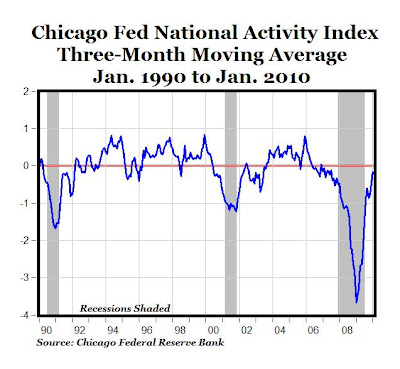

Another V-Sign of Economic Recovery: Chicago Fed National Activity Index Reaches 30-Month High

"Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index in January was slightly positive for the second time in the past three months. From June 2007 through October 2009, the index had been consistently negative. The index increased to +0.02 in January from –0.58 in December, with all four categories of indicators having improved.

"Led by improvements in production- and employment-related indicators, the Chicago Fed National Activity Index in January was slightly positive for the second time in the past three months. From June 2007 through October 2009, the index had been consistently negative. The index increased to +0.02 in January from –0.58 in December, with all four categories of indicators having improved.The index’s three-month moving average, CFNAI-MA3, increased to –0.16 in January from –0.47 in December, reaching its highest level since July 2007 (see chart above). January’s CFNAI-MA3 suggests that, consistent with the early stages of a recovery following a recession, growth in national economic activity is beginning to near its historical trend."

2 Comments:

IMHO i think this is just govt stimulus package related activity.

you can see from this chart there is less than zero demand/supply for commercial loans

There is no V shaped recovery. There's not a single economist of any repute who's making that case. ALL of them are either saying we are in a long, slow recovery, are at risk of a double dip, or are still in recession.

The V-sters are, in a word, delusional. What's worse, if we WERE in a V-shaped recovery, who gets the credit - Obama and Pelosi for their stimulus?

No dice. John Taylor explained it best. The rise in GDP was due mostly to rivate investment and most of that was replenishment of obsolete inventory and replacement of goods sold at steep discounts (if not losses). Even Janet Yellen, an Obamabot, isn't turning cartwheels about GDP numbers. Krugman isn't impressed. When the political likes of Geithner, Obama and Pelosi and the profiteers of market timing like Wesbury and Zandi are the ONLY people touting a strong recovery, it's time to unsuspend disbelief and guard your wallt.

Post a Comment

<< Home