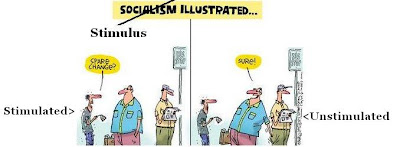

Stimulated vs. Unstimulated

(Click to enlarge.)

Any so-called stimulus program is a ruse. The government can increase its spending only by reducing private spending equivalently. Whether government finances its added spending by increasing taxes, by borrowing, or by inflating the currency, the added spending will be offset by reduced private spending. Furthermore, private spending is generally more efficient than the government spending that would replace it because people act more carefully when they spend their own money than when they spend other people's money.

Any so-called stimulus program is a ruse. The government can increase its spending only by reducing private spending equivalently. Whether government finances its added spending by increasing taxes, by borrowing, or by inflating the currency, the added spending will be offset by reduced private spending. Furthermore, private spending is generally more efficient than the government spending that would replace it because people act more carefully when they spend their own money than when they spend other people's money.~George Mason economist Richard Wagner

In stimulus package language, if Congress taxes to hand out money, one person is stimulated at the expense of another, who pays the tax, who is unstimulated.

~George Mason economist Walter Williams

10 Comments:

There's a problem with the first link. Both go to WW.

Nick: Both quotes are from the Walter Williams article. Walter quotes Richard Wagner.

Very good piece on fiscal stimulus by John Cochrane that you may find interesting.

Mark: Ooops! sorry. I got confused when they both seemed the same.

The argument did seem to assume though that GDP stayed the same, which is what one should be setting out to prove.

Sure, the LRAS curve is vertical, but if we get forced off it in the SR, anything which increases M or V should shift AD to the right, and help us get back to the LRAS, and so increase real income and output. Fiscal policy will usually increase V (upward pressure on interest rates, so V increases, for example).

Both Wagner and Williams get paychecks that are both directly and indirectly funded by various governments.

Ah, a little credibility problem here?

(not an endorsement of the stimulus package)

QT, that's an interesting article. However, much of it seems wrong (including some of the fiscal stimulus, which doesn't take into account the U.S. became an open economy after 1980). The root cause of the financial crisis is global imbalances. For example, China sold its goods too cheaply, which induced U.S. demand. China then lent its dollars too cheaply, which also induced U.S. demand. So, there was a virtuous U.S. cycle, of consumption and investment. The U.S. captured increasingly larger gains of trade, while China captured increasingly smaller gains of trade (e.g. through diminished U.S. marginal utility, and China earning greater negative returns, through low interest rates, inflation, e.g. not exchanging its goods for enough U.S. goods, currency exchange rates, etc.). The cycle became a boom that was unsustainable. Here's what an Oxford economist stated:

Through the quarter-century in which China has been opening to world trade, Chinese leaders have deliberately held down living standards for their own people and propped them up in the United States. This is the real meaning of the vast trade surplus—$1.4 trillion and counting, going up by about $1 billion per day—that the Chinese government has mostly parked in U.S. Treasury notes. In effect, every person in the (rich) United States has over the past 10 years or so borrowed about $4,000 from someone in the (poor) People’s Republic of China.

Any economist will say that Americans have been living better than they should—which is by definition the case when a nation’s total consumption is greater than its total production, as America’s now is. Economists will also point out that, despite the glitter of China’s big cities and the rise of its billionaire class, China’s people have been living far worse than they could. That’s what it means when a nation consumes only half of what it produces, as China does.

Neither government likes to draw attention to this arrangement, because it has been so convenient on both sides. For China, it has helped the regime guide development in the way it would like—and keep the domestic economy’s growth rate from crossing the thin line that separates “unbelievably fast” from “uncