CARPE DIEM

Professor Mark J. Perry's Blog for Economics and Finance

Tuesday, October 31, 2006

More Internet Porn, Less Rape?

From University of Rochester economist Steven E. Landsburg, author of "Armchair Economist: Economics and Everyday Experience," a new article in today's Slate.com titled "How the Web Prevents Rape." Here are some excerpts:

"Does pornography breed rape? Quite the opposite, it seems.

What happens when more people view more of porn? The rise of the Internet offers a gigantic natural experiment. Better yet, because Internet usage caught on at different times in different states, it offers 50 natural experiments.

The bottom line on these experiments is, "More Net access, less rape." A 10 percent increase in Net access yields about a 7.3 percent decrease in reported rapes. States that adopted the Internet quickly saw the biggest declines. And, according to Clemson professor Todd Kendall, the effects remain even after you control for all of the obvious confounding variables, such as alcohol consumption, police presence, poverty and unemployment rates, population density, and so forth."

Monday, October 30, 2006

NYC Taxi Cartel, I Mean Commission

Over the last 5 years, NYC taxi medallion prices have more than doubled from $200,000 in October 2001 to an all-time high of $450,000 in 2006! Click here for a better view of the graph above. Note that a $450,000 medallion is the license required to operate only ONE taxicab in NYC!

Over the last 5 years, NYC taxi medallion prices have more than doubled from $200,000 in October 2001 to an all-time high of $450,000 in 2006! Click here for a better view of the graph above. Note that a $450,000 medallion is the license required to operate only ONE taxicab in NYC!Why so expensive? A medallion is the membership fee to join a taxi cartel, with a strict limit on the number of members competing for business in NYC. With such high barriers to entry, and strict limits on competition, the taxi cab cartel can charge monopoly prices, which then justifies paying $450,000 to join the cartel.

According to the NYC Taxi and Limousine Commission, the official name of the NYC Taxi Cartel: "In 1937, the number of taxicab medallions was limited to those that existed at that time. By the late 1940s, this number settled at 11,787 and was capped by law. Today there are currently only 12,779 yellow medallion taxicabs operating in New York City. A new medallion is a rare opportunity."

Yes, a rare opportunity to join a cartel. Membership has its privileges.

London Stock Exchange Trivia

Stock prices are quoted on the London Stock Exchange in British "pence" and not British "pounds." For example, British Airways is trading at about 457.75, which is 457.75 pence and not 457.75 pounds.

Strange, but true. See the list of stocks in the FTSE-100 here, note that there is a "p" after each stock price.

Michigan vs. France

Michigan's September unemployment rate of 7.1% is considered high for the U.S., second highest in the country next to Mississippi (7.2%). But if Michigan was a country in Europe, it would be considered much better than average compared to the 7.9% average unemployment rate for OECD Europe countries.

Germany's unemployment rate is 8.5% for August, France is 8.8%, Finland 7.8%, and Belgium 8.6%.

From today's Investor's Business Daily, an editorial about the persistent unemployment problems in France, despite the mandatory maximum 35-hour work week that was supposed to create jobs:

No longer able to withstand the rigors of a normal schedule, the French had to cut back to a 35-hour workweek. Six years later, and the rotten fruit of socialism is being harvested.

With fewer hours worked, the state predictably has been collecting fewer taxes. The shorter workweek, Finance Minister Thierry Breton reported this week, has added roughly $126 billion to the national debt. For a country obsessed with the safety net, this was deflating news.

But the lost productivity and the drag on economic growth are even worse. All told, the 35-hour week has cost France hundreds of billions of dollars in lost output.

The 35-hour workweek, introduced by I-saw-Karl-Marx-in-my-dreams Socialist Prime Minister Lionel Jospin, was peddled as a solution for France's high unemployment rate. With employees working fewer hours — down from 39 a week before overtime kicked in — businesses would be forced to hire more people.

Has it worked? No. France's jobless rate continues to stagnate in the 9% area — just modestly better than the 5 1/2-year high of 10.2% between March and May of last year, but not much. Nine percent is about where it was when President Jacques Chirac took office more than 10 years ago.

It can take up to 100 days of bureaucratic dithering to get rid of an employee in a big company. As a result, businesses are shy about hiring because they fear they can't fire a worker for not doing his or her job.

French business leaders want the 35-hour workweek abolished. That's a good idea. Unfortunately, fierce resistance from the socialists might be too much to overcome.

Google Rocks

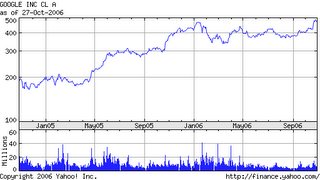

Google stock price is approaching $500 per share. It originally sold for about $100 in August 2004 when it went public, and has doubled in less than 18 months, since May 2005 when it was $222.

Google stock price is approaching $500 per share. It originally sold for about $100 in August 2004 when it went public, and has doubled in less than 18 months, since May 2005 when it was $222.Google's market capitalization of $145 billion is more than IBM, Hewlett-Packard, Intel, McDonald's, Merck and Coca-Cola. It is worth 4X the market value of Yahoo! and 3X the market value of Ebay.

It is worth about the same as the combined market value of GM, Ford, ChryslerDaimler and Boeing.

Grade Inflation

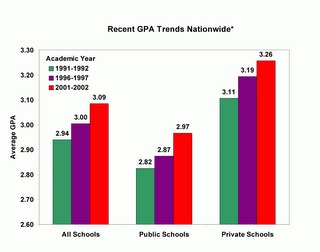

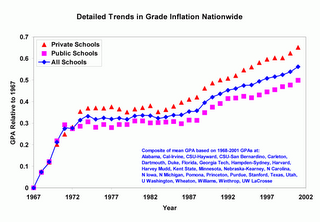

Graphs above are from the website GradeInflation.Com, run by a retired Duke University professor.

Graphs above are from the website GradeInflation.Com, run by a retired Duke University professor.Also, there is an article titled "When Bs Are Better" in the current issue (subscription required) of The Chronicle for Higher Education (subscription required) by a Rutgers management professor:

In the fall of 2001, The Boston Globe reported that 91 percent of the seniors who had graduated from Harvard University the previous June had received honors, prompting an investigation that concluded grade inflation was indeed a serious problem at Harvard.

Faculty members have not fulfilled the responsibilities associated with their proclaimed right to be the final judges of student performance. In shirking that duty, they have also neglected their broader obligations to society: Teachers weaken rather than bolster the commonweal when they fail to award meaningful grades. Grading laxness at all levels of American education has contributed directly or indirectly to a variety of problems, including declining scores on the SAT, decreases in the ability of American undergraduate and graduate students to understand prose, and poor training in mathematics and science, which puts American students behind their peers in many European and Asian countries.

Could more-realistic grading stem the tide? Ample evidence shows that students learn more when the bar for success is raised rather than lowered. For example, Valen Johnson's Grade Inflation contains analyses demonstrating that students who took prerequisite courses from teachers who were tough graders performed better in upper-division classes than did students whose prerequisite courses were taught by easier graders.

What are universities doing?

Carpe diem.A few universities have established grading standards, and their administrators monitor professors' compliance. Perhaps the most heralded example is Princeton University's adoption of limits on the percentage of A's given in undergraduate courses. And in the M.B.A. programs at the University of Chicago and New York University's Leonard N. Stern School of Business, online grade-reporting systems will not accept an instructor's grades in certain courses if the grades exceed school or departmental standards.

