Housing Affordability is Historically Very High

A recent analysis by Trulia concluded that buying a home today is 45% cheaper on average compared to renting a comparable home, see CD post here. That post generated a lively discussion with about 100 comments, and some questioned some of Trulia's assumptions and analysis (or lack of some key assumptions), although I think the general conclusion is valid that buying a home is relatively affordable today compared to renting a similar home -whether it's 10%, 20%, 30% or 45% cheaper.

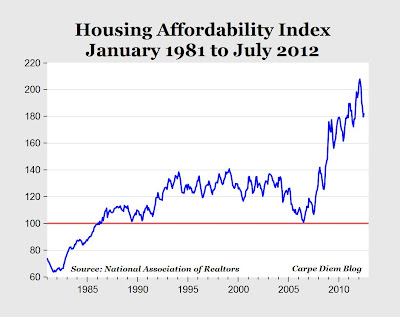

Another measure of housing affordability is to compare the median household income in the U.S. (or regions) to the qualifying income needed to purchase a median-priced home, and that analysis is reported monthly by the National Association of Realtors based on its Housing Affordability Index (HAI), see chart above.

In July, the Housing Affordability Index increased to 182.0 from 179.7 in June, but is down from historical highs for the HAI above 200 in the first three months of 2012. Looking back over the last thirty years, the July HAI of 182 is still very high by historical standards (see chart).

An HAI of 182.0 means that the typical American household earning the median annual family income of $61,080 in July would actually have 182% of the standard qualifying income level of $33,552 required to purchase a median-priced existing single-family house ($181,000) with a 20% down payment, financing the remaining 80% of the sales price with a 30-year fixed rate mortgage at the July average of 3.78% (monthly payment of $699 for principal and interest). For the Midwest region of the country, the HAI in July of 219 means that the typical Midwest household income of $60,657 is more than twice the qualifying income ($27,696) necessary to purchase the median price home at $155,400.

Bottom Line: Whether comparing buying to renting a home, or comparing the median household income to the qualifying income necessary to purchase a home, homeownerhip today is extremely affordable. And that historically high affordability is one of the factors that will continue to support the housing recovery taking hold across the country right now.

46 Comments:

mark-

where did that median household income number come from?

that $61k number looks much too high.

"A report from the Census Bureau Wednesday said annual household income fell in 2011 for the fourth straight year to an inflation-adjusted $50,054.

Median annual household income—the figure at which half are above and half below—now stands 8.9% below its all-time peak of $54,932 in 1999, at the end of the 1990s economic expansion. "

http://online.wsj.com/article/SB10000872396390444426404577647470593975642.html

income would have to be up over 20% in real terms in the last 8 months for $61k to be true.

in nominal terms, it was even lower.

http://www.davemanuel.com/median-household-income.php

morganovich, hate to say it, but mark's number looks close to right...the $50,054 number is for all households; mark qualified it with "family"...citing the census, the median family household income in 2011 was lower than 2010 by 1.7% at $62,273...

http://www.census.gov/newsroom/releases/archives/income_wealth/cb12-172.html

Are there HAI studies for major metropolitan areas? In areas like Los Angeles and Ventura County it seems to be the opposite on both counts, renting beats owning at the moment and prices still exceed median incomes.

Another ratio that would be interesting to see if median home price in a county compared to that counties median income and unemployment level.

morganovich,

The ratio shown by the National Association of Realtors is median family income to standard qualifying income. Median U.S. family income for 2011 was reported by the Census Bureau to be $60,974. Median household income for the same period was $50,054.

You can find the data for household income and family income at the Census Bureau's Income, Poverty, and Health insurance webpage.

I read but did not understand how the two different income measurements differ. Perhaps you can figure it out.

The graph is interesting.

The increase in housing affordability from 1980 to 1995 reflects both rising incomes and much lower interest rates.

The reduction in housing affordability after 2005 was certainly due to the asset bubble.

So what accounts for most of the striking increase in affordability since 2005? Reduced prices or reduced interest rates? I don’t think median family incomes rose very much.

rjs said...

morganovich, hate to say it, but mark's number looks close to right...the $50,054 number is for all households; mark qualified it with "family"...citing the census

...

