May Empire Manufacturing Survey Mixed, But Employment, Cap. Expenditures at Multiyear Highs

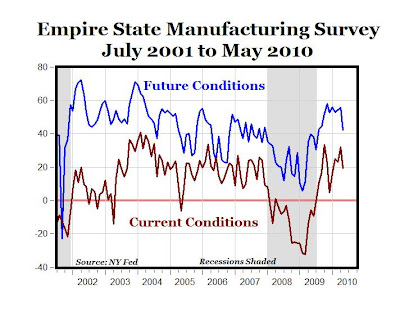

"The Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to improve for a tenth consecutive month in May, albeit at a slower pace than in April. The general business conditions index fell 13 points, to 19.1 (see top chart above). Similarly, the new orders and shipments indexes also moved lower but remained at positive levels. The inventories index dropped back to a level near zero after rising into positive territory in March and April.

The prices paid index continued to climb, reaching its highest level of the year, while the prices received index was little changed and positive. The index for number of employees rose for a fifth consecutive month, reaching its highest level since 2004 (see bottom chart above). Future indexes suggest that activity is expected to expand further in the months ahead, but the level of optimism was noticeably lower in May than in recent months (see top chart). The capital expenditures index advanced several points to 38.2, a multiyear high (see bottom chart)."

MP: While the May manufacturing report for the New York Fed region was somewhat mixed, the employment and capital expenditure indexes were especially strong in May, with the employment index reaching a six-year high, and the capital expenditure index at the highest level since late 2006. Since concerns about employment remain elevated, this strong reading for manufacturing employment in the NY Fed area suggests that jobs are slowly, but consistently returning to the manufacturing sector.

9 Comments:

Hmmm, I wonder who these New York manufacturers sell to?

Europe? That may be a real big problem...

this smells to me like the late stages of an inventory replenishment cycle.

new orders index cut in half, shipments down 2/3, unfilled orders now significantly negative and inventories flat.

we also see signs of inflation and margin pressure.

there's a great deal to worry about in this report.

"The general business conditions index retreated from its relatively high April level, falling 13 points to 19.1. This reading—lower but still positive—marked the tenth consecutive month of improvement in business conditions. The drop in the index suggests that the pace of growth slowed in May, after accelerating for much of the year. The new orders index was also lower, falling 15 points to 14.3. The shipments index tumbled 21 points to 11.3. The unfilled orders index, at -7.9, was below zero for a second consecutive month. The delivery time index fell from a positive reading last month to -6.6, suggesting that delivery times have quickened. The inventories index dipped 10 points to 1.3, a sign that inventory levels remained relatively steady after growing in March and April."

also: look at the inflation:

"In response to a series of supplementary questions on prices, manufacturers estimated that the prices they paid for inputs rose by a little less than 6 percent, on average, over the past twelve months (though i do not believe that this is dollar weighted, so difficult to interpret as an aggregate)

Pricing pressures continued in May. The prices paid index inched up 3 points from last month’s elevated level, reaching 44.7, with 46 percent of respondents reporting that prices had risen over the month, and 1 percent reporting that prices had fallen."

I wonder if GE and other manufacturers will "Backsource"manufacturing operations to NY state? Jeff Immelt, GE CEO, has stated that it is very important for the U.S. to work a balance between Services and Manufacturing.

BTW, Japan has Backsourced a lot of manufacturing from foreign locations due to intellectual property "loss" concerns.

Morganovich-

Yeah, but a year ago prices for everything were very depressed--below cost or production etc. In my little corner of the world, guys were installing cabinets in houses etc at prices just high enough not to take a loss, or just to keep good employees on payroll, even with pay cuts.

BTW, even though I often disagree with you, I like your insights.

b-

what evidence do you cite for prices for everything being below cost last year?

i can certainly see how it would be true in home building, but i do not think that was a broad manufacturing trend.

according to this report, margins are shrinking with prices paid up 6% and prices charged up 3%.

http://www.newyorkfed.org/survey/empire/May10.pdf

if they were losing money before, they are losing more now.

that said, this is survey and therefore prone to respondent bias.

i'd be awry of putting too much faith in the numbers.

MOrganovich-

It was an anecdote-but man oh man, from 2008-09, in many businesses, you only stayed in business by "giving it away."

Note to Dr. Perry

US credit card delinquencies down again in April

Reuters - Joe Rauch, Brenton Cordeiro - 32 minutes ago

CHARLOTTE, North Carolina (Reuters) - US credit card delinquencies fell for the fourth straight month in April, the latest indicator that Americans are recovering from the worst economic downturn since the Great Depression.

Here's a video on the electric car industry.It's the best one I have been able to find.

www.mitsubishi-motors.com.au

left click concept cars then click"MIEV"then click virtual test drive.

Take note of how beautifully made the video is.

Here's another website that shows how these cars are advancing worldwide and how much they have advanced.

www.cnet.com.au Detroit motor show 2010 Electric Cars.

benny-

i talk to dozens of small businesses a week and analyze far more across nearly every industry.

this "you only stayed in business by giving it away" line is just totally untrue in any kind of generalized way. sure, a few companies (especially in home building) may have done so, but be very careful making generalizations from a few data points.

Interesting stuff. The business conditions drop doesn't look good (caused by weakness in the Euro?), but higher employment is a good sign.

Post a Comment

<< Home