Real Estate Rebound in Canada: Home Price Index Rises for 8th Straight Month to a New Record High

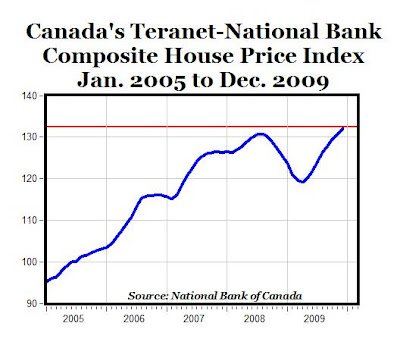

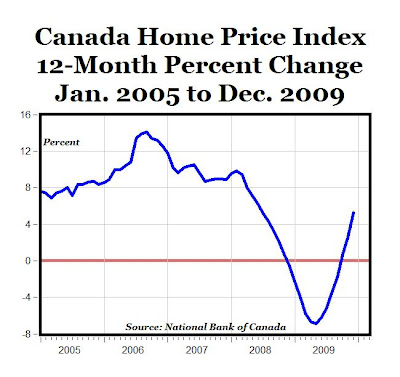

1. "Canadian home prices in December were up 5.2% from a year earlier, double the 12-month advance recorded in November, according to the Teranet-National Bank National Composite House Price Index. December was the third consecutive month in which prices were up from a year earlier, after 10 consecutive months of 12-month deflation. The turnaround is due to eight straight monthly increases in the countrywide index. December's robust 1.2% monthly gain pushed the composite index above the pre-recession peak, that is, to a new record (see chart above)."

1. "Canadian home prices in December were up 5.2% from a year earlier, double the 12-month advance recorded in November, according to the Teranet-National Bank National Composite House Price Index. December was the third consecutive month in which prices were up from a year earlier, after 10 consecutive months of 12-month deflation. The turnaround is due to eight straight monthly increases in the countrywide index. December's robust 1.2% monthly gain pushed the composite index above the pre-recession peak, that is, to a new record (see chart above)."2. REUTERS -- "Encouraged by rock-bottom interest rates and rising consumer confidence, home sales and prices have been on a stunning rebound after grinding almost to a halt in the wake of the global financial crisis in late 2008.

"All in all, this report adds to the growing list of indicators pointing to a strong housing market in Canada, and underscores the view that Canadian home buyers are continuing to take advantage of the still favorable buying conditions, particularly given the very low mortgage rates (variable-rate mortgages goes are just 2.25% and five-year fixed-rate mortgages are below 4%)," said Millan Mulraine, an economics strategist at TD Securities."

3. Does Canada now have to be worried about a U.S.-style housing bubble? Opinions are mixed, but some experts are saying Yes, see article here.

6 Comments:

Yeah, it sucks.

I am an accountant from Canada living in the USA. I'd love to take my wife to Canada to set up shop.

Sadly, we can't afford it. The Harper government decided that Keynes was right and the solution to the bust was to keep the boom alive via the CMHC. It is a gambling hall now.

I fully completely refuse to become a debt slave. I will not do it. I will not borrow 3/4 of a million dollars on a low 6-figure income to live in a Vancouver shoebox. I will not do it. I will not tether my life to the Royal Bank of Canada (especially after paying off my student debt).

I sure hope you aren't posting Canadian house prices as a sign of a good economy. An asset bubble completely supported by the state is not a good economy. A 900,000$ median Vancouver shoebox isn't a good economy. Not when median family income is 70k.

Please tell me you aren't arguing this. Pretty please. There has to be at least one economist alive on this earth who understands what the middle class is being subject to.

Their real estate may, or may not, rebound but their Olympic hockey team will not.

shame the US market is heading back into the toilet. it's going to get rapidly worse as buyer credits end and mortgage rates head up when the fed stops holding them down on march 31...

WASHINGTON (AP) -- Sales of new homes plunged to a record low in January, underscoring the formidable challenges facing the housing industry as it tries to recover from the worst slump in decades.

The Commerce Department reported Wednesday that new home sales dropped 11.2 percent last month to a seasonally adjusted annual sales pace of 309,000 units, the lowest level on records going back nearly a half century. The big drop was a surprise to economists who had expected sales would rise about 5 percent over December's pace.

While winter storms were partly to blame, home sales have fallen for three straight months despite sweeping government support. Economists were already worried that an improvement in sales in the second half of last year could falter as various government support programs are withdrawn.

"There is no doubt that January and February are going to be messy months for housing, given the severe weather conditions, but that doesn't take away from the fact that the housing sector has taken another big step back, even with the government aid," Jennifer Lee, a senior economist at BMO Capital Markets, said in a research note.

January's weakness was evident in all regions except the Midwest, where sales posted a 2.1 percent increase. Sales were down 35 percent in the Northeast, 12 percent in the West and almost 10 percent in the South.

The drop in sales pushed the median sales price down to $203.500. That was down 5.6 percent from December's median sales price of $215,600, and off 2.4 percent from year-ago prices.

New home sales for all of 2009 had fallen by almost 23 percent to 374,000, the worst year on record. The National Association of Home Builders is forecasting that sales will rise to more than 500,000 sales this year, an improvement from 2009 but still far below the boom years of 2003 through 2006 when builders clocked more than 1 million new home sales per year.

"after grinding almost to a halt" -- Reuters

Is that what the chart actually shows?

So how low can a dip mathematically go, to show a cessation of activity?

The chart shows a home price index for Canada, not real estate sales. Sales could have slowed considerably, but that would not necessarily be reflected in a chart of home prices.

Canada has no mortgage interest tax deduction, and so less spec-fever in housing.

The home mortgage interest tax deduction is a terrible market distortion, resulting in too much capital flowing into housing.

The more-expensive your house, and the higher your income-tax bracket, the bigger the deduction.

But you will never hear the "libertarian," "free market" Red Ink Republicans breath boo against this really stupid tax break.

It's easier to blame the CRA. The CRA is why luxury housing is in the toilet coast-to-coast?

Post a Comment

<< Home