While that's correct, it implies that family based households are the only ones that buy houses, which is incorrect.

Morganovich's numbers are much more broad based, and not limited to just families.

Home price to rent ratio (Case/Shiller/OER)

Monthly payment, Case Shiller, 20% down, 30 year mortgage

Bottom Line: Whether comparing buying to renting a home, or comparing the median household income to the qualifying income necessary to purchase a home, homeownerhip today is extremely affordable. And that historically high affordability is one of the factors that will continue to support the housing recovery taking hold across the country right now.

It seems to me that the Fed does not want housing to be affordable and is trying its best to blow up another bubble in the sector. The actions suggest that housing is not as sound as Mark is claiming and that the Fed is desperate to end the contraction.

Every farthing that was tossed into the housing bubble, by those that purchased homes outright or with a mortgage, went to a builder or previous home owner. That money didn't spontaneously combust. But we never hear anything about it or the wily/lucky folks that received it. Did they put all that money in a coffee can and bury it in the backyard? Did they move right back into their old house after the foreclosure took place? Are they living on houseboats in Sausalito? Somebody needs to write some biography.

Bart, it really doesn't matter if households is a broader group than families. The measure the National Association of Realtors wishes to use is the affordability of housing for families. That's the measure they have used for decades.

IMO, families is a better group to measure for housing. Households includes a huge number of single person households, and they just do not buy homes as often (absolutely or proportionately).

Every farthing that was tossed into the housing bubble, by those that purchased homes outright or with a mortgage, went to a builder or previous home owner. That money didn't spontaneously combust. But we never hear anything about it or the wily/lucky folks that received it. Did they put all that money in a coffee can and bury it in the backyard? Did they move right back into their old house after the foreclosure took place? Are they living on houseboats in Sausalito? Somebody needs to write some biography.

Most people moved up to a new home or extracted equity out of their current home to use on consumption. Many went on very nice vacations, purchased expensive cars, jewellery, etc. That money is gone and the fall in the market value of most homes has meant a loss for the purchasers in the later stage of the cycle. The builders made decent profits but many of them went back into land purchases that have to be written down or have already been written down. The sellers of that land spent or invested the proceeds mostly right before the bubble popped. Because value is subjective and is determined at the margin the market value of housing related assets vaporised in a very short period of time. (Which is why the Fed is saying it wants prices to go up.)

Every farthing that was tossed into the housing bubble, by those that purchased homes outright or with a mortgage, went to a builder or previous home owner. That money didn't spontaneously combust. But we never hear anything about it or the wily/lucky folks that received it. Did they put all that money in a coffee can and bury it in the backyard? Did they move right back into their old house after the foreclosure took place? Are they living on houseboats in Sausalito? Somebody needs to write some biography.

Most people moved up to a new home or extracted equity out of their current home to use on consumption. Many went on very nice vacations, purchased expensive cars, jewellery, etc. That money is gone and the fall in the market value of most homes has meant a loss for the purchasers in the later stage of the cycle. The builders made decent profits but many of them went back into land purchases that have to be written down or have already been written down. The sellers of that land spent or invested the proceeds mostly right before the bubble popped. Because value is subjective and is determined at the margin the market value of housing related assets vaporised in a very short period of time. (Which is why the Fed is saying it wants prices to go up.)

jet-

thanks.

so, i found the definitions:

household:

"A household consists of all the people who occupy a housing unit. A house, an apartment or other group of rooms, or a single room, is regarded as a housing unit when it is occupied or intended for occupancy as separate living quarters; that is, when the occupants do not live with any other persons in the structure and there is direct access from the outside or through a common hall.

