Big and Slow Doesn't Work, Big and Fast Might

From today's (Sunday) NY Times article "Now Playing in Europe: The Future of Detroit:"

From today's (Sunday) NY Times article "Now Playing in Europe: The Future of Detroit:"“There’s no case anywhere in the world of any previously dominant manufacturer retaining much more than 20 percent once the market is opened to full global competition,” said G.M.’s vice chairman, Robert A. Lutz.

While some national loyalty lingers in Europe, as it does in the United States, no company can rely on such loyalty to sell cars. Carmakers are forced to continually update their brand images in order to stand out in a crowded market. At the same time, like their European counterparts, America’s unionized autoworkers must also adjust. They cannot count much longer on the cushy contracts that typified their jobs in the past, because new deals at new factories have chipped away at pay and benefits while emphasizing more-productive work methods.

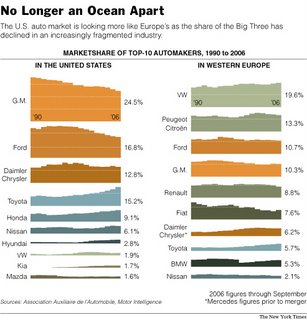

European companies have long competed this way, but it is a new reality for American carmakers who were so dominant for much of the last century. As recently as 1990, G.M., Ford and Chrysler together sold more than 70 percent of the cars bought in the United States; G.M. alone accounted for more than one-third of auto sales.

Now those companies’ American market share has dropped to around 50 percent, while the influence of Toyota and other foreign manufacturers is growing. Though G.M. remains on top, its share has slipped below one-quarter, and the battleground has become the section between 10 percent and 20 percent of the market. That is the area where Ford and Chrysler have slipped and where Toyota and Honda have grown.

David E. Cole, chairman of the Center for Automotive Research in Ann Arbor, Mich., said that American carmakers must change, and fast, or risk disaster. “For an automobile manufacturer, big and slow doesn’t work anymore,” he said. “Big and fast gives you a chance.”

0 Comments:

Post a Comment

<< Home