Why The Goldilocks Economy Can Handle $3 Gas

In a previous CD post "The Energy-Efficient Economy Can Handle $100 Oil," I suggested that today's economy is much better able to absorb higher energy prices than at any other time in the past, due to significant improvements in energy efficiency of the last 50 years. Compared to the early 1970s, the economy today is about twice as efficient, measured by energy consumption per dollar of real GDP. The graph in that post was featured on CNBC's "Kudlow and Company" a few weeks ago and also appeared in Larry's blog.

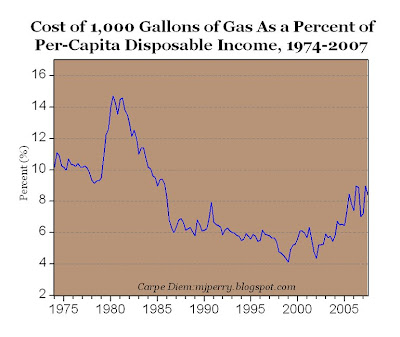

Here's another reason that the Goldilocks economy is able to handle $3 per gallon gas without sending consumer spending into a tailspin and without causing a recession: Even at $3 per gallon, gas is still relatively affordable for today's consumers, as a percent of disposable income, especially compared to the 1970s and 1980s.

The graph above (click to enlarge) shows the cost of 1,000 gallons of gas at the average retail price (using EIA data) as a percent of per-capita disposable income (from the BEA), from 1974-2007. Consider that since gas prices peaked in the early 1981 at about $1.40 per gallon, retail gas prices have increased by 2.21 times to $3.099 per gallon today. But per-capita disposable income has increased during that same period by more than 3.5 times, from $9591 in 1981 to $33,940 today.

In the early 1980s, it would have taken almost 15% of per-capita disposable income to buy 1,000 gallons of gas, and today it only takes only 8.5% (third quarter 2007). Even back in the "good old days" when gas sold for 50-60 cents per gallon in the mid-1970s, gas was more expensive as a share of income (10-11%) than today.

Bottom Line: Measured as a share of per-capita disposable income, gas prices would have to rise all the way to $5 per gallon today to be as expensive as gas in the early 1980s. Even if gas gets to $3.76 per gallon, it would be equivalent to 50 cent gas in the "good old days" of the mid-1970s, when measured as a share of disposable income. Goldilocks can handle $3 gas, no problem.

Here's another reason that the Goldilocks economy is able to handle $3 per gallon gas without sending consumer spending into a tailspin and without causing a recession: Even at $3 per gallon, gas is still relatively affordable for today's consumers, as a percent of disposable income, especially compared to the 1970s and 1980s.

The graph above (click to enlarge) shows the cost of 1,000 gallons of gas at the average retail price (using EIA data) as a percent of per-capita disposable income (from the BEA), from 1974-2007. Consider that since gas prices peaked in the early 1981 at about $1.40 per gallon, retail gas prices have increased by 2.21 times to $3.099 per gallon today. But per-capita disposable income has increased during that same period by more than 3.5 times, from $9591 in 1981 to $33,940 today.

In the early 1980s, it would have taken almost 15% of per-capita disposable income to buy 1,000 gallons of gas, and today it only takes only 8.5% (third quarter 2007). Even back in the "good old days" when gas sold for 50-60 cents per gallon in the mid-1970s, gas was more expensive as a share of income (10-11%) than today.

Bottom Line: Measured as a share of per-capita disposable income, gas prices would have to rise all the way to $5 per gallon today to be as expensive as gas in the early 1980s. Even if gas gets to $3.76 per gallon, it would be equivalent to 50 cent gas in the "good old days" of the mid-1970s, when measured as a share of disposable income. Goldilocks can handle $3 gas, no problem.

10 Comments:

The only difficulty I see is that not everyone takes home their share of "per-capita disposable income." Combine that with the spread in income inequality that has occurred since the 70s and there is a recipe for a significant downturn in the economy.

Taking such a simplistic view of things reminds me of the old saying, "put one hand in boiling water and the other in ice cold water and on average you will be comfortable."

"income inequality", what's that?

Are you saying that people aren't being paid for what they are actually worth or are some sectors of the employment picture not worth as much as others?