A household includes the related family members and all the unrelated people, if any, such as lodgers, foster children, wards, or employees who share the housing unit. A person living alone in a housing unit, or a group of unrelated people sharing a housing unit such as partners or roomers, is also counted as a household. The count of households excludes group quarters. There are two major categories of households, "family" and "nonfamily". (See definitions of Family household and Nonfamily household)."

family:

"A family is a group of two people or more (one of whom is the householder) related by birth, marriage, or adoption and residing together; all such people (including related subfamily members) are considered as members of one family. Beginning with the 1980 Current Population Survey, unrelated subfamilies (referred to in the past as secondary families) are no longer included in the count of families, nor are the members of unrelated subfamilies included in the count of family members. The number of families is equal to the number of family households, however, the count of family members differs from the count of family household members because family household members include any non-relatives living in the household."

http://www.census.gov/cps/about/cpsdef.html

based on this, i think household is the correct one to use, not family.

it is specifically set up around people who occupy a housing unit. it also includes people (like me) who live alone but own a house.

family skews everyhting upwards by including only groups of 2 or more as if single people do not buy houses, which seems like a bad assumption to me.

one think to also keep in mind:

this affordability index is only looking at one kind of affordability. it assumes you have a down payment.

such an assumption might have been more realistic 15 years ago when equity in homes was high. but post the crash, more than 30% of homeowners have less than 5% equity in their home and about half have less than 20%.

this is a different kind of affordability. in the last couple years, fewer homeowners than ever in us history have had too little equity to make a down payment if they moved. that means going cash in to buy a house, which makes it less affordable.

there are 2 things you need to afford to buy a house.

the first is a down payment. if you cannot afford that, then really great rates and low monthly payments are irrelevant. it's an great drink special in a vip room you cannot get into.

while payment affordability may be quite high, down payment affordability is at lows. the cash to do it is far less available.

looking at just one or the other yields only a partial view of what is going on in housing.

morganovich: "based on this, i think household is the correct one to use, not family."

It doesn't matter what you think. Or what I think. The industry group believes that "median family income" is the correct metris to use. That's what they've been using for at least a couple of decades if not longer.

Suppose you decided to create an alternate index based on median household income. Don't you believe it would also show that housing affodability is historically very high? Do you have any reason to believe that the trend in median household income is any different than the trend in median family income?

I don't understand why you care whether housing affordability is based on household income or on family income.

This comment has been removed by the author.

Jet

"I don't understand why you care whether housing affordability is based on household income or on family income."

Only that "families" in this context is a subset of the larger group "households", so that a larger number of people would be included in the analysis, which presumably would provide a slightly more accurate picture of affordability.

morganovich: "such an assumption might have been more realistic 15 years ago when equity in homes was high. but post the crash, more than 30% of homeowners have less than 5% equity in their home and about half have less than 20%."

Not sure I believe those numbers. Do they refer to all homeowners or just to mortgage holders? Many Boomers and our parents now own our homes free and clear. The latest data I've been able to find shows that over 31% of U.S. homes carry no mortgage at all.

I suspect that 35 years ago the median equity for homes was close to 20%. Why? Because Boomers had only just started to buy homes. Because there were far fewer seniors with paid-off mortgages than today.

We could sit around arguing demographics, interest rates, savings rates, and all sorts of extraneous garbage. The truth is, though, that the decline in housing prices and the extremely low interest rates have made housing very cheap historically. I'm not a market timer, so that doesn't matter to me. But for those folks who were prudent - or for those who were fortunate enough to live in bubble-resistent states - buying a house is certainly easy right now.

Ron H: "so that a larger number of people would be included in the analysis, which presumably would provide a slightly more accurate picture of affordability."

I'm not sure I completely agree.

The majority of single person households - which is the big difference between "family" data and "household" data - neither own homes nor are seeking to own homes. The National Association of Realtors (NAR) is attempting to assess the affordability of homes for their customers - the people who want to buy homes. Including all those very young single person households would severely distort the metric the NAR is providing for its industry. Including all the elderly widows and widowers who are also not likely to be in the housing market - and who have limited incomes - would likewise distort the industry metric.

If the NAR decided to include households headed by only the 30 to 65 age group - or perhaps the 25 to 65 age group - then perhaps a household metric might be slightly more accurate than a family metric. But not stikingly different. Of course, changing the metric afters decades of consistently would just decrease its credibility.

Th ratio of median family income to median housing price is a standard that has been around a long time. I think the industry knows what it's doing by using that metric.

