Jan. Home Sales Drop Sharply from Dec., But Are At Highest Level for Month of January Since 2007

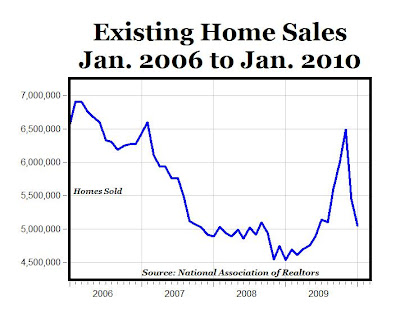

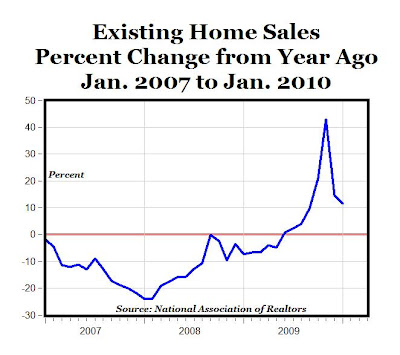

"Existing-home sales fell in January but are above year-ago levels, according to the National Association of Realtors. Existing-home sales – including single-family, townhomes, condominiums and co-ops – dropped 7.2% to a seasonally adjusted annual rate of 5.05 million units in January from a revised 5.44 million in December, but remain 11.5% above the 4.53 million-unit level in January 2009 (see top two charts above).

"Existing-home sales fell in January but are above year-ago levels, according to the National Association of Realtors. Existing-home sales – including single-family, townhomes, condominiums and co-ops – dropped 7.2% to a seasonally adjusted annual rate of 5.05 million units in January from a revised 5.44 million in December, but remain 11.5% above the 4.53 million-unit level in January 2009 (see top two charts above).Lawrence Yun, NAR chief economist, said there is still some delay between shopping and closing that affected current sales. “Most of the completed deals in January were based on contracts in November and December. People who got into the market after the home buyer tax credit was extended in November have only recently started to offer contracts, so it will take a couple months to close those sales,” he said. “Still, the latest monthly sales decline is not encouraging, and raises concern about the strength of a recovery.”

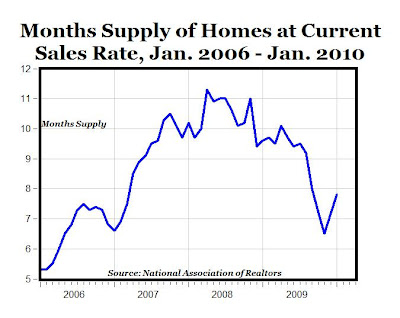

Total housing inventory at the end of January fell 0.5% to 3.27 million existing homes available for sale, which represents a 7.8-month supply at the current sales pace, up from a 7.2-month supply in December, but down from a 9.6-month supply in January 2009 (see bottom chart above)."

Other reports for January real estate sales:

1. Sales of existing homes and condos in South Florida rose in January, though prices continued to fall. Statewide, existing home sales were up 28% last month, to 10,465 homes sold from 8,174 homes sold a year ago, according to Florida Realtors. Existing condo sales rose 81% statewide compared to the previous year's sales figure. This marks the 17th consecutive month that Florida sales activity has increased in a year-to-year comparison.

2. Reflecting a trend seen across much of the West, Phoenix region January home sales fell harder than normal from December, but they were still the highest for a January since 2007.

There were continued signs of price stability for resale houses. The median price paid for existing single-family detached houses didn’t decline from the year-ago level for the first time since July 2007, though it slipped a bit from December.

3. Las Vegas region January home sales fell more than usual from December but were still the highest for that month since 2007 thanks to relatively strong demand for condos and other sub-$200,000 homes. The overall median sale price declined from December, but one home-type category – resale single-family detached houses – showed continued signs of price stability.

MP: Many reports are expressing concern about the strength of the real estate recovery because of the huge drop from December sales, but year-to-year January sales increased at 11.5%, and are at the highest level for that month in three years both nationally and in markets like Phoenix and Las Vegas.

6 Comments:

I have seen original data. NorthEast had volume reversal November 009. Will this bottom out of existing home prices now spill over into other regions?

All depends on what Congress tampers next.

Vote for grid-lock.

Prices have dropped, and new listings are priced appreciably lower.

http://articles.moneycentral.msn.com/Banking/HomebuyingGuide/home-sellers-finally-get-real.aspx

New home builds are starting to slip,

http://www.calculatedriskblog.com/2010/02/housing-best-leading-indicator-for.html

Meanwhile, 24% of mortgages are "underwater".

http://www.creditloan.com/blog/2010/02/26/more-americans-trapped-in-underwater-loans/

http://online.wsj.com/article/SB10001424052748703795004575087843144657512.html?mod=WSJ_Stocks_MIDDLEROI

Unfortunately sales are not the measure of a recovering market. It's good news for realtors and mortgage brokers - those who still have jobs.

Residential investment which has traditionally led us out of every recession, is woefully low. Residential and commercial construction are both at 30 year lows and the prospects for growth are slim. Real estate analysts show modest increases in residential construction this year but no full recovery until 2014. If you're a construction worker, it's time to get an Accounting degree.

When I look at the graphs on this site I think, "Things don't look so bad." When I look at the data graphed differently at Calculated Risk I think, "Wow, things are still pretty bad." I find that the same data graphed differently conveys an opposite interpretation.

My take, things are still bad but slowly getting better.

"All depends on what Congress tampers next.

Vote for grid-lock"...

Heh! Heh! Heh!

Courtesy of Bloomberg: Fannie Mae will seek $15.3 billion in U.S. aid, bringing the total owed under a government lifeline to $76.2 billion, after its 10th consecutive quarterly loss.

The mortgage-finance company posted a fourth-quarter net loss of $16.3 billion, or $2.87 a share, Washington-based Fannie Mae said in a filing yesterday with the Securities and Exchange Commission.

Anonymous, changing the scale of measurement (or length of observation) is one of the example innumeracies in "How to Lie with Statistics."

Comparing growth rates from low levels to growth rates from high levels could be another one. A small community in Alaska had a 100% population increase this year - the only couple had twins!

Post a Comment

<< Home