Record-low interest rates and an $8,000 tax credit for new home buyers have been key factors to the XHB rebound.The Yankees decided when they opened their new ballpark, that they would outsmart the scalpers and just raise ticket prices to levels where the tickets had normally sold on the secondary market in previous years. It seemed pretty smart at the time and then the first 6 games happened and the seats were glaringly empty at new Yankee Stadium. Now the Yankees have announced that they are going to go ahead and lower some prices.

In a previous CD post, I suggested that "Since fewer than 10% of all U.S. jobs are now in the manufacturing sector, should we continue to rely on industrial production as a key economic variable, when the manufacturing share of overall employment continues to decline to record low levels?"

In a previous CD post, I suggested that "Since fewer than 10% of all U.S. jobs are now in the manufacturing sector, should we continue to rely on industrial production as a key economic variable, when the manufacturing share of overall employment continues to decline to record low levels?"

The National Association of Realtors released its monthly Housing Affordability Index today, showing that the index fell in March to 166.7 from 174.4 in February, and from 176.9 in January (historical high), but is still 43 points above the 123.7 index average since 1989 (see chart above).

The National Association of Realtors released its monthly Housing Affordability Index today, showing that the index fell in March to 166.7 from 174.4 in February, and from 176.9 in January (historical high), but is still 43 points above the 123.7 index average since 1989 (see chart above).

Imagine strolling through your neighborhood and, with a glance at your iPhone, finding out instantly how much just about any home you walk by last sold for. What if your iPhone could also display your location on a map that pinpoints nearby homes for sale and any that have recently changed hands? That's the promise of the new location-based iPhone application unveiled today by property valuation and listings giant Zillow.

Imagine strolling through your neighborhood and, with a glance at your iPhone, finding out instantly how much just about any home you walk by last sold for. What if your iPhone could also display your location on a map that pinpoints nearby homes for sale and any that have recently changed hands? That's the promise of the new location-based iPhone application unveiled today by property valuation and listings giant Zillow.

The economy contracted at a 6.1% annual rate in the first quarter, according to today's BEA report, which was worse than the 4.6% decrease in real GDP expected by economists. The one bright spot in today's report was the rebound in Personal Consumption Expenditures during the first quarter - consumer spending grew at 2.2% during the first quarter (see graph above) following two quarters of negative growth (-4.3% in 2008:Q4 and -3.9% in 2008:Q3), and was just slightly below the 2.27% average growth since 2001.

The economy contracted at a 6.1% annual rate in the first quarter, according to today's BEA report, which was worse than the 4.6% decrease in real GDP expected by economists. The one bright spot in today's report was the rebound in Personal Consumption Expenditures during the first quarter - consumer spending grew at 2.2% during the first quarter (see graph above) following two quarters of negative growth (-4.3% in 2008:Q4 and -3.9% in 2008:Q3), and was just slightly below the 2.27% average growth since 2001.

Manufacturing activity in the central Atlantic region contracted at a markedly diminished pace in April, according to the Richmond Fed’s latest survey. Our broadest indicators of overall activity—shipments, new orders and employment—remained in negative territory but the rate of decline moderated considerably from our last report. Evidence of diminished weakness was also reflected in all other indicators. District contacts reported that orders backlogs and vendor delivery times remained negative but improved from March’s readings, while capacity utilization was virtually unchanged. In addition, manufacturers reported somewhat slower growth in inventories.

Manufacturing activity in the central Atlantic region contracted at a markedly diminished pace in April, according to the Richmond Fed’s latest survey. Our broadest indicators of overall activity—shipments, new orders and employment—remained in negative territory but the rate of decline moderated considerably from our last report. Evidence of diminished weakness was also reflected in all other indicators. District contacts reported that orders backlogs and vendor delivery times remained negative but improved from March’s readings, while capacity utilization was virtually unchanged. In addition, manufacturers reported somewhat slower growth in inventories.