A household consists of all the people who occupy a housing unit. A house, an apartment or other group of rooms, or a single room, is regarded as a housing unit when it is occupied or intended for occupancy as separate living quarters; that is, when the occupants do not live with any other persons in the structure and there is direct access from the outside or through a common hall.

When the kids who graduated from university but now work at Starbucks because they can't find better jobs move back in with mom and dad household income goes up by a significant amount. But does that mean that the per capita savings has gone up by enough to support a recovering housing market?

vangeiv: "When the kids who graduated from university but now work at Starbucks because they can't find better jobs move back in with mom and dad household income goes up by a significant amount."

Do you think the majority of college graduates are accepting Starbucks level jobs? The data I've seen show that about 50% of college graduates are finding jobs in their fields. All of the remainder may not be working in their desired fields, but that doesn't mean they're working for near minimum wages.

Suppose that you are correct, and that half the nation's 2012 college graduates - about 700,000 young folks - add a Starbucks level income to a 700,000 households. Is that going to move the nation's median household income or median family income very much? The U.S. data on income includes about 80 million families and 120 million households.

Do you think the majority of college graduates are accepting Starbucks level jobs? The data I've seen show that about 50% of college graduates are finding jobs in their fields. All of the remainder may not be working in their desired fields, but that doesn't mean they're working for near minimum wages.

I think that the data shows that college educated kids are having a terrible time of it. They may not be working for minimum wage but they are very far from where their predecessors used to be. And when they move back in with their parents the household income goes up.

Suppose that you are correct, and that half the nation's 2012 college graduates - about 700,000 young folks - add a Starbucks level income to a 700,000 households. Is that going to move the nation's median household income or median family income very much? The U.S. data on income includes about 80 million families and 120 million households.

You are right. But the median household is also getting a lot in transfer payments that it was not getting a decade ago. Add up everything and it does begin to matter. And I still don't see the sustainable housing recovery that you guys are looking at. Looking at the Fed's actions I would argue that most of the Fed governors don't either. The decision to buy mortgage paper from the GSEs so that they could buy more mortgages in the secondary market as banks try to make new loans in an attempt to reflate the burst housing bubble.

morganovich: "while payment affordability may be quite high, down payment affordability is at lows. the cash to do it is far less available."

FHA loans still only require 3.5% down payment. As reported in the NY Times earlier this year":

"F.H.A.-insured mortgages represented almost a third of all mortgages in 2011"

FHA loan rates are currently historically low.

FHA Homepath loans have even lower requirements: 3% down payment and no PMI. These loans are restricted to Fannie-owned foreclosures.

In recent months, 20% of existing home sales in the U.S. were for homes priced below $100K. For such homes, a 3.5% down payment is not terribly burdensome.

A quick search via Google reveals that credit unions all over the nation are currently offerring 95% conventional mortgage loans (down payments of only 5%). Rates are slightly higher than those for 80% loans, but still very low by historical levels.

The availability of 96.5% FHA loans and 95% credit union loans means that young folks do not need large amounts of cash to buy a home.

Anecdotal evidence from my workplace reveals that many young homebuyers are receiving assistance from parents in meeting the down payment requirements.

FHA loans still only require 3.5% down payment. As reported in the NY Times earlier this year":

"F.H.A.-insured mortgages represented almost a third of all mortgages in 2011"

FHA loan rates are currently historically low.

FHA Homepath loans have even lower requirements: 3% down payment and no PMI. These loans are restricted to Fannie-owned foreclosures.

In recent months, 20% of existing home sales in the U.S. were for homes priced below $100K. For such homes, a 3.5% down payment is not terribly burdensome.

This is an argument against purchasing a home now because it shows that the market needs a huge amount of help and there is no basis for a sustained recovery or real price increases. Any upward momentum will be met with overhead resistance as people who are finally even look to get out and deleverage. At the same time the improvements will allow some of the supports to be taken away. The combination of the two will make housing a lousy investment compared to some of the alternatives.

The availability of 96.5% FHA loans and 95% credit union loans means that young folks do not need large amounts of cash to buy a home.

It also means that young people are likely to walk away during the next contraction and that the shadow inventory will have a long way to go. A healthy market does not need the Fed intervening or banks to be reckless.

vangeiv: "This is an argument against purchasing a home now because it shows that the market needs a huge amount of help and there is no basis for a sustained recovery or real price increases"

I suppose someone who believes they can time markets would believe that. I certainly do not.

