Bank Stocks Rebound by 2.5%, Keepin' Hope Alive

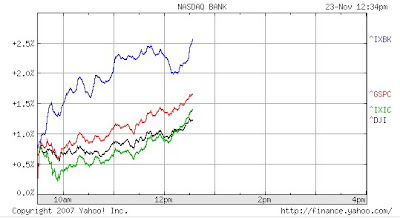

In some "Black Friday bargain hunting," the broader stock market indexes rebounded today by about 1.4% (see chart above, SP=red line, DJ=black and NASDAQ=green), and bank stocks rebounded at almost twice that rate (about 2.5%) as measured by the NASDAQ Bank Index (blue line above).

In some "Black Friday bargain hunting," the broader stock market indexes rebounded today by about 1.4% (see chart above, SP=red line, DJ=black and NASDAQ=green), and bank stocks rebounded at almost twice that rate (about 2.5%) as measured by the NASDAQ Bank Index (blue line above).Maybe there's hope.

(P.S. I'll probably retire from intraday prognasticatin', and wait until the market has closed to do my analyses.)

3 Comments:

Good to see that you believe in the free market of ideas, Mark. Censorship is anti-libertarian.

"Bank Stocks Recover: Worst of Credit Crisis Over? - Nov. 14, 2007"

From early October through last week, the NASDAQ Bank Sector Index (^IXBX, composed of 520 bank stocks traded on NASDAQ, blue line above in the chart) dropped by about -12%, about twice the -12% drop in the overall market (DJIA, red line above).

Since last week, bank stocks have recovered nicely, registering an +8% gain over the last week. And as the 3-month chart above shows, bank stocks are now about exactly on part with the overall market (DJIA), providing further evidence that the subprime mortgage troubles have not adversely affected the overall banking sector.

Note: As of 9:46 a.m. this morning, the NASDAQ Bank Index is up by 18%, amid a growing belief on Wall Street that the worst of the credit crisis is over.

Down 4.16% today, Mark (versus about 2% for the rest of the stock market). I'm expecting you'll be deleting this post any day now... just like your Nov. 14 post.

But as anonymous @ 12:45

demonstrated, the memory hole is pretty shallow these days.

Post a Comment

<< Home