Long-Term Interest Rates Suggest Low Inflation?

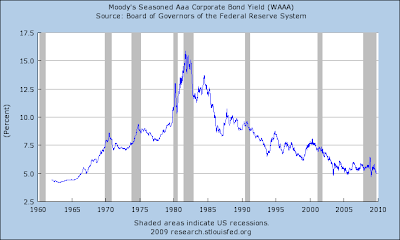

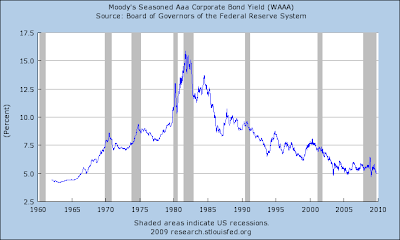

AAA Corporate 30-year Bond Yields, 1962-2009:

Baa Corporate 30-year Bond Yields, 1962-2009:

Prime rate, 1955-2009:

Baa Corporate 30-year Bond Yields, 1962-2009:

Prime rate, 1955-2009:

In a previous post, I suggested that historically low 30-year mortgage rates reflected relatively low market expectations of future inflation. Some commenters (and Robert Shiller this afternoon on CNBC) pointed out that the Fed is buying mortgage securities, which is temporarily keeping 30-mortgage rates low, rather than low inflation expectations keeping rates low.

But the charts above that other long-term rates (30-year Treasury bond, 30-year AAA corporates and 30-year Baa corporates) are historically low, as well as the prime rate being historically low, and these low rates wouldn't necessarily have anything to do with Fed purchases.

Question: How could all of these long-term rates be so low if there were inflationary pressures building up in the economy, which would lead to higher expected future inflation, and higher nominal long-term interest rates, and not historically low long-term rates?

29 Comments:

"How could all of these long-term rates be so low if there were inflationary pressures building up in the economy . . "

i agree. heck, it could be we're headed for deflation.

Don't mean to monitor your blog spot publicly, but you mispelled inflation in tagline...thought you might want to know...I know how you are about these things. Peace

Thanks anonymous, it's fixed now.

"i agree. heck, it could be we're headed for deflation"...

You know I think you have a point there at least for right now...

What I wonder is how long that will last especially in light of the stimulus nonsense?

From the blogProf:

Disaster: Hard Stimulus Data Reveals That Michigan "Saved Or Created" Only 397 Jobs For 620 Million Stimulus Dollars, FAR Short Of 19,500 Claim

I think fear is keeping people in Treasuries. While stock markets have been rallying, it's been with many people on the sidelines. They're just so afraid of another downdraft.

With the US debt to grow by another $1 trillion or so each of the next 3 years, how long will buyers be around to hoover that up? At some point, the supply growing much faster than GDP has to be a factor. There's only so much demand for long term sovereign bonds.

Note that rates in the mid 70's were not predictive of inflation past a few years. Anyone holding for even 10 years was handed back much deflated dollars.

All long-term rates are low because of arbitrage, and obviously they don't represent expectations because the Fed is actively driving the rates down. They've put a gag on the debt market, that's all.

As was pointed out by OA, it can change really fast. In reality, past episodes of high inflation were never made by slow upward trends, they were always made by a sequence of sudden jumps, which easily create a vicious circle since people start to realize that real interest rates are always negative ex-post.

Sorry, I meant bond market, not debt market.

Some very interesting comments here.

If government puts a long term bias on a large sector, via loan subsidies;, then other sectors, over time, would tend to follow the borrowing pattern of the subsidized sector.

In the free market, when demand exceeds supply, prices rise and there's excess profit. So, new supply is created, until excess profit disappears. That's a mechanism to keep supply and demand in equilibrium.

However, there remains too little money chasing too many assets and goods. Banks seem more willing to build-up capital and invest than lend. Eventually, that'll change. Unfortunately, the government is making it more expensive to produce, and it seems inevitable taxes need to rise. Consequently, the U.S. will be a weaker engine of global growth.

More Americans seem to believe making money is bad and losing money is benevolent. The new Administration has taken full advantage of the scare talk about another Great Depression or the Great Recession to make big government even bigger.

Government has been spending money faster than Americans can earn it. Now, it's a runaway train, and it'll be U.S. households who'll be railroaded. It won't be long before the typical middle class worker finds half of his payroll check withheld by the government, while consumption taxes continue to increase.

interest rates show expectations, not pressures building.

all you can say from these rates is that inflationary expectations are lower.

this has been a structural move for decades, abetted by a hedonics based CPI that drastically understates actual inflation.

measured using a pre clinton CPI calculation, CPI was over 8% in parts of 2008.

bond rates didn't respond.

cook the numbers enough, and their relationships start to break down.

but that does not mean that you didn't lose piles of money on a PPP basis in the late 2000's holding bonds. you had a negative real rate of interest if you measure inflation without a hedonic substitution effect.

this does not prove that inflation is coming, but it does show that bond markets can not only ignore inflation, but that they seem to be tied to a measure that bears less and less resemblance to reality if reality is a constant consumption basket. the divergence in the performance of "old CPI" and "new cpi" from 1992-2006 is striking, the former rose from 5% to about 11% fairly linearly while the latter dropped from 4% to 2%.

use a bad number for CPI and all your real interest rate calculations are off.

i would ague that this data slant is causing massive over investment in bonds. (and under adjustment of social security and medicare)

Do not pay attention to the rates today. They are temporary.

Most of us hope to live another 20 yrs or more. Look at the chart for AAA corporate bond yields. See how they rose from 4% to 16% in the years 1962-82. Rates are low because of suppressed economic activity and the powerful Fed pushing interest rates below the market rate. Huge borrowing by the US government and the eventual abandonment of the dollar by the rest of the world will cause rates to soar like 1980-2. I remember my 16% mortgage in July 1982. If you have a good job you can enjoy your deflation now while it lasts. Your savings will be dissipated by a weakening dollar soon enough. Inflation will be obvious in president Obama's second term. Bond rates may go from 5% to 25% in the next ten years. Domestic and military spending will have to be sliced in half while tax rates for working Americans rise above 50% as inflation rages. The government will take 95% of what is left when you die. Many of the most productive Americans will simply move to other countries instead of staying here and working for nothing. Others will be trapped here in a dysfunctional society.

The mighty Federal Reserve Bank has used all of its ammunition and cannot prevent the crash of the dollar. Overspending and excessive debt will crush a generation or two of Americans. Boomers will be caught short of cash in retirement and the echo boomers will be handicapped by excess government spending since 1950. They will be paying high interest rates on the debts for Korea, Vietnam, Iraq I, Iraq 2, Afghanistan and maybe Pakistan or Iran. They will pay the costs for the Great Society etc.

Enjoy your deflation while you can. These are the good old days. Americans should fire those big spenders in Washington and put their replacements on an allowance before it is too late.

These charts suggest Bernanke has it wide-open to print boatloads of money, and I hope he does.

A sinking dollar woold be great for America--more tourists here, more manufacturing sales here, and foreigners would come here to buy cheap assets.

I never liked the "strong dollar." I think people allowed the word "strong" to influence their feelings, as if a high exchange rate meant strength. It did not.

I think inflation is dead. Labor has no leverage--average weekly earnings are lower now than in 1964. Worker productivity is rising continuously.

Additionally, there is a global surfeit of capital. That keeps rates down, and is another reason we are on the cusp of another 20-year boom in global growth.

The USA can participate, but we have to whack our parasitic military and crush rural subsidies, to become internationally competitive.

Or, we can become a ferociously armed banana republic.

> Labor has no leverage--average weekly earnings are lower now than in 1964.

A stupid and irrelevant comparison through ignorance of context. The buying power of the american public is vastly greater than at any time in history. This is reflected in their massively increased disposable income. Even if some magical calculation manages to claim that fixed wages have dropped, it's in the larger context of what one MUST buy, and what one CAN buy, that those numbers apply. The price of the former is far lower than at any time in US history, and the options for the latter are vastly greater than at any time in human history.

> A sinking dollar woold be great for America--more tourists here, more manufacturing sales here, and foreigners would come here to buy cheap assets.

I don't know about the rest of the world, but I don't think the Japs are going to fall for that last one a second time in a couple decades.

As far as the "manufacturing sales" here, go home and learn something basic and essential about economics: The USA is in a postindustrial economy, and has been for decades. -- there is no NEW money to be made for America in manufacturing. All future millionaires will come from IP and Services. Duh. Really, really DUH.