IMO, locking in a very low interest rate mortgage loan right now is worth far, far more than any expected price decline.

vangeiv: "A healthy market does not need the Fed intervening or banks to be reckless."

I agree that government interference in free markets is very dangerous. I do not believe that either banks or credit unions are being reckless right now.

I suppose someone who believes they can time markets would believe that. I certainly do not.

Actually, neither do I. I am simply looking at the data and don't like what I see. My investment is based on my analysis free of the hype or spin that we get from promoters. (This is why I don't buy the shale hype that Mark is spinning. When I look at the EURs I can't see any material support for the claims made by the people that Mark keeps quoting.)

IMO, locking in a very low interest rate mortgage loan right now is worth far, far more than any expected price decline.

But with 5% down you will likely be underwater after the interest rate rise drives prices lower. Of course, you could believe that the Fed and Treasury could continue to intervene in the markets as they attempt to reflate the bubble. But if that is the case there are far better ways to make money than by buying a home.

And before I end this let me point out that you could have made the same argument two or three years ago. Most people who bought homes are still trapped because the prices are not high enough to exit the market and cover all of the transaction costs. What happens to them if they have better employment opportunities elsewhere?

jet-

"

I don't understand why you care whether housing affordability is based on household income or on family income."

i care because family income is a smaller subset and leave out a significant number of homebuyers. it leaves out anyone who is single, any non married couples that buy a house, and any of the "share buys" and tic type deals that are very common in cities.

i just think you get a better actual sense of affordability by looking at all those groups as opposed to only people who are married.

why would you use a narrow sample when a broader one is readily available?

those numbers refer to mortgage holders, not overall homeowners.

52 million have mortgages.

24 million own outright.

so even if only 69% of all homes have mortgages, if the % of mortgagees with sub 20% equity gets cut by this figure, a 45%ish gain there over the last 15 years is still roughly 30% of all homeowners.

that's a pretty big deal.

for them, the market looks far less "affordable" than it did because they need to go cash in to get the good rates.

my point is that there are 2 things you need to afford, a down payment and the monthly payments.

monthly payments look quite affordable based on the current low rates, but down payments look more difficult to make than they were pre crash.

"

I agree that government interference in free markets is very dangerous. I do not believe that either banks or credit unions are being reckless right now"

no, but the treasury is.

the banks are very safe. they are selling nearly everyhting to the government.

between freddy, fannoe, and the FHA it's 90% of the new mortgage market.

they now own or guarantee 50% of the entire us residential mortgage market.

they are doing so at very low rates based on a cost of capital predicated on zirp and twist.

assuming those programs end one day, there is going to be a nasty duration mismatch and profit squeeze that joe taxpayer will be on the hook for.

residential mortgages have been all but nationalized in the us.

perhaps you disagree, but that strikes me as extremely reckless.

jet-

fha loans are predominantly for first time buyers.

that's a small portion of the market and does not help the folks who are underwater.

it's also a very aggressive program whose risk is faced by taxpayers.

large subsidies often look like a great deal if you are the one getting them, but i have some real questions about how good an idea that is for the taxpayers.

large taxpayer subsidy seems like a poor foundation for a market.

morganovich: "why would you use a narrow sample when a broader one is readily available?"

It is not me who chose to use median family income. It is the National Association of Realtors (NAR). I believe they know their industry better than you or I know it.

My guess - which I've already explained - is that the median income of families is much closer to the median income of homebuyers.

It is true that many single adult households buy homes. But I believe the ones who do have higher incomes than the median household income. That's because I believe that the low end of single adult households includes very young adults and very old adults (widows and widowers). Those folks are just not homebuyers.

I believe that NAR knows that the median family income is more representative of their customer base. That's why they use it, IMO.

morganovich: "fha loans are predominantly for first time buyers."

First time homebuyers make up a large portion of the people who cannot come up with 20% down payments.

Credit union 95% loans are not just for first time buyers.

morganovich: "large subsidies often look like a great deal if you are the one getting them, but i have some real questions about how good an idea that is for the taxpayers."

