Kauffman Foundation Economic Bloggers Outlook

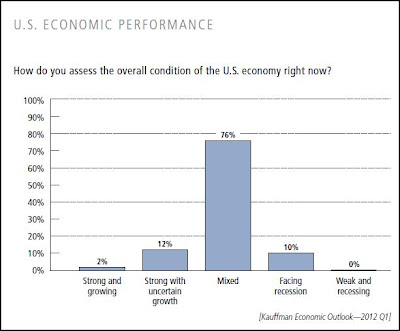

"Despite a continued cloudy view of the U.S. economy, some top economics bloggers are beginning to see a ray of hope on the horizon. According to a new Ewing Marion Kauffman Foundation survey, 14 percent of respondents now believe the economy is "strong and growing" or "strong with uncertain growth," an improvement over last quarter (see chart above).

For the Kauffman Economic Outlook: A Quarterly Survey of Top Economics Bloggers of 2012, the Kauffman Foundation sent invitations to more than 200 leading economics bloggers as identified in the Palgrave's econolog.net December 2010 rankings about their views of the economy, entrepreneurship, and innovation.

Looking ahead, only 33 percent now anticipate U.S. poverty to increase in the next three years, a significant positive change from previous surveys. Respondents also believe that employment and global output will rise faster than anything else and, surprisingly, some expect a higher marginal tax rate."

4 Comments:

is there a past track record on their predictions?

have they been successful?

is it a contrary indicator like investor bullishness?

i have no idea how to read this thing.

anyone have any experience with it?

It means, Morganovich, that once again your Gloomy Gus doomsterism is off base.

Only a too-tight Fed can derail this growth, and Bernanke now recognizes the mistakes he has made. The FOMC board has some first-rate tight-asses on it, but I think Bernanke will prevail.

"Only a too-tight Fed can derail this growth, and Bernanke now recognizes the mistakes he has made..."....

LOL!

Yahoo news AP item: Figures on government spending and debt

From Zer0 Hedge: Initial Claims Print Near Expectations, To Be Revised Adversely Next Week; Productivity Misses, Labor Costs Increase

And in other labor news, Q1 GDP will likely see more cuts after nonfarm productivity came at 0.7% on expectations of 0.8%, and the previous number was revised lower from 2.3% to 1.9%. Finally labor costs rose from an upward revised -2.1% to 1.2%, higher than expectations of 0.8%. Overall nothing material today, as all focus on tomorrow's NFP, which as noted here previously, has a big chance of surprising to the downside...

What do you bet we'll here 'u unexpected' or 'steeper that expected' again?

bunny-

that was a stupid and pointless comment even for you.

do you even attempt to include actual content in your babbling?

all i did was ask a question. you then erect a straw man and provide a zero content answer that clearly has nothing at all to do with the matter under discussion.

do you even qualify as sentient bunny? can you pass a turing test?

Post a Comment

<< Home