> The USA can participate, but we have to whack our parasitic military and crush rural subsidies, to become internationally competitive.

LOL, we need our military more than ever. We will have a huge debt load to China. China has a highly gender-imbalanced male society as a result of its one-child policy and the foolish cultural preference for males. Historically, this leads to a jingoistic state with a highly aggressive foreign policy. America is fat and rich. If we do NOT maintain the best military on the planet, you can bet your fat lazy ass you will regret it, as China takes the military route to wealth instead of the industrial trade route to wealth. Generals instead of Business tychoons as a way to attain the attention of scarce females. Only if we can keep that a blatantly risky path to wealth and power -- by having far and away the greatest military on the planet -- will we avoid the fate of the top-dog empires (regardless of our not being an "empire") in history.

Q.E.D., you're an idiot if you think we can afford to have a weak military anytime in the next 50+ years.

aiosat-students.blogspot.com

www.aiosat.us

The long term nominal interest rate reflects BOTH expectations of future inflation as well as expectations of future real growth. At present, expectations of future real growth are very close to zero, so a 4-6% nominal interest rate reflects significant expectations of future inflation.

PS. This explanation does not ignore some of the other suggestions made in other comments.

Gold will be $2,000 before the end of next year.

I agree with you.

The real inflation is in the volume of commentators who are pitching their beliefs vs reality to fill the 500 channels of TV 24x7. People want to believe the 70's and 80's hyperinflation is just around the corner so TV feeds them what they want to here and keeps the debate alive to grab more viewers. And it helps pump up the price of our gold and oil investments too.

Morganovich, You cite pre-Clinton inflation rating that do not reflect hedonics (ie. the costs of computers dropping therefore costs of everthing else is down). What is the source of your of your calaculations for current inflation with pre-Clinton methodology?

I responded to this post here:

http://wp.me/pEWUs-3r

getting-

a number economists and services provide such data.

i am fond of SGS, and it has a very reasonable subscription price.

http://www.shadowstats.com/charts_republish#cpi

there is a good explanation of how CPI calculations have changed over time here:

http://www.shadowstats.com/article/consumer_price_index

O Bloody Hell-

Your see that $1,5 trillion bill coming down the pike just for the Iraqistan wars? On top of $700 billion a year just to maintain the fattest, least efficient, federal agency of them all, the DoD?

I am sure we cannot maintain this parasite--and our weakling, subsidized rural economies too.

Between the Pentagon and rural subsidies, we are out $1 trilloion a year--we could pay don debt nicely with that, in just 10-15 years be debt-free.

A huge standing, expensive military is not part of the American tradition--indeed, many of our Founding Fathers would regard such an institution as an horrid monstrosity.

Even Eisenhower, at the height of the Cold War, warned against the perma-war boys--as did James Monroe.

Maybe you are smarter than Eisenhower and Monroe--you probably wave a flag around more, and in some circles than substitute for thinking.

With low dollar and rates everyone is buying US assets. Will that lead to profit?

In short, the world is split by those that are playing poker and those that are ducking.

I also say that Inflation data is manipulated to not show real prices. The House bubble only reached those heights because it was taken out of Inflation index.

lucklucky

> O Bloody Hell-

Your see that $1,5 trillion bill coming down the pike just for the Iraqistan wars? On top of $700 billion a year just to maintain the fattest, least efficient, federal agency of them all, the DoD?

You're an idiot, Benny.

1) how it is that it will cost 1.5 trillion when it hasn't cost that much already? Cite your source, I'm betting it will be some blatantly ridiculous, utterly senseless, and totally biased anti-war organization at the heart of it.

> Maybe you are smarter than Eisenhower and Monroe--you probably wave a flag around more, and in some circles than substitute for thinking.

What "standing military" are you talking about? The one that involves, including civilian contractors, around a single percent of the American populace?

Oh, you're sooooo right, that's a GIANT force!! We is one giant militarized state!!

(for contrast, with US Census Data:

World War II (1941-1945)

Total Servicemembers (Worldwide)--16,112,566

US Census numbers for comparison

(1940) 132,164,569

% of populace: 12.2

World War I (1917-1918)

Total Servicemembers (Worldwide)--4,734,991

US Census numbers for comparison

(1920) 106,021,537

% of populace: 4.4

Civil War (1861-1865)

Total U.S. Servicemembers (Union)--2,213,363

Total Servicemembers (Conf.)--1,050,000

Total US citizens in military, Civil War: 3,263,363

US Census numbers for comparison

(1860) 31,400,000

% of populace: 10.4

And thanks for finding one idiotic, easily refuted point to bother with, rather than spending any time actually trying to refute the array of comments made, all of which are far more relevant than even the irrelevant point your ridiculous attempts to cite authority against relate to instead of actual facts.