Oh, you should know that I agree completely. I'm not arguing that the affordability of homes right now is necessarily a good thing for anyone. I'm just agreeing with Mark that housing - for whatever reason - is very affordable today.

It is not me who chose to use median family income. It is the National Association of Realtors (NAR). I believe they know their industry better than you or I know it.

It is more likely that it wants to paint the best picture possible for the industry.

Oh, you should know that I agree completely. I'm not arguing that the affordability of homes right now is necessarily a good thing for anyone. I'm just agreeing with Mark that housing - for whatever reason - is very affordable today.

Given the demographic and monetary headwinds that may not be true for even the medium term.

morganovich: "residential mortgages have been all but nationalized in the us.

perhaps you disagree, but that strikes me as extremely reckless."

No, I agree. My point was simply that private sector banks are not being reckless with shareholders' money.

Washington, on the other hand, is being reckless in just about everything it does.

vangeiv: "It is more likely that it wants to paint the best picture possible for the industry."

Why would the NAR want to do that? One of the main functions of the NAR is to lobby on behalf of their members. How does painting the best picture possible for their industry help their lobbying efforts?

Why would the NAR want to do that? One of the main functions of the NAR is to lobby on behalf of their members. How does painting the best picture possible for their industry help their lobbying efforts?

It wants more sales to take place. Those don't happen in as great a volume if prices are going down and there is no promotional activity pushing buyers to enter the markets now. The insiders in the industry would like nothing more than to be able to sell their shares or raise more cash by issuing equity at a higher price.

vangeiv: "It wants more sales to take place."

Perhaps, but I don't think statistics about housing afforability are going to drive any prosepctive homebuyer to make a buying decision. What matters to the prospective homebuyer is whether or not he or she can afford a house - not whether the median family can.

vangeiv: "The insiders in the industry would like nothing more than to be able to sell their shares or raise more cash by issuing equity at a higher price."

The NAR represents thousands of private real estate companies. They're not issuing equity.

jet-

"

It is not me who chose to use median family income. It is the National Association of Realtors (NAR). I believe they know their industry better than you or I know it.

My guess - which I've already explained - is that the median income of families is much closer to the median income of homebuyers."

call me mr cynical, but i think the more likely interpretation is that family income is higher than household, so the NAR chooses to use it precisely to make housing look more affordable.

keep in mind that this is the national association of REALTORS. it's an industry group interested in promoting the purchase of homes.

one might reasonably expect them to have some bias here.

when the national association of florists tells you it's a great time to send flowers, you'd take that with a bit of a grain of salt, no?

But if using family income instead of household income makes housing look more affordable, wouldn't the time series of the HAI using household income have almost exactly the pattern over time, but just shifted down by a slight amount?

jet-

re banks and risk:

this may not be quite that straightforward. selling the mortgages to or getting them guaranteed by a gse is a risk reducer, absolutely. it takes risk off the books.

but what are they then doing with the cash?

to keep tier 1 high, they have limited options.

some of it goes on deposit at the fed (who is currently paying interest but can change that at any time) but a lot is also going into levered federal debt.

that is quite risky.

if you own a 5 year bond, the yield is deeply negative in real terms. so you lever up. at 10:1 gearing, such a bong might be ok.

but with rates this low due to fed intervention, the principal value of that bond really only has one way to go. if the 5 year went back to 4%, the principal hit on a 10:1 portfolio would be pretty nasty.

that is risk, and worse, it's very concentrated risk and very homogeneous across banks.

the bursting of the govvies bubble is where the next crisis will come from, and it's likely to be a nasty one.

like the oxy addicts that switched to heroin in response to abuse resistant oyxcontin being released, that banks may have jumped out of a frying pan and into the fire on the risk side.

ark J. Perry said...

But if using family income instead of household income makes housing look more affordable, wouldn't the time series of the HAI using household income have almost exactly the pattern over time, but just shifted down by a slight amount?

I don't track both of them, but this points at a substantial difference between the two.

http://en.wikipedia.org/wiki/File:Gdp_versus_household_income.png

Post a Comment

<< Home