Sunday, October 29, 2006

Big and Slow Doesn't Work, Big and Fast Might

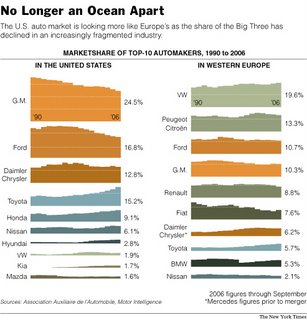

From today's (Sunday) NY Times article "Now Playing in Europe: The Future of Detroit:"

From today's (Sunday) NY Times article "Now Playing in Europe: The Future of Detroit:"“There’s no case anywhere in the world of any previously dominant manufacturer retaining much more than 20 percent once the market is opened to full global competition,” said G.M.’s vice chairman, Robert A. Lutz.

While some national loyalty lingers in Europe, as it does in the United States, no company can rely on such loyalty to sell cars. Carmakers are forced to continually update their brand images in order to stand out in a crowded market. At the same time, like their European counterparts, America’s unionized autoworkers must also adjust. They cannot count much longer on the cushy contracts that typified their jobs in the past, because new deals at new factories have chipped away at pay and benefits while emphasizing more-productive work methods.

European companies have long competed this way, but it is a new reality for American carmakers who were so dominant for much of the last century. As recently as 1990, G.M., Ford and Chrysler together sold more than 70 percent of the cars bought in the United States; G.M. alone accounted for more than one-third of auto sales.

Now those companies’ American market share has dropped to around 50 percent, while the influence of Toyota and other foreign manufacturers is growing. Though G.M. remains on top, its share has slipped below one-quarter, and the battleground has become the section between 10 percent and 20 percent of the market. That is the area where Ford and Chrysler have slipped and where Toyota and Honda have grown.

David E. Cole, chairman of the Center for Automotive Research in Ann Arbor, Mich., said that American carmakers must change, and fast, or risk disaster. “For an automobile manufacturer, big and slow doesn’t work anymore,” he said. “Big and fast gives you a chance.”

Friday, October 27, 2006

NCAA's Tax-free Lifestyle Operating Football and Basketball Factories at Colleges

From George Will's new column in today's Washington Post:

What is the place of high-stakes football in higher education? Only 55 percent of football players and 38 percent of basketball players at Division I-A schools graduate.

Republican Rep. Bill Thomas wrote, as chairman of the tax-writing Ways and Means Committee, an eight-page letter to the president of the National Collegiate Athletic Association, asking awkward questions. Thomas wonders how, or whether, big-time college sports programs, which generate billions of tax-exempt dollars -- CBS pays the NCAA an annual average of $545 million, mainly for the rights to televise the March Madness basketball tournament -- further the purposes for which educational institutions are granted tax-exempt status.

Some say the tax-exempt status of college sports is justified by the fact -- and it is a fact -- that successful sports teams often trigger increased applications for admission, and largess from alumni and legislatures. But, Thomas notes, "federal taxpayers have no interest in increasing applicant pools at one school opposed to another." Furthermore, athletic success that causes a surge of giving to universities might decrease giving to worthy charities.

Also, tax exemption is financing an escalation of coaches' salaries. More than 35 college football coaches are paid more than $1 million annually.

The University of Michigan, which has had 198 consecutive sellouts at its stadium -- it now seats 107,501 -- is spending $226 million to add 3,200 luxury seats and 83 suites. The University of Texas at Austin is spending $150 million to add 10,000 seats to its current 85,123 capacity. These may be sound commercial decisions, but why should this commerce be tax-exempt?

Arbitrage on Eagle Coin Sets?

American Eagle 20th Anniversary Silver 3-coin sets are available from the US Mint for $100 + $4.95 shipping.

American Eagle 20th Anniversary Silver 3-coin sets are available from the US Mint for $100 + $4.95 shipping.These exact same coin sets are selling on Ebay for $160 - $175, + $5-$10 for shipping.

The only difference is that coins on Ebay are available immediately, and the coins from the Mint will be shipped in early December. But being willing to $60-$75 extra for delivery in November vs. delivery one month later in December for $100, is about a 720%-900% annual interest rate. Annualized interest rates at Paycheck Advance operations are often less than that, see some rates here, showing that 14-day rates are "only" 460% on an annual basis.

Arbitrage profits anyone? You can purchase up to ten sets from the US Mint!

New Homes: Good Time to Buy, Save $40k vs Feb

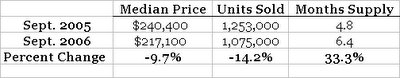

The median price for new homes sold in September ($217,100) was 9.7% below last September's median price of $240,400, which is the largest percentage year-over-year drop in median home prices since December 1970! The median price home in September 2006 fell to about the same as the median price two years ago in August 2004 ($218,100). The median price for new homes peaked in February 2006 at $250,800, and new home prices have fallen by almost $40,000 in the last seven months!

The median price for new homes sold in September ($217,100) was 9.7% below last September's median price of $240,400, which is the largest percentage year-over-year drop in median home prices since December 1970! The median price home in September 2006 fell to about the same as the median price two years ago in August 2004 ($218,100). The median price for new homes peaked in February 2006 at $250,800, and new home prices have fallen by almost $40,000 in the last seven months!Unit sales have fallen by more than 14% over the last year, and the "months supply"of new homes has increased (months supply is the ratio of new houses for sale to new houses sold).

The information above is from the monthly report on new home sales from the Census Bureau. Monthly reports on existing-home sales come from the National Association of Realtors. According to the Realtors report earlier this week, the median price for an existing home was $220,000 in September, 2.2 percent below last September's median price of $225,000.

Therefore, you can now buy the median priced new home for $217,100, which is almost $5,000 cheaper than buying the median priced existing home!

Thursday, October 26, 2006

Big Worries for Big Oil?

From today's WSJ, a staff editorial on oil companies, profits and oil prices:

Our favorite headline this week has to be "Big Worries for Big Oil," reporting that oil company profits are under pressure as oil prices decline. Exxon Mobil, Royal Dutch Shell, BP and other members of the vast energy conspiracy may have a hard time keeping their run of profit growth going now that oil prices have fallen to $60 or so a barrel from upwards of $80.

Imagine that: Oil companies are subject to market forces. They may make big profits when the price of oil rises, but those profits invariably fall back down to Earth when oil prices decline. This is also what happened in the 1990s, as oil crashed below $20 a barrel after the heights reached in the 1970s. The companies and their shareholders swallowed those declines, as they should have.

This cycle is typical of commodity markets, and is part of the risk of doing business. The run-up in oil prices over the past couple of years was rooted in worries about supply related to hurricanes, Middle East tensions and low stockpiles, as well as growing demand in a strong global economy and the Federal Reserve's easy money policy. As supply fears and demand have ebbed and the Fed has tightened, prices have fallen back down, albeit still to higher levels than a decade ago.

The recent price decline is also proof of the folly of a "windfall profits" tax or similar punitive measures against Big Oil favored by so many politicians. Only this week, however, Democratic Leader Nancy Pelosi repeated her pledge to soak the oil companies if her party takes over the House next month.

Her policy seems to be that when oil prices decline, oil company shareholders must absorb all the market risk and the lower profits. But when oil prices rise, the companies must hand over a cut of their profits to Members of Congress to spend as they like. The only "windfall" is for the political class.

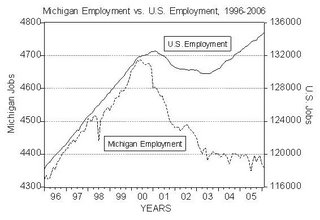

Michigan: Single State Recession?