Arlington, Va. – U.S. metropolitan areas with lower taxes exhibit higher employment growth, faster population growth, and greater increases in real personal income than areas with a higher tax burden, concludes a new study released today by the National Foundation for American Policy (NFAP), an Arlington, Va.-based policy research group. The study, “Higher Taxes, Less Growth,” found that areas with higher taxes had lower employment growth, smaller personal income gains and slower growth of population.

Arlington, Va. – U.S. metropolitan areas with lower taxes exhibit higher employment growth, faster population growth, and greater increases in real personal income than areas with a higher tax burden, concludes a new study released today by the National Foundation for American Policy (NFAP), an Arlington, Va.-based policy research group. The study, “Higher Taxes, Less Growth,” found that areas with higher taxes had lower employment growth, smaller personal income gains and slower growth of population.

The chart above (click to enlarge) displays the most recent 3-month returns for the emerging market stock markets (in local currency) vs. the USA (4.09%), according to data from MSCI Barra. Nineteen of the emerging market indexes are showing double-digit returns for the last three month period.

The chart above (click to enlarge) displays the most recent 3-month returns for the emerging market stock markets (in local currency) vs. the USA (4.09%), according to data from MSCI Barra. Nineteen of the emerging market indexes are showing double-digit returns for the last three month period.

Looks like smartphones are getting even smarter. We can already access our email, GPS navigate and use a wide range of business document formats, making them an integral part of a business person’s day. Now doctors might soon be packing a smartphone alongside their stethoscopes. Computer engineers at Washington University in St. Louis have combined a smartphone with USB-based ultrasound probe technology to produce a mobile imaging device that fits in the palm.

Looks like smartphones are getting even smarter. We can already access our email, GPS navigate and use a wide range of business document formats, making them an integral part of a business person’s day. Now doctors might soon be packing a smartphone alongside their stethoscopes. Computer engineers at Washington University in St. Louis have combined a smartphone with USB-based ultrasound probe technology to produce a mobile imaging device that fits in the palm.

Federal spending is growing by leaps and bounds. The budget hit $3.9 trillion this year, double the level of spending just eight years ago. The government is also increasing the scope of its activities, intervening in many areas that used to be left to state and local governments, businesses, charities, and individuals.

By 2008, there were 1,804 different subsidy programs in the federal budget. Hundreds of programs were added this decade—ranging from a $62 billion prescription drug plan to a $1 million anti-drug education grant—and the recent stimulus bill added even more. We are in the midst of the largest federal gold rush since the 1960s.

~From the study "Number of Federal Subsidy Programs Tops 1,800," by Chris Edwards, Director of Tax Policy Studies, Cato Institute

Click to enlarge graphs.

Click to enlarge graphs.

5. Isn't naming professional sports teams after foreign animals (Tigers, Lions) somewhat unpatriotic? If a team is named for an animal, wouldn't it really be better to name teams after American animals instead? If you support "Buy American," shouldn't you also support a "Name American" practice for professional sports teams?

According to the Federal Reserve's recently released financial statements for 2008:

Don Boudreaux in the Pittsburgh Tribune-Review:

Don Boudreaux in the Pittsburgh Tribune-Review:

Industrial production is also one of the main variables used by the NBER to determine recessions:

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

MP: But is industrial production still as relevant as an economic indicator as it used to be? Probably not, since industrial production is a measure of manufacturing output and manufacturing jobs as a percent of total payroll employment have declined significantly from 26.5% in 1969 (more than 1 out of every 4 jobs was in manufacturing) to the lowest-ever level of only 9.25% (about 1 in 11 jobs is in manufacturing) in March 2009 (see chart above, data are from the BLS via Economagic).

Since fewer than 10% of all U.S. jobs are now in the manufacturing sector, should we continue to rely on industrial production as a key economic variable, when the manufacturing share of overall employment continues to decline to record low levels? Probably not. While it might have made sense to rely on industrial production as a key economic indicator in the 1960s and the 1970s during the Machine Age, it probably doesn't make sense any longer in the Information Age.