Calling wage and salary differences "income inequality" seems rather simplistic and quite socialistic to me...

juandos I was using "income inequality" in the same way that Professor Mark J. Perry used it in "Rising Inequality: Natural Outcome of Competition" in this months blogs. Quoting directly from Mr. Perry...

"In 1986, the top 25% earned 59.04% of total income, and by 2005 the income share of the top 25% increased to 67.5%, indicating rising income inequality over time."

So here you go inferring that Professor Mark J. Perry is simplistic and socialist when in fact he stands for all things that support free market capitalism.

My point is that one can not assume that because "per-capita disposable income" rises that it will apply to everyone equally. Not everyone's take home pay increases by the same amount.

Prices increase for everyone but the higher income earners work less time to earn the same goods and services than they did in the year 2000 for example. Middle to low income earners now work more hours to purchase the same goods as compared to the year 2000.

Saying the the share of income going to the top 25% has increased, doesn't necessarily mean that the bottom 10%, 20%, 25% or 50% are worse off today than they were in 1982. The bottom 20% could be better off today than in 1982, even though the share of inomce for the top 25% has gone up.

Bottom Line: The rich are getting richer, and the poor are getting richer. And today's rich were possibly yesterday's poor. And today's poor are tomorrow's rich in many cases.

How much have the middle 3 (excluding the top and bottom) quintile per-capita disposable incomes increased since the year 2000?

How much has gasoline gone up since 2000?

How much has heating oil gone up since 2000?

How much have home prices gone up since 2000?

How much has the same basket (no substituting hamburger for steak to skew the numbers) of commonly purchased groceries gone up since 2000?

It does take more time for the 3 middle quintiles to earn enough to buy the same somewhat "essential" things they did in 2000.

If consumer incomes have not risen as fast as their expenses then consumers will begin cutting back on non-essential spending and that will have a further compounding impact on the rest of the economy.

If we had a golilocks economy that might be true but we don't so let's just agree to disagree on that one. If the FED keeps cutting rates gasoline will be 3.75 by next summer, it's already 3.25 where I'm at in the mid-west.

$3 gas is wishful thinking. What is tyhe economy going to do with $8 gas?

Good Afternoon anon @ 12:09 PM....

I didn't Professor Mark's use of the term was really any better if the truth be told...

I don't know if I can explain it but I don't see it as, "income inequality" since it seems that somehow it infers to me at least that some folks aren't getting paid what the market deems them a worth for the work they do...

Everyone does take home their own per capita deposible income or at least what the market thinks they are worth...

I'm reminded of New Orleans today where market forces are paying illegals almost twice + for roofing work there than in the St. Louis county area... The same market forces are of course driving the price of rental living spaces too...

Over at the Kiplinger site I found the following that was supposedly garnered from the IRS from 2005: 'New data show that an income of $30,881 or more puts you in the top half of the class. Earning about twice that much -- $62,068 -- earns you a spot among the top 25% of all wage earners. You crack the elite top 10% if you earn more than $103,912.

And $364,657 buys top bragging rights: Earn that much or more and you're among the top 1% of all American earners. Together, the top 1% earn a full 21% of the income reported to the IRS -- far more than the 13% of total income reported by the bottom 50% of earners.'

Is this really, 'income inequality' or just people getting what the market forces assess as their worth?

Where the inequality comes about is when the federal government sticks its not so invisible hand into the situation: "Here's another powerful statistic about the top 1% of earners: They pay a whopping 39% of all federal income taxes. The bottom 50% pay just 3% of all income taxes"...

Now that's some serious income inequality...

The appropriate lesson to take out of this analysis is that the upper limit to gas prices (before people really start to change their behaviour) is much, much higher than $3.

Differnt anon here...

"Here's another powerful statistic about the top 1% of earners: They pay a whopping 39% of all federal income taxes. The bottom 50% pay just 3% of all income taxes"...

So that means one group cannot afford to pay the same taxes as the other (not that I think income tax is right). Ie, someone who earns 20k per year can't pay what someone who earns 200k per year does.

But it can not, under any circumstances, mean they can't equally afford afford to pay $3/gal of gas and probably $5?!

I wish I could afford THAT kind of reasoning, but if I reasoned that way... then I suspect I wouldn't be able to afford my brain! ;)

Post a Comment

<< Home