From today's WSJ, an editorial about Michigan's economy and upcoming election for governor, written by Michigan resident Shikha Dalmia of the Reason Foundation.

That Michigan has become the Mississippi of the Midwest is no secret (actually, Mississippi is doing better than Michigan right now). While the rest of the country is experiencing real overall growth of 3.2%, Michigan is in a single-state recession. Its unemployment rate, at 7.1%, is twice the national average; it was the only state last year not hit by a hurricane to lose jobs. Personal per capita income is 7% below the national average. Home foreclosure rates have doubled this year. And over the last four years, 200,000 economic refugees have left the state, a trend that will only accelerate as the ongoing downsizing of the Big Three forces other auto-related industries to lay off workers.

The fundamental reason why not a single non-U.S. auto maker like Honda and Toyota has ever opened a major plant in Michigan -- notes David L. Littmann, a senior economist at the Mackinac Center for Public Policy -- is not a lack of these offices (MP: Devos' plan to make Michigan globally competitive involves opening offices in 10 countries to promote trade and tourism), but that it costs too much to generate wealth in this state.

Thanks to the strong union presence, Michigan's labor costs relative to productivity are the second-highest in the nation. Normally, an economy might adapt to such realities by "diversifying" -- to use a buzz word that both candidates bandy -- into non-unionized service industries. But Michigan's onerous combination of redistributive regulations and high taxes has prevented even this from happening, making it more vulnerable to the imploding auto industry.

Lesson on Opportunity Cost: Professor Gatemouth

I think blues guitarist Clarence Gatemouth Brown understood opportunity cost, based on his song "My Time is Expensive." Here are the lyrics:

My time is expensive, baby.

I'm tryin' to make it last.

My time is expensive, baby.

I'm tryin' to make it last.

If we're going to get together,

We better do it fast.

Listen yoself here: My Time is Expensive by Clarence Gatemouth Brown, R.I.P.

Happy 25th Anniversary, HP-12C Calculator

In 1981, Hewlett-Packard introduced the HP-12C financial calculator, and it became the standard financial calculator used by financial anlaysts, mortgage bankers, stock analysts, bond traders, accountants, real estate brokers, MBA students, finance and accounting majors, etc.

The HP-12C orignally sold for $150, it now sells for $70.

The goal of developing the 12C was to have a sophisticated programmable financial calculator, that would be small enough to fit in a shirt pocket, would have long battery life and would meet the HP "drop test" - the ability to withstand a fall from a desktop onto a concrete floor. HP worked with several researchers with Ph.D.s in numerical analaysis, mathematics, electrical engineering and computer science to develop the 12C.

The decision was made, for the ultimate mathematical and computational efficiency, to use RPN (Reverse Polish Notation) for data entry, instead of the traditional algebraic entry. For example, instead of 2 + 2 = 4 (algebraic entry), RPN entry would be 2 ENTER 2 + (mathematical operation comes last). Although mathematicians and engineers were comfortable with RPN, HP was concerned that finance professionals would have trouble accepting RPN, but the calculator became a huge success, and is still used widely today.

In 2003, HP introduced the Platinum 12-C that uses either RPN or algebraic. Although once you learn RPN, I can guarantee that you will NEVER go back to algebraic, it is TOO slow.

For the 25th anniversary of the 12C, HP recently introduced a limited edition 12C model for $80, with both RPN and algebraic, with a beautiful leather case.

Here is HP's backgrounder on the 12-C.

Here is an explanation of RPN.

BTW, I own 2 original 12Cs, one platinum 12C, 2 two of the new 25th anniversary 12C, one HP 10B and one HP 10BII.

Wednesday, October 25, 2006

Happy 5th Anniversary, Economic Expansion

As we celebrate the 5th anniversary of the iPod in October, let's also get ready to celebrate another important upcoming 5th anniversary: In November, it will be the fifth anniversary of the current economic expansion, which started in November 2001. The National Bureua of Economic Research is the offical national authority on business cycle dates, see its official business cycle reference dates here, back to before the Civil War.

The last record-setting 120-month economic expansion lasted from March 1991 to March 2001, and the last recession lasted 8 months from March 2001 to October 2001. Then the current economic expansion started in November 2001, and therefore November 2006 will mark the 5th anniversary of this expansionary phase of the business cycle.

The average economic expansion is 52 months, so the current 60-month expansion is already longer than average. And we are half way to the 120-month record of the last expansion.

Happy 5th Birthday, U.S. Economic Expansion!

Latest Asian Economic Tiger: Vietnam

From today's NY Times, an article about Vietnam's roaring economy:

In the three decades since Vietnam has gone from communism to a form of capitalism, it has begun surpassing many neighbors. It has Asia’s second-fastest-growing economy, with 8.4 percent growth last year, trailing only China’s, and the pace of exports to the United States is rising faster than even China’s. Through the end of last year; Vietnam’s growth rate exceeded that of Thailand, Malaysia, Taiwan, South Korea and even India, its closest rival.

American companies like Intel and Nike, and investors across the region, are pouring billions of dollars into the country; overseas Vietnamese are returning to run the ventures.

The Vietnamese government, like China’s, has embraced capitalism after becoming disillusioned with the widespread poverty and sometimes hunger that accompanied tight state control of the economy. Economic liberalization policies have been pursued in earnest since the early 90’s, after poor harvests and economic mismanagement left millions facing malnutrition in 1990.

Bottom Line: The biggest difference between capitalism and socialism is this: Capitalism works.

Congressional Price Gouging?

From Walter E. Williams' latest column:

The Washington-based Institute for International Economics has assembled data that show that tariffs and quotas on imported sugar saved 2,261 jobs during the 1990s. As a result of those restrictions, the average household pays $21 more per year for sugar. The total cost, nationally, sums to $826,000 for each job saved. Trade restrictions on luggage saved 226 jobs and cost consumers $1.2 million in higher prices for each job saved. Restrictions on apparel and textiles saved 168,786 jobs at a cost of nearly $200,000 for each job saved.

You might wonder how it is possible for, say, the sugar industry to rip off consumers. After all, consumers are far more numerous than sugar workers and sugar bosses. It's easy. A lot is at stake for those in the sugar industry, workers and bosses. They dedicate huge resources to pressure Congress into enacting trade restrictions.

But how many of us consumers will devote the same resources to unseat a congressman who voted for sugar restrictions that forced us to pay $21 more for the sugar our family uses? It's the problem of visible beneficiaries of trade restrictions, sugar workers and bosses, gaining at the expense of invisible victims -- sugar consumers.

We might think of it as congressional price-gouging.

Tuesday, October 24, 2006

Best Jazz on the Internet

For the best jazz radio on the Internet, actually the best jazz radio on the planet, check out Minneapolis station KBEM-FM Jazz 88 here.

Are Oil Prices and Gas Prices Related?

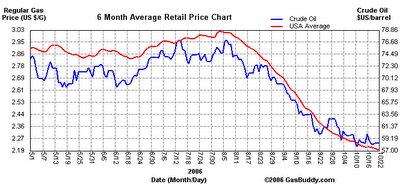

A few weeks ago, I had a nationally distributed op-ed on the "gas price conspiracy," where I made the claim that the main economic reason that gas prices have come down is because crude oil prices have come down. Seems simple and obvious.

A few weeks ago, I had a nationally distributed op-ed on the "gas price conspiracy," where I made the claim that the main economic reason that gas prices have come down is because crude oil prices have come down. Seems simple and obvious.Here is what I wrote: "The simple truth is that changes in the world price of crude oil account for nearly all changes in the retail price of gasoline -- and so recent international events such as an easing of tensions in the Middle East and growing inventories of oil exerted substantial influence in reducing both oil and gasoline prices -- exactly what textbook economics tells us to expect."