Summary: A typical leftist twit incompetent argumentation attempt.

BTW, Benny, how much of the ONE SINGLE YEAR 1.7 TRILLION dollar deficit boondoggle from Obama have you complained about in the last month or so?

And then there's THIS stupidly ignorant and/or completely fabricated comment:

On top of $700 billion a year just to maintain the fattest, least efficient, federal agency of them all, the DoD?

Here's a pie chart -- in Billions:

Defense: 613 (not quite 700 billion, off by more than 10%, Benny)

Social Security: 612 (and that only because it's not being honest, and is about to go bankrupt within a decade as a result)

Medicare/Medicade: 682 (This would be the one which Obama wants to effectively EXPAND)

The DOD could almost certainly be pared down, as could just about every single agency out there. The difference is, of course, that the DoD is actually one of the few activities which your "founding fathers" that you supposedly revere (just for long enough to cite as authorities, of course, after which they can go hang as far as you're concerned) ACTUALLY identified as a legitimate purpose of the Federal government.

Would I cut the budget of the DoD? Yeah, by not more than 50% of what I cut the budget for from every OTHER US agency, as long as every dollar removed from those budgets goes to cutting taxes and/or paying off the deficit.

I'd also put Pierre Sprey and Boyd's old Fighter Mafia in charge of all military budgeting, if I had my way. Because then I'd know things were getting spent sensibly.

I'm not in charge, though, so I can't directly do much in that regard. But when MORONS like you start acting like cutting off the military's funding is even vaguely rational when there is so much else in the budget which is far more frivolous than even $1000 spanners, I do raise some objections.

"A nation with a goofy foreign policy needs a very serious policy of defense."

- P.J. O'Rourke, 'Parliament of Whores' -

And under Obama, it's blatantly clear that we are, indeed, getting the most absurdly goofy of all possible foreign policies.

.

"You're an idiot, Benny"...

I second that comment...

Regarding OBH's comment: "The buying power of the american public is vastly greater than at any time in history. This is reflected in their massively increased disposable income"...

Consider the following by eoncomist Stephen Rose as posted in Stats: An economist looks at the numbers

The Myth of the Declining Middle Class...

Here's the next part...

Bubble. Another financial fad with far too much money invested. The world is awash in cash.

"Question: How could all of these long-term rates be so low if there were inflationary pressures building up in the economy, which would lead to higher expected future inflation, and higher nominal long-term interest rates, and not historically low long-term rates?"

The answer to your question is in the data you presented. The answer is that long term interest rates are a lousy predictor of future inflation. Specifically, look at the period between 1970 and 1973. Interest rates were relatively low, however, the government had already done the damage that would cause high inflation in the 1970's. Nixon had abandoned the Bretton-Woods agreement devaluing the dollar. The growth of government was well underway in 1970-1973. Inflation was the product of these lousy policies.

Conversely, the period between 1980 and 1985 showed very high interest rates, yet in hind site, future long term inflation for this period was low. Reagan and Volker had followed policies to strengthen the dollar.

The current situation is that the world has been flooded with U.S. dollars. The fed has made a banana republic response by monetizing $300 billion in U.S. government debt, and indirectly monetizing more government debt by printing money to buy mortgage securities. The banks who sold the fed the mortgages, it turn used that monney to buy an additional $200 billion in U.S. treasuries.

$1.2 trillion dollars was created out of thin air to buy U.S. treasuries and mortgages. On a supply/demand basis, the supply of U.S. dollars surged. Initially, this frees up a lot of money for people to buy debt and drive down borrowing costs, but longer term, inflation WILL result unless you don't believe in supply and demand. Just like the period between 1970-1973 did a lousy job predicting future inflation, and the period between 1980 and 1985 did a lousy job predicting a drop in inflation. The current interest rates are doing a lousy job predicting future inflation.

Professor,

Where can I find current Long Term Corporate Interest Rates?

Post a Comment

<< Home