U.S. Companies With Global Sales Perform Better

From today's Financial Times (paid subscription required):

When Isaac Merritt Singer set up a branch of his sewing machine maker in Paris in 1855, he probably did not think he was blazing a trail U.S. companies would still be following more than 150 years later. Singer's expansion in France turned the New York-based company into the first US multinational, pioneering a business model that would be adopted by other icons of American capitalism, from Ford to Standard Oil to General Electric.

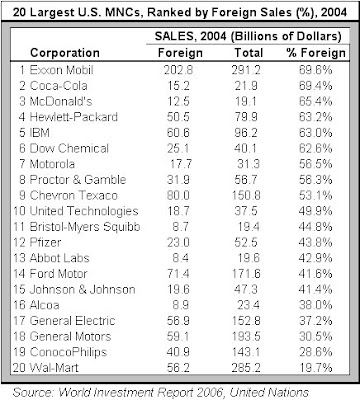

But perhaps the most important legacy of Singer's daring move was that it worked: within six years of the French opening, foreign sales had exceeded US revenues. It is a lesson not lost on today's corporate leaders (see chart above, many U.S. MNCs have half to two-thirds of sales overseas).

As the U.S. economy is squeezed by a housing slump and credit turmoil, a gap has opened up between companies with large overseas operations and those focused on the domestic market. The second-quarter results season drawing to a close has provided the starkest evidence yet of this trend.

Over the past three months, blue-chips such as General Electric, the conglomerate, IBM, the technology giant have hitched a ride on a global economy growing faster than the U.S. By contrast, companies that depend on domestic sales such as Wal-Mart and Home Depot, the do-it-yourself chain, have released disappointing results and gloomy predictions.

"U.S. companies are in the midst of an unprecedented boom in global earnings," wrote Joseph Quinlan, chief market strategist for Bank of America, in a recent note to clients. "The second-quarter earnings season was a tale of two earnings: robust overseas earnings . . . versus weak/soft domestic earnings".

This dichotomy has been reflected in U.S. stock markets, particularly during the past few weeks as investors have run for cover from domestic woes. After monitoring more than 40 stock-picking techniques, Merrill Lynch analysts concluded that buying shares in S&P500 companies with the highest percentage of international sales was the second-best performing investment strategy this year.

When Isaac Merritt Singer set up a branch of his sewing machine maker in Paris in 1855, he probably did not think he was blazing a trail U.S. companies would still be following more than 150 years later. Singer's expansion in France turned the New York-based company into the first US multinational, pioneering a business model that would be adopted by other icons of American capitalism, from Ford to Standard Oil to General Electric.

But perhaps the most important legacy of Singer's daring move was that it worked: within six years of the French opening, foreign sales had exceeded US revenues. It is a lesson not lost on today's corporate leaders (see chart above, many U.S. MNCs have half to two-thirds of sales overseas).

As the U.S. economy is squeezed by a housing slump and credit turmoil, a gap has opened up between companies with large overseas operations and those focused on the domestic market. The second-quarter results season drawing to a close has provided the starkest evidence yet of this trend.

Over the past three months, blue-chips such as General Electric, the conglomerate, IBM, the technology giant have hitched a ride on a global economy growing faster than the U.S. By contrast, companies that depend on domestic sales such as Wal-Mart and Home Depot, the do-it-yourself chain, have released disappointing results and gloomy predictions.

"U.S. companies are in the midst of an unprecedented boom in global earnings," wrote Joseph Quinlan, chief market strategist for Bank of America, in a recent note to clients. "The second-quarter earnings season was a tale of two earnings: robust overseas earnings . . . versus weak/soft domestic earnings".

This dichotomy has been reflected in U.S. stock markets, particularly during the past few weeks as investors have run for cover from domestic woes. After monitoring more than 40 stock-picking techniques, Merrill Lynch analysts concluded that buying shares in S&P500 companies with the highest percentage of international sales was the second-best performing investment strategy this year.

Bottom Line: U.S. companies with a higher percentage of foreign sales are stronger, more stable and more diversified, compared to companies that rely only, or mostly, on domestic sales. Just another underappreciated benefit of globalization.

1 Comments:

Whoa...

Didn't we want to impose excessive profit taxes on ExxonMobil because people thought it was milking US customers? But look at its overseas sales. Shouldn't an economic xenophobe encourage Exxon in milking foreigners for all they're worth?

Post a Comment

<< Home