The World Is Flat, and Chocolatiers Want to Coat It

NY Times: Swiss chocolatiers, having long ago conquered markets in Europe and North America, are now aiming at the vast expanses of Russia, India and China, making Swiss chocolate a case study in globalization.

NY Times: Swiss chocolatiers, having long ago conquered markets in Europe and North America, are now aiming at the vast expanses of Russia, India and China, making Swiss chocolate a case study in globalization.

Reminder: Trade works both ways. As economies like India, Russia, China, and Brazil become wealthy and prosperous by producing goods and services for the U.S. and European markets, the workers of those economies also become increasingly wealthy and prosperous consumers of American and European products.

Exhibit A: Swiss chocolate.

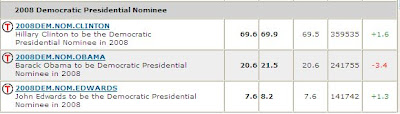

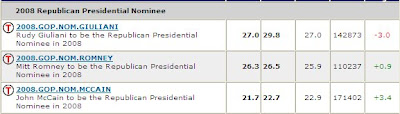

Based on Intrade.com trading:

Based on Intrade.com trading: