CARPE DIEM

Professor Mark J. Perry's Blog for Economics and Finance

Saturday, February 07, 2009

About Me

- Name: Mark J. Perry

- Location: Washington, D.C., United States

Dr. Mark J. Perry is a professor of economics and finance in the School of Management at the Flint campus of the University of Michigan. Perry holds two graduate degrees in economics (M.A. and Ph.D.) from George Mason University near Washington, D.C. In addition, he holds an MBA degree in finance from the Curtis L. Carlson School of Management at the University of Minnesota. In addition to a faculty appointment at the University of Michigan-Flint, Perry is also a visiting scholar at The American Enterprise Institute in Washington, D.C.

Previous Posts

- Girl Power: Employment and Higher Education

- Even The NY Times Understands...

- The "Man-Cession" Worsens, Record M-F Gap

- How About Adjusting for the Size of Labor Force?

- Jobless Claims As Percent of Payrolls

- Reason TV

- Cap-And-Trade Will Hammer Consumers

- Is Worst Behind Us? Online Ad Revenue Up in Q4

- Taxes: Tim and Tom

- Drill, Drill Drill: 20 Billion Barrels of Oil in C...

9 Comments:

I don't want to be stimulated. I want to take it easy. Why does our economy only work if we are nearly goosed to death?

Off topic

WHERE ARE THE NEW BANKS?

is it so hard to start up a bank?

Interest rate spreads are great now. 0% for money and lend it at 7%. Seems like a good business to get into.

A new bank would start off with NO BAD LOANS ON THE BOOKS.

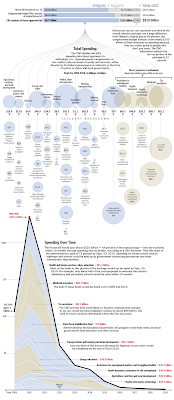

Professor Perry. This is an incredibly valuable diagram. If possible, please post a similar diagram of the final stimulus plan that Obama signs.

Thank you,

JCarr

The bank bailout was supposed to save the financial system and get the economy moving by making credit available again... $700 billion.

The economic stimulus package is supposed to save jobs and get the economy moving by making consumer spending available again... $780 billion.

http://hallofrecord.blogspot.com/2009/02/bailout-stimulus.html

Charles Krauthammer on the urgency of pork. As usual, he comes uncomfortably close to home.

This objective, incisive, understandable WASHINGTON POST summary of the stimulus package is outrageous! No, not because of all the pork, misallocation, delayed effect and spending primarily on government employment.

The outrageous aspect is that the editors from the POST let this expose' graphic be printed in the first place. Who's in charge back there? I want names, damnit!

When I read WASHINGTON POST articles, I fully expect such material to be completely sanitized and slanted to the left wing socialist viewpoint.

Someone at the paper screwed up and printed the truth. Another cherished American tradition has fallen.

Heads should roll, I tell you!

What a huge waste. Just earmarks.

Well, not quite the truth, Richard. That graphic's text is not really accurate when it says "because they are credits going to people who don't pay taxes." If it had said "people who don't pay _income_ taxes," then they would have been correct. But Lindsey from the Bush administration is going around saying that the best stimulus at this point would be to cut the payroll tax, because it helps not only the consumer (keeping more of their paycheck) but also helps the consumer's employer (since their share of payroll taxes equals the employee's share) by lowering the cost of employing people, thereby reducing unemployment.

So, most of those people getting credits are actually paying taxes, just not _income_ taxes, but rather _payroll_ taxes. Lindsey's idea of just cutting the payroll tax is better, more direct, less wasteful, and less prone to social engineering and other tinkering by politicians, but giving earned income tax credits to people who are paying payroll taxes isn't totally bad, albeit only 50% as good, since it helps the consumer but not the consumer's employer. And then of course the rest of the stimulus plan tries to deal with the other 50%, but since only the "pet" industries of the politicians get help, the impact on the unemployment rate will still be less helpful than if they payroll tax alone were cut.

"WHERE ARE THE NEW BANKS?"

I live in Collierville, TN, a suburb east of Memphis. We have eight different banks within a two mile radius of the center of the city. Two of the eight were built in 2008.

I never saw any signs of the credit crunch that Paulson claimed would destroy us if we didn't act. A VP at the Memphis regional headquarters for Bank of America said the same thing. In our area, for the past year, banks have lots of money but no borrowers.

Much of the spending isn't directed to correct the problems in the economy. It's similar to responding to a fire in Michigan by building fire engines for the state of Massachusetts.

Anyway, the Wall Street consensus expects an economic expansion to begin in mid-'09, although if Obama's stimulus plan is enacted, the contraction may be greater in the first half of '09, resulting in a larger contraction for the entire year.

Also, I may add, GDP only reflects the production side. On the consumption side, there are excess assets and goods (which is why there's deflation). During the 1981-82 recession, there was double-digit inflation and interest rates, because there was too much money chasing too few goods and too little capital (created by U.S. firms, i.e. the capital stock, or captured in the global economy), which is the complete opposite compared to today. So, when you add both the production and consumption sides, this recession is even milder.

Post a Comment

<< Home