CARPE DIEM

Professor Mark J. Perry's Blog for Economics and Finance

Monday, April 12, 2010

About Me

- Name: Mark J. Perry

- Location: Washington, D.C., United States

Dr. Mark J. Perry is a professor of economics and finance in the School of Management at the Flint campus of the University of Michigan. Perry holds two graduate degrees in economics (M.A. and Ph.D.) from George Mason University near Washington, D.C. In addition, he holds an MBA degree in finance from the Curtis L. Carlson School of Management at the University of Minnesota. In addition to a faculty appointment at the University of Michigan-Flint, Perry is also a visiting scholar at The American Enterprise Institute in Washington, D.C.

Previous Posts

- Inventory Rebuilding Shows Economic Strength

- Might Be 2011 Before Official NBER Announcement

- Lumber Prices Reaching Four-Year Highs

- CD Milestone: 6,000 Posts

- Milton Friedman on the Responsibility to the Poor

- The Increasing College Degree Gap; Will College Wo...

- G. Will on Decadent Dependence of Welfare State

- Next Equal Occupational Fatality Day in 2020

- The Triumph of the Ordinary Cellphone

- Ongoing Economic Recovery, Even in Michigan!!

8 Comments:

Good question, indeed

St. Louis Fed says MZM, its definition of money supply, is contracting.

How does this fit with the gold nut-superinflationary boom we keep hearing about?

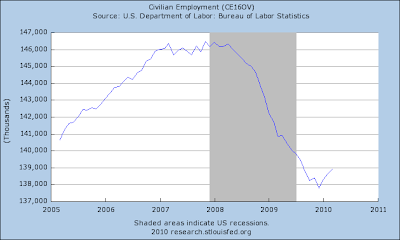

When you run a chart on Fred, say http://research.stlouisfed.org/fred2/series/M2 , a few links show up underneath the chart, and one of those (in the Notes section) is "US recession dates." Click on it, and you'll see the explanation ( http://research.stlouisfed.org/fred2/help-faq/#graph_recessions ): "The NBER has not yet determined the end of the recession that began in December 2007. The date 2009-07-01 has been substituted in graphs as an estimate. This estimate is based on a statistical model for dating business cycle turning points developed by Marcelle Chauvet and Jeremy Piger (A Comparison of the Real-Time Performance of Business Cycle Dating Methods, Journal of Business and Economic Statistics, 2008, 26, 42-49). For more information, see http://www.uoregon.edu/~jpiger/us_recession_probs.htm "

Sticking with Max, I, too, see NO evidence of recovery....though, as you and I both know, measurements of recession and recovery have been so manipulated over the years so as to favor the "evidence" of recovery over recession that with "substitutions" and other additions to government reporting, it's actually a SURPRISE that NBER hasn't 'attempted' to call the recession's end sooner! PILE OF "SH*T".... Find a new sabbatical to undertake rather than regurgitating government 'sunshine' for a change....

I can easily imagine that Noureil Roubini is wondering the samething...

Based on the timing for past NBER calls for the timing of a recession, they tend to call the start and end based on overall employment. If they following the pattern of the past few recessions, the end will be December 2009.

You are a little way behind the curve -- We posted on this back in January:

Dude, Where’s My Recession Bar?

http://www.ritholtz.com/blog/2010/01/dude-wheres-my-recession-bar/

Barry: I plead guilty as charged. Now I know.... forever....

Mark

Post a Comment

<< Home