1. Apple (+40%) vs. S&P 500 (-40%) over the last two years (see chart above).

1. Apple (+40%) vs. S&P 500 (-40%) over the last two years (see chart above). 2. Market Capitalization: Microsoft vs. Apple 1990-2009 (see chart above), via Scott Grannis, who writes, "As recently as a little over 9 years ago Microsoft had a market cap of $586 billion, while Apple's was a mere $17 billion. MSFT investors have since lost $421 billion, while AAPL investors have gained $95 billion. In my first post on this subject last October, I suggested AAPL could surpass MSFT's market cap within a few years. One reader said it would happen in less than a year. He has a good chance of being right."

2. Market Capitalization: Microsoft vs. Apple 1990-2009 (see chart above), via Scott Grannis, who writes, "As recently as a little over 9 years ago Microsoft had a market cap of $586 billion, while Apple's was a mere $17 billion. MSFT investors have since lost $421 billion, while AAPL investors have gained $95 billion. In my first post on this subject last October, I suggested AAPL could surpass MSFT's market cap within a few years. One reader said it would happen in less than a year. He has a good chance of being right."Decriminalizing the possession and use of marijuana would raise billions in taxes and eliminate much of the profits that fuel bloodshed and violence in Mexico.

The California Association of Realtors' (CAR) Traditional Housing Affordability Index (HAI) measures the percentage of households that can afford to purchase the median priced home in the state and regions of California based on traditional assumptions (methodology here).

The California Association of Realtors' (CAR) Traditional Housing Affordability Index (HAI) measures the percentage of households that can afford to purchase the median priced home in the state and regions of California based on traditional assumptions (methodology here).According to a recent Standard & Poor's study comparing index funds to actively-managed funds for a five-year period ending in 2008:

KATHMANDU -- Mobile phone services will soon be available on top of Mt Everest, the world’s tallest peak. The service, which will operate on both GSM and CDMA handsets, will be introduced by Nepal Telecom (NT), Nepal’s largest telecom company.

KATHMANDU -- Mobile phone services will soon be available on top of Mt Everest, the world’s tallest peak. The service, which will operate on both GSM and CDMA handsets, will be introduced by Nepal Telecom (NT), Nepal’s largest telecom company.

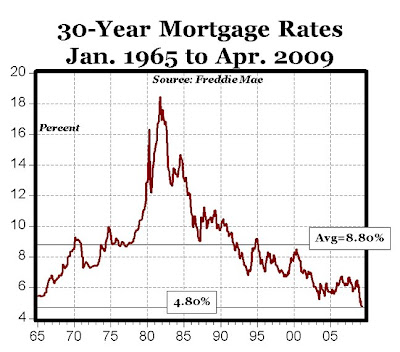

According to data released today by Freddie Mac, 30-year mortgage rates fell this week to 4.80%, from 4.82% last week and 4.87% the previous week. Except for the 4.78% average during the first week of April, the 4.80% rate marks the lowest 30-year mortgage rate in history (see chart above), and is a full 4 percentage points below the 8.80% average rate since 1964.

According to data released today by Freddie Mac, 30-year mortgage rates fell this week to 4.80%, from 4.82% last week and 4.87% the previous week. Except for the 4.78% average during the first week of April, the 4.80% rate marks the lowest 30-year mortgage rate in history (see chart above), and is a full 4 percentage points below the 8.80% average rate since 1964.What feature do 15 out of the top 16 states for economic outlook have in common?

What feature do the top 8 states for domestic migration have in common? What feature do the bottom 10 states have in common?

What feature do the top 8 states for domestic migration have in common? What feature do the bottom 10 states have in common?WASHINGTON (October 18, 2006) -- Postage stamps can be purchased by mail, at the supermarket, even from many bank cash machines. But there's one place you won't be able to get them in a few years - vending machines at the post office. The U.S. Postal Service plans to eliminate its 23,000 vending machines by 2010, the agency said in a recent internal memo.

After a 15% collective pay cut in 2007, chief executives of the 500 biggest companies in the U.S. (as measured by a composite ranking of sales, profits, assets and market value) took another reduction in total compensation, 11%, for 2008. The last time the big bosses took a pay hit for two consecutive years was in 2001 and 2002.