Here is a question from a reader in San Diego:

I read your editorial in the San Diego Union Tribune. Interesting stuff. You make the claim that gas prices have come down because the price of crude has come down. My question is this: Since crude prices have come down ~25% and since the price of crude accounts for ~50% of gas prices, why aren't gas prices in the $2.60 range? How do you account for this discrepancy?I sent the reader the chart above that shows graphically very clearly the direct relationship between crude oil prices and retail gas prices.

iPod 5 Years Later

On October 23, 2001, Apple announced in this press release its introduction of the ipod for $400 retail, holding 1,000 songs on a 5 GB hard drive, that could only be used with a Mac. Steve Jobs said at the time, “With the iPod, listening to music will never be the same again.”

On October 23, 2001, Apple announced in this press release its introduction of the ipod for $400 retail, holding 1,000 songs on a 5 GB hard drive, that could only be used with a Mac. Steve Jobs said at the time, “With the iPod, listening to music will never be the same again.”Five years later, for less money ($332 at BestBuy), and for use on a Mac OR PC, you can get an 80 GB iPod that holds 20,000 songs and plays movies! A 4GB iPod comparable to the original iPod holding 1,000 songs now sells for $189 at BestBuy.

Things get better and better and cheaper all time time, remember when VCRs cost $1200? Probably not, if you were born after 1975 or so.

See CafeHayek for more on this: how does BLS handle this significant price decrease and significant quality improvement?

Monday, October 23, 2006

Tigers Win Game 2, ¡Viva los Tigres!

Pudge Rodriguez (Puerto Rico) and Jim Leyland have been two of the biggest reasons for the Tigers' turnaround in the last three years.

Pudge Rodriguez (Puerto Rico) and Jim Leyland have been two of the biggest reasons for the Tigers' turnaround in the last three years.Hispanic connection: 11 players on the Tigers are of Latino descent:

Dominican Republic: Placido Polanco, Fernando Rodney, Neifi Perez, Alexis Gomez, Ramon Santiago.

Venezuela: Carlos Guillen, Magglio Ordonez, Wilfredo Ledezma, Omar Infante.

Puerto Rico: Ivan "Pudge" Rodriguez

Mexico: Joel Zumaya (grew up in California, parents are Mexican.)

From today's WSJ, an editorial titled "Stealing Bases, Not Jobs," which highlights a recent study titled: "Immigrants, Baseball and the Contributions of Foreign-Born Players to America's Pastime." Here is an excert of the WSJ article:

On the eve of the World Series, the sprinkle has become a solid block. A new study shows that, as of Aug. 31, a whopping 23% of players on active rosters in the majors were foreign born. That's more than double the percentage as recently as 1990 and about 10 times what it was in the 1920s and '30s.

But you don't hear Americans complaining about this group of immigrants. And we're not aware of any U.S.-born hitters accusing the Red Sox home-run champion David Ortiz -- or the other Dominican players here on visas -- of stealing their job. Of course not. They get it, we all get it: Foreign players been berry, berry good to baseball.

Sunday, October 22, 2006

Chinese Cars in the US? Not Yet.

From the NY Times, an article about China's effort to export cars to the US:

From the NY Times, an article about China's effort to export cars to the US:Despite growing anxiety that the Chinese would quickly seek to conquer yet another important industry, it now looks as if it will be at least another several years before Chinese automakers start exporting large numbers of cars they both design and make. They had intended to start selling their own brands in the United States as soon as 2007 but have pushed off their plans by a couple of years.

And now, some Chinese auto executives admit, it could be as late as 2020 before they will be ready to take on the world auto market.

While Chinese cars are inexpensive and approaching Western levels of reliability, Chinese automakers have not yet brought their styling, safety, emissions and performance standards up to snuff, let alone their skill at marketing home-grown nameplates around the globe.

CD Exclusive: Record Low Jobless Rates in 11 States

Eleven states have set historical record low unemployment rates so far this year (through September 2006):

Alabama: 3.3% in September

Arizona: 3.7% in August

Florida: 3.0% in June

Idaho: 3.2% in March

Louisiana: 2.9% in July

Montana: 3.4% in March

Nevada: 3.6% in January

New Mexico: 4.0% in March

Utah: 2.8% in September

Washington: 4.6% in March

W. Virigina: 3.8% in January

A Google News search indicates that nobody has reported this. You read it here first on Carpe Diem!

Saturday, October 21, 2006

Trade Deficit Angst

Protectionist Pat Buchanan worries about our trade deficit in a recent column, and free trade economist Walter Williams responds in his column:

First, he laments, "Europeans, Japanese, Canadians and Chinese sell us so much more than they buy from us, because they have rigged the rules of world trade." But so what? I buy more from my grocer than he buys from me. It wouldn't make a difference if I lived 2 feet south of the U.S.-Canadian border and my grocer lived 2 feet north of it.Remember: The balance of payments always balances, and equals zero. We hear a lot about the "trade deficit" for merchandise (about $800 billion), without hearing about the offsetting and matching surplus on our capital account (about $800 billion). Trade statistics are based on double-entry bookkeeping, so there HAS to be an overall balance. BP = 0.

Like many, Buchanan worries about our foreign trade deficit, pointing out that it's reaching an annual rate of $816 billion, and that means "dependency on foreigners." Actually, the foreign dependency is a two-way street. I'll explain it, starting with the alleged trade deficit I run with my grocer.

When I purchase $100 worth of groceries, my goods account (groceries) rises by $100, but my capital account (money) falls by $100. That means there's really a balance in my trade account. By the same token, my grocer's goods account (groceries) falls by $100 but his capital account (money) rises by $100, also a balance in his trade account.

Mr. Buchanan writes, "Imports surged to $188 billion for the month [of July], as our dependency on foreigners for the vital necessities of our national life ever deepens." That means we imported $188 billion worth of goods. Do foreigners keep all those dollars they earned under a mattress? They are not that stupid. They use those dollars to import capital goods such as U.S. stocks, bonds and U.S. Treasury notes.

They might use some of it to build factories in the U.S. such as Honda, Novartis and Samsung. The dollar amount of those purchases is going to equalize the value of what we import. We sport a huge surplus in our capital account with foreigners. As such, they are dependent on us for a safe and profitable place to invest their earnings. That dependency contributes to our economic growth.

Do a Google News search for "current account deficit" and you'll get about 2200 hits. Search for "capital account surplus" and you'll get about 542 hits? Hmmmmmmmm. Even though a capital account surplus of $800 billion is just the flipside of a $800 billion current account deficit, and they are really just two sides of the same coin, we hear about 4X as much/often about the trade deficit, as the capital surplus?

What's to complain about anyway when we have a trade deficit? We get access to the world's cheapest goods and increase our consumption, and more of the world's goods end up here than our goods end up there. In other words, a trade deficit of $800b means we end up in the USA with a net increase of $800b in foreign-produced goods. We end up with more stuff, why do we even call that a "trade deficit" in the first place? Actually, it is because we follow the money, and NOT the goods. We end up with a cash outflow and a goods inflow, and we call it a "trade deficit."

If we tracked and recorded where the actual merchandise and goods actually end up and get consumed, instead of where the money ends up, we would then think of our trade balance as a $800 billion trade surplus, no? I am not sure the general public understands that a "trade deficit" really means that we end up with "more stuff" and is really a "stuff surplus?"

Weekly Summary of U.S. Economy

Summary: Sharp declines in energy prices brought good news on the inflation front, with both producer (PPI) and consumer (CPI) prices declining in September. The housing market got a boost with housing starts rising in September, but the overall housing market remains soft. The Index of Leading Economic Indicators was up in September, but just barely (.10%). And on Wall Street, the Dow Jones Average marked the 19th anniversary of the 1987 crash by closing above 12,000 on both Thursday and Friday, setting a new record. For the week, the yield of the 10-year U.S. Treasury note fell 3 basis points to 4.78%, and the average 30-year fixed mortgage rate rose 1 basis point to 5.93%.

Read more here

Outsourcing Works Both Ways, Talent Shortage in India

From the NY Times:

Indian IT firms like Infosys (NASDAQ:INFY) are now recruiting engineering talent in the US - they get trained in India (at Mysore, near Bangalore), and then return to the US to work for Infosys, according to this article:

From a related NY Times article, "Skills Gap Hurts Technology Boom in India":Where once the brains of India left for more lucrative pastures in the United States, today a handful of fresh American college graduates are sampling the fruits of the Indian economic boom.

The recruits from America and elsewhere are not expected to fill the looming labor pinch. But they do illustrate the efforts by Indian companies to extend their global reach and recognition.

As its technology companies soar to the outsourcing skies, India is bumping up against an improbable challenge. In a country once regarded as a bottomless well of low-cost, ready-to-work, English-speaking engineers, a shortage looms.India still produces plenty of engineers, nearly 400,000 a year at last count. But their competence has become the issue.

A study commissioned by a trade group, the National Association of Software and Service Companies, found only one in four engineering graduates to be employable. The rest were deficient in the required technical skills, fluency in English or ability to work in a team or deliver basic oral presentations.

Movie and TV Mistakes: DOH!

Which movie has the most mistakes, like factual errors, visible crew or equipment, continuity mistakes, etc.? According to MovieMistakes.com, the movie with the most mistakes is "Pirates of the Caribbean: The Curse of the Black Pearl," with 220 mistakes, followed closely by "Apocalypse Now," with 219 mistakes, "The Birds" (212), Star Wars (209), and Harry Potter and the Chamber of Secrets (203).

Example of a factual error in the movie "Spinal Tap": In the scene where Derek Smalls is having trouble with the airport security the gate only beeps when he walks 'in'. The gate would beep no matter what way he walked through it.

Continuity problem from "Cuckoo's Nest": In the scene where the boys are playing blackjack, watch McMurphy's (Jack Nicholson) cigarette as he talks to Martini about the rules of the game. It changes length throughout the scene.

Who thinks of these things?

For TV mistakes, check it out here. Friends is #1, Simpons is #2. DOH!

Friday, October 20, 2006

Stay in School

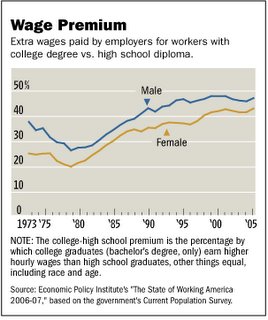

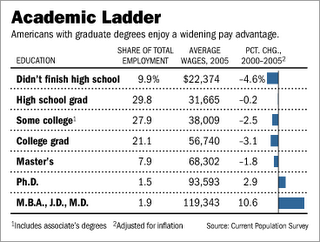

WSJ: The typical American worker with a four-year college degree earns a lot more money than a similar worker who didn't go beyond high school -- 45% more.

WSJ: The typical American worker with a four-year college degree earns a lot more money than a similar worker who didn't go beyond high school -- 45% more.Education does pay. But in today's economy, getting a bachelor's degree is no longer a guarantee of raises big enough to beat inflation.

Although the best-paid college grads are doing well, wages of college grads have fallen on average, after adjusting for inflation, in the past five years. The only group that enjoyed rising wages between 2000 (just before the onset of the last recession) and 2005 (the most-recent data available) were the small slice with graduate degrees.

Economic Hypochondria

According to George Will: "Economic hypochondria, a derangement associated with affluence, is a byproduct of the welfare state: An entitlement mentality gives Americans a low pain threshold — witness their recurring hysteria about nominal rather than real gasoline prices — and a sense of being entitled to economic dynamism without the frictions and "creative destruction" that must accompany dynamism. Economic hypochondria is also bred by news media that consider the phrase "good news" an oxymoron, even as the U.S. economy, which has performed better than any other major industrial economy since 2001, drives the Dow to record highs."BTW, the unemployment rate for college graduates in September was 2% ( and was 1.8% in August - the lowest jobless rate for college grads in more than 5 years). For those with less than a HS degre the September unemployment rate was 6.4%. Stay in school.

"Today's widening income disparities will be partly self-correcting. Granted, income statistics show the increasing disadvantages of persons with education deficits. But that is the market saying — shouting, really — "Stay in school!" Over time the voice of the market is rational, credible and therefore a potent instrument for changing behavior."

Gotta Love Wal-Mart

Wal-Mart Stores Inc. on Thursday said it would begin selling $4 generic prescriptions in 14 additional states, including New York and Texas, speeding up the roll-out of a plan that has put pressure on rival retailers.I think even Wal-Mart employees can afford these prices.

Wal-Mart said the $4 program covers a 30-day supply of 143 different drug compounds, representing nearly 25 percent of the prescriptions it currently dispenses in pharmacies nationwide.

The program, initially launched in Florida last month, will be available in an additional 1,264 stores throughout Alaska, Arizona, Arkansas, Delaware, Illinois, Indiana, Nevada, New Jersey, New Mexico, New York, North Carolina, Oregon, Texas and Vermont.

Wal-Mart said it filled 88,235 new prescriptions in Florida in the 10 days after it rolled out the $4 program across the state. (MP: That's more than 6 prescriptions every minute in FL, 24/7).

Mankiw's Top 10 List for $1 Gas Tax

Well, Harvard economist Greg Mankiw actually only gives 7 reasons for a $1/gallon gasoline tax in his WSJ article today:

1. Help the Environment

2. Reduce traffic congestion

3. Reduce energy dependence

4. Help the federal budget, $100 billion per year in increased tax revenue

5. Tax incidence - some of the $1 tax would be paid by OPEC producers

6. Economic growth - tax consumption, not income and investment

7. National security

Even after a $1 hike, the U.S. gas tax would still be less than half the level in, say, Great Britain. But don't expect those vying for office to come around until the American people recognize that while higher gas taxes are unattractive, the alternatives are even worse.

Thursday, October 19, 2006

EU = Mississippi?

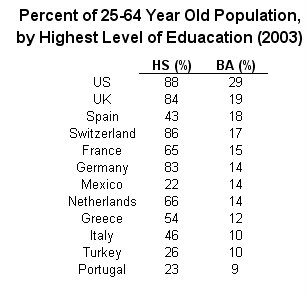

I find these education statistics for selected OECD countries very interesting, you can find the complete data set here.

I find these education statistics for selected OECD countries very interesting, you can find the complete data set here.For example, I had no idea that only about 50% of the adult population in countries like Greece, Italy, and Spain finish high school, and only about 1/4 of the adult population in countries like Turkey, Portugal and Mexico finish high school!

Further, the US has close to twice as many college graduates in percentage terms compared to UK, France, Switzerland, and Spain; more than twice as many college graduates as Germany, Netherlands, and Mexico; and almost three times as many college graduates as Greece, Italy, Turkey and Portugal.

That probably explains why a recent study by a Swedish public policy group found that if the European Union were a state in the USA, it would belong to the poorest group of states. France, Italy, Great Britain and Germany have lower GDP per capita than all but four of the states in the United States. And in fact, GDP per capita is lower in the vast majority of the EU-countries than in most of the individual American states.

This puts Europeans at a level of prosperity on par with states such as Arkansas, Mississippi and West Virginia.

EU Farmers Harvest Cash Too, In Private

From today's WSJ, an editorial "Behind the Subsidy Curtain," about the billions of euros paid by taxpayers in the form of farm subsidies, without ever knowing who is receiving subsidies and how much.

"The vast majority of handouts go to big agribusiness firms that could survive just fine on their own -- or, if they couldn't, should have fallen by the wayside long ago."

Social Security

The NY Times reports today that Social Security payments will go up by 3.3% next year. The average monthly benefit check will rise to $1044 for more than 53 million people. If my math is correct, that will mean more than $55 billion per month and more than $660 billion (2/3 of a trillion dollars) will be spent next year for Social Security. Now that there are 300 million people in the U.S. , social security payments work out to about $2,213 PER PERSON.

Harvesting Cash: A Bumper Crop for Farmers

As Congress prepares to debate a farm bill in 2007, the Washington Post is examining federal agriculture subsidies that grew to more than $25 billion in 2005, despite near-record farm revenue. The Post has run a series of a dozen articles about farm subsidies, starting last July with an article "Farm Program Pays $1.3 Billion to People Who Don't Farm." They ran 4 articles in last Sunday's paper, and another on Monday this week. Here are several excerpts:

Nationwide, the federal government has paid at least $1.3 billion in subsidies since 2000 to individuals who do no farming at all. (See humorous post below about getting paid not to farm.)

The checks to landowners were intended 10 years ago as a first step toward eventually eliminating costly, decades-old farm subsidies. Instead, the payments have grown into an even larger subsidy that benefits millionaire landowners, foreign speculators and absentee landlords, as well as farmers.

What began in the 1930s as a limited safety net for working farmers has swollen into a far-flung infrastructure of entitlements that has cost $172 billion over the past decade. In 2005 alone, when pretax farm profits were at a near-record $72 billion, the federal government handed out more than $25 billion in aid, almost 50 percent more than the amount it pays to families receiving welfare.

Farmers often get paid twice by the government for the same disaster, once in subsidized insurance and then again in disaster assistance, a legal but controversial form of double-dipping, a Washington Post investigation found in another article. Together, the programs have cost taxpayers nearly $24 billion since 2000.The government pays billions to help farmers buy cheap federal insurance, billions more to private insurance companies to help run the program and billions more to cover the riskiest claims. And on top of all that, it spends billions on disaster payments.

Wednesday, October 18, 2006

TO: Honorable Secretary of Agriculture, Washington, D.C

Dear Sir,

My friend over at Wells, Iowa received a check for $10,000 from the Government for not raising hogs, and I want to go into the "not-raising-hogs" business.

What I want to know is, in your opinion, what is the best kind of farm not to raise hogs on, and what is the best breed of hogs not to raise? I want to be sure that I approach this endeavor in keeping with all governmental policies. I would prefer not to raise razorbacks, but if that is not a good breed not to raise, then I will just as gladly not raise Yorkshires or Durocs. As I see it, the hardest part of this program will be in keeping an accurate inventory of how many hogs I haven't raised.

My friend, Peterson, is very joyful about the future of the business. He has been raising hogs for twenty years or so, and the best he ever made on them was $4,220 in 1988, until this year when he got your check for $10,000 for not raising hogs. If I get $10,000 for not raising 50 hogs, will I get $20,000 for not raising 100 hogs? I plan to operate on a small scale at first, holding myself down to about 400 hogs not raised, which will mean about $80,000 the first year. Then I can afford an airplane.

Now another thing, these hogs I will not raise will not eat 10,000 bushels of corn. I understand that you also pay farmers for not raising corn and wheat. Will I qualify for payments for not raising wheat and corn not to feed the 400 hogs I am not going to raise?

Also, I am considering the "not milking cows" business, so send me any information you have on that too.

Patriotically Yours,

Otis Deal

Minority Enrollment in CA Universities

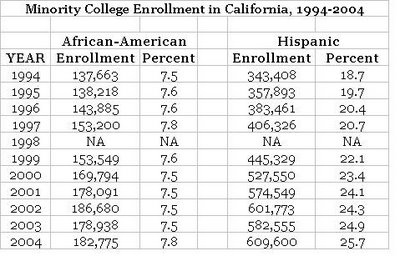

Source: National Center for Educational Statistics

Source: National Center for Educational StatisticsWe often hear the claim that since Prop 209 was passed in CA ten years ago, minority enrollment at California universities has declined. For example, see page 2 of this report titled "The Potential Impact of the Michigan Civil Rights Initiative on Employment, Education and Contracting," by Susan Kaufman (University of Michigan's Center for the Education of Women), who writes that Prop 209 in CA "led to significant decreases in college enrollment of minority students."

As the data above clearly show, there have NOT been any significant decreases in minority enrollment in the state of California since Prop 209 was passed in 1996. In fact, there has been an enrollment increase in absolute numbers for all three minority groups in the state of California from 1994-2004, and either a stable percentage (African-American and Native American) or a significant increase in percentage (Hispanic) of these minority groups.

Please also note that the total enrollment for the entire University of California (UC) system at the 8 UC campuses is approximately 200,000 students. Compared to the total college enrollment for the entire state of California of approximately 2,400,000 students, college enrollment in California at the UC campuses represents less than 9% of the total college enrollment in the state. Further, there are approximately 400 colleges and universities in the state of California, and the eight UC campuses represent only 2% of the total number of colleges in the state of California.

English Has the Richest Vocabulary

Number of human languages and dialects: 6,912

Number of words in the English language: 500,000 according to the number of words in the Oxford English Dictionary. There are supposedly another 500,000 uncataloged technical and scientific terms. By comparison, most estimates indicate that German has a vocabulary of about 185,000 words and French and Spanish have fewer than 100,000 words.

Number of people who use English: 750 million

Number of people for whom English is their mother tongue: 350 million

Percent of information stored on the world's computer in English: 80%

Percent of world's technical and scientific periodicals in English: >50%

Official language of the Olympics: English

Default language of aviation and air traffic control: English

Americans With No Abilities Act

On Monday, Congress approved the "Americans With No Abilities Act," sweeping new legislation that provides benefits and protection for more than 135 million talentless Americans.

The act is being hailed as a major victory for the millions upon millions of U.S. citizens who lack any real skills.

Under the Americans With No Abilities Act, more than 25 million important-sounding "middle man" positions will be created in the white-collar sector for nonabled persons, providing them with an illusory sense of purpose and ability. Mandatory, non-performance-based raises and promotions will also be offered to create a sense of upward mobility for even the most unremarkable, utterly replaceable employees.

The legislation also provides corporations with incentives to hire nonabled workers, including tax breaks for those who hire one non-germane worker for every two talented hirees.

Quote of the Day: Peak of Prosperity

“The economic situation during the past 20 years has been unprecedented in the history of the world. You will find no other 20-year period in which prices have been as stable – relatively speaking – in which there has been as little variability in price levels, in which inflation has been so well-controlled, and in which output (GDP) has gone up as regularly.

You hear all this talk about economic difficulties, when the fact is we are at the absolute peak of prosperity in the history of the world. Never before have so many people had as much as they do today.

I believe a large part of that is to be attributed to better monetary policy. The improved policy is a result of the acceptance of the view that inflation is a monetary phenomenon, not a real phenomenon. We have accepted the view that central banks are primarily responsible for maintaining stable prices and nothing else.”

Milton Friedman

Tuesday, October 17, 2006

Wal-Mart Has Done More for Poverty Than World Bank, IMF and United Nations?

Has any organization in the world lifted more people out of poverty than Wal-Mart, asks John Tierney in today's NYTimes? Probably not.... He cites an article from TCSDaily.com titled "Forget the World Bank, Try Wal-Mart":

Even without considering the $263 billion in consumer savings that Wal-Mart provides for low-income Americans, or the millions lifted out of poverty by Wal-Mart in other developing nations, it is unlikely that there is any single organization on the planet that alleviates poverty so effectively for so many people. Moreover, insofar as China's rapid manufacturing growth has been associated with a decline in its status as a global arms dealer, Wal-Mart has also done more than its share in contributing to global peace.

There are estimates that 70 percent of Wal-Mart's products are made in China. One writer vividly suggests that "One way to think of Wal-Mart is as a vast pipeline that gives non-U.S. companies direct access to the American market."

Monday, October 16, 2006

Thanks to Marginal Revolution

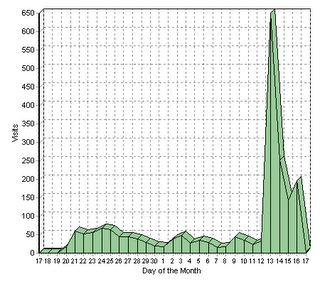

Wow, traffic to my blog went WAY up last week after it was mentioned on my favorite blog, Marginal Revolution! Thanks Tyler.

Wow, traffic to my blog went WAY up last week after it was mentioned on my favorite blog, Marginal Revolution! Thanks Tyler.Michigan Economy, Election for Governor

From today's WSJ, an article about the Michigan economy and the upcoming election for governor - incumbent Jennifer Granhom (D) vs. the billionaire challenger Dick DeVos, who has spent $16 million of his own money from the Amway family fortune!

From today's WSJ, an article about the Michigan economy and the upcoming election for governor - incumbent Jennifer Granhom (D) vs. the billionaire challenger Dick DeVos, who has spent $16 million of his own money from the Amway family fortune!What's an anti-business Democratic governor to do to get re-elected when the job picture is so bleak (see graph above)?Ms. Granholm isn't considered particularly pro-business, having relied heavily in her first term, as do most Democratic politicians here, on union support. Her campaign against Mr. DeVos has included traditional Democratic business-bashing, with jabs at her opponent for decisions he made at Amway. In the 1990s, Mr. DeVos oversaw the elimination of about 1,400 jobs and turned the company toward the world's biggest potential market: China.

While other states dispense incentives to companies, few governors have done as much and as fast as Ms. Granholm -- especially during a re-election campaign. In August and September, Granholm-controlled development boards doled out $315 million in tax breaks and loans.

Why racial preferences are a product of white guilt

From "An open letter to my collegues and students at the University of Michigan," by Professor Carl Cohen, published in the Michigan Daily (student newspaper at the University of Michgian):

The preferences we give to minorities in admission (and in other contexts) were initiated as a form of compensation for injuries earlier inflicted; they were efforts to make retributive payment. In reality those preferences impose great burdens on minorities, burdens that outweigh any benefits they appear to offer; nevertheless the preferences are commonly viewed as instruments of redress. This compensatory intention was for many years explicit. But equal treatment under the law is plainly inconsistent with compensation by ethnicity; one is entitled to redress for injury without regard to skin color. So the compensatory justification of preference was thrown out by the courts, even though it remains for most ordinary folks the only ground on which preferences might make any sense at all. Our University, defending preferences in the courts, renounced that compensatory justification explicitly, resorting instead to the one justification that had some hope of winning the legal battle: diversity.

As a defense of race preference, the alleged compelling need for racial diversity is entirely without merit. That defense has been advanced and accepted only because there is no other way, under the U. S. Constitution, to rescue the drive to expiate white guilt. We are told repeatedly, by people who seem not to fear embarrassing themselves, that diversity is the very heart of educational excellence. The compensatory payments by race that cannot otherwise be defended are saved by a dreadful argument.

That the diversity defense is no more than a stratagem is made manifest by the history of this controversy. Diversity was hardly ever mentioned until the compensatory justification was thrown out by the courts.

The race card always works in our country because, where the atmosphere is one of pervasive racial guilt, the accusation of racism leveled at a person or an institution sticks like glue, and needs no proof to do its damage. Universities, like corporations, do not pay to the measure of any actual racism; they pay to the measure of racism's bloated reputation in the age of white guilt.

Finance vs. Econ Salaries, What a Difference One Field Exam Makes!

How much do new assistant professors make at AACSB B-schools? Here are the data for 2005-2006 from AACSB, these are national means for new hires:

1. Finance $111,000

2. Accounting $104,200

3. Marketing $89,300

4. Management $88,900

5. Operations $87,500

6. MIS $87,400

7. Quant $75,100

8. Economics $71,900

It is interesting to me that there is almost a $40,000 difference in starting salaries between economics and finance. Especially after just aquiring lots of information from interviewing 40 finance candidates at the Financial Management Association conference in Salt Lake City for a finance position at the Flint campus of the University of Michigan. I asked a lot of candidates about the amount of economics they take in graduate PhD programs in finance, and was surprised to find out that many PhD programs in finance are actually about 50% economics, in terms of the courses they take. Many PhD programs in finance require students to take graduate macro (one or two semesters), graduate micro (one or two semesters), and between 2-4 econometrics classes, and sometimes a class in Math Econ. In fact, many finance PhDs take preliminary examinations in economics. Therefore, in reality, finance PhDs basically get a PhD in economics with a field specialization in finance.

Further, I found it interesting that most finance PhD programs are very small, they only admit a few students per year in many cases, compared to large entering classes in economics PhD programs (25 is typical for econ at UM Ann Arbor), and most finance PhD programs can be completed in 4 years, vs. 5 years for many/most economics programs (another reason to get a PhD in finance vs. economics). The small number or PhDs in finance vs. economics explains a lot of the salary differential.

Maybe more economics PhD programs should offer fields in finance-related fields like financial economics, capital markets, asset pricing, financial markets, futures and options, international finance, etc., so that PhD students in economics could capture that $40,000 additional starting pay if they can penetrate the finance market for academics. Over a 35-year career, that would be additional lifetime income of close to $1.5 million (ignorning discounting), seems like it would be worth it.

It is easy to explain the $29,000 difference in starting salaries between economics and accounting, because they are two fairly different subjects/fields. But how to explain the $40,000 difference in two disciplines that are almost exactly the same? Market inefficiency? Comments welcome on this issue.

My advice for those considering PhDs in economics: Switch to finance if you have any interest in finance-related topics. You will still get to take a full year of PhD-level economics (micro, marco and econometrics), and you just specialize in finance instead of monetary economics and industrial organization (like I did!).

B School Dean Salaries

Can you guess how much recently hired deans of top B schools are making, like the new dean at my alma mater, the Carlson School of Management at the University of Minnesota?

Hint #1: She makes more than the president of the University of Minnesota.

Hint #2: If your guess was $400,000, you would be more than 10% TOO low!

Read about Carlson School Dean Alison Davis-Blake, including her salary, in the StarTribune here.

When Reducing Tariffs on Imported Steel, Why Not Cars Too?

The US automakers (GM, Ford and DaimlerChrysler) have teamed up with foreign transplants (Honda, Nissan and Toyota) to pressure the Bush Administration and the International Trade Commission (ITC) to drop tariffs on imported galvanized steel used to make motor vehicles. See the WSJ article and the editorial in today's Detroit News.

Searching the ITC's online 2006 tariff database, I found tariff rates on foreign steel used for motor vehicles to be only between 2 to 3.2%. Tariffs on imported, finished motor vehicles, are 2.5%.

Just wondering, during the ITC hearings starting tomorrow (10/17/06), could they perhaps discuss ending tariffs on both imported steel and imported vehicles?

China's Government Lifts Ban on Wikipedia, English Only

From today's NY Times, an article about the ending of China's ban on Wikipedia, but only the English version:

The Chinese government last week appeared to lift its block on the English-language version of the online encyclopedia Wikipedia, an unexpected move that comes almost a year to the day when access was first denied. The Chinese-language site, however, remains blocked within China.

“We are pleased to see the change, but would like to see the Chinese version unblocked, too,” said Jimmy Wales, founder of Wikipedia, the encyclopedia created by voluntary contributors. “We don’t know what prompted the block and don’t know what prompted the unblock.”

Trade with China

From today's WSJ editorial page, an excellent article about US trade with China:

From today's WSJ editorial page, an excellent article about US trade with China:This explosion of cross-border commerce has worked to the benefit of both nations. China has had a compounded rate of GDP growth of 10% for the past five years. A report by McKinsey consulting finds that if anywhere near these rates of GDP growth are sustained over the next decade, poverty rates in China -- a nation barely able to maintain subsistence living standards for centuries -- will fall by two-thirds.

What has America gained? A surge in low-priced, high quality consumer products. Apparel, footwear, consumer electronics, computer equipment, and so on -- all of which Americans have bought voluntarily (MP: countries don't trade, individual companies and individual consumers trade). Arguably the biggest beneficiary of China's emergence on the world trading stage has been America's poor, who have new access to bargain-priced consumer goods. A 27.5% China tariff would be the most regressive tax imposed on low income Americans in decades.

The standard response from the China-bashers (just as the Japan-bashers argued two decades ago) is that America is "exporting" jobs overseas. But over the time period that trade with China has surged, so has the number of new jobs created here. Yes, some U.S. manufacturers have lost market share to lower-cost Chinese competitors, and in recent years U.S. apparel and light manufacturing firms have brought a series of anti-dumping complaints against the Chinese.

But it's a myth that U.S. manufacturing is disappearing. A recent Cato Institute report shows that U.S. manufacturing output is up 50% in the past 12 years along with our expanding trade with China. And the National Association of Manufacturers reports that August was the tenth consecutive month in which U.S. manufactured goods exports rose more than imports. Outsourcing to China has allowed many U.S. companies to remain competitive against foreign producers, and a large chunk of U.S.-China trade is in fact intra-company trade conducted by American firms.

So has China "cheated" in the trade arena by holding the yuan artificially low relative to the dollar? The yuan has been pegged at 7.92 against the dollar since the mid-1990s, and Beijing has begun to allow a modest fluctuation in the last year or so. But this is not a "manipulation" of its exchange rate so much as it is a contracting out of its monetary system to the U.S. Federal Reserve Board. That strategy has allowed China to remove the uncertainty of exchange-rate fluctuations from investment decisions and allowed China to grow rapidly while controlling inflation (so long as the Fed controls it too, which is a separate issue).

The Chinese have thus avoided the bane of most developing nations of inept monetary controls leading to price fluctuations and periods of hyper-inflation. China was one of the few Asian nations that didn't face a crippling currency devaluation during the monetary crisis of the late 1990s.

Nor is it clear that a yuan revaluation of even 10% to 30% would have any meaningful impact on the U.S. trade deficit. China imports some $100 billion a year of raw materials. A stronger yuan would lower the price of those inputs, and thus of production costs, which could largely offset the impact of the stronger currency on export prices.Sunday, October 15, 2006

Music Recommendations

1. Dr. John: Live at Montreux 1995. It doesn't get any better than Dr. John when it comes to funky New Orleans piano, and this is a great live recording of Dr. John with a 7-piece band (New Orleans Social and Pleasure Club), at his best, performing at the Montreux Jazz Festival in 1995.

2. Sierra Leone's Refugee All-Stars: Living Like a Refugee

Amazon: This is a group of musicians who lived for years as refugees in the West African nation of Guinea. While living in a tent camp, they acquired a couple beat up guitars and a rusted out sound system and began playing. American documentary filmmakers made the band the focus of their movie, which received enthusiastic endorsements from the likes of Keith Richards, Paul McCartney, Joe Perry, and Ice Cube. The film's success has allowed the band to tour internationally to ecstatic audiences. Born in the midst of a violent, decade-long civil war, the group and its music celebrate our ability to sustain hope, inspiration, and creativity - the best in us - even in a climate of rage, loss, and madness.3. Reverend Arthur T. Jones: Speak for Me OOP (out-of-print) and only available used on Amazon, but great gospel music from the executive director and producer of the Florida Mass Choir. You can really "get your praise on" with this CD.

World Series Tickets for $1000

As might be expected, tickets are already being sold on Ebay for the World Series, check it out here. Face value for Tigers tickets for the games at Comerica Park are $90 - $250, but tickets have already sold on Ebay for $1000 per ticket. Notice that in many Ebay listings now, you can actually see the view of the field from the seat you are buying (see picture above), from a company called SeatData.

Saturday, October 14, 2006

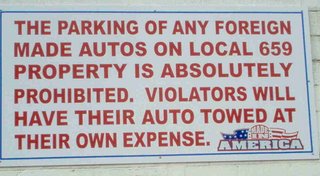

To Tow or Not to Tow?

The sign above is posted in the parking lot of the UAW Local #659 in Flint, Michigan, and I just took this picture today. I noticed a Honda in the parking lot while I was taking photos, so I am not sure how strictly this parking ban is enforced.

Just wondering..... how do you think the local union would classify these vehicles?

Buick Lacrosse, Chevy Equinox, Chevy Impala, Chevy Monte Carlo, Chevy Silverado, Chrysler 300, Chrysler Pacifica, Chrysler Town and Country, Dodge Caravan, Dodge Charger, Dodge Magnum, Ford Crown Victoria, Ford Freestar, GMC Sierra, Mercury Grand Marquis, Dodge Stratus, and Pontiac Torrent. Problem? All of these vehicles are made by the UAW, but in Canada. Isn't that a foreign country? Wouldn't those be "foreign made autos"?

Another problem is that the Chevy Silverado and GMC Sierra are also produced in the U.S., directly across the street from UAW Local #659 in Flint at the Flint Truck Plant. Better check those VINs before towing - 1A is US and 2A is Canada. Same for the Chrysler Town and Country and the Dodge Caravan, they are produced both in the U.S. and Canada, so check those VINs before towing those models.

Now, what about these vehicles?

Mitsubishi Eclipse, Mitsubishi Galant, Mazda 6, Toyota Corolla, Mazda Tribute, Mitsubishi Endeavor, Mazda B Series Truck, Mitsubishi Raider, Toyota Tacoma, Isuzu I-Series Trucks?

The problem? All of these vehicles are produced in the U.S. BY THE UAW!? Hmmmmmmm. Guess they can't be towed. But don't they sound pretty "foreign"?

And what about the Cadillac Catera, now discontinued and replaced by the STS and CTS? The problem? It was built in Germany. Tow or no tow?

And to further complicate matters, what about Volvos, Jaguars and Saabs? Volvo and Jagaur are owned by Ford and Saab is owned by GM?

To tow or not to tow? It gets soooooo complicated in the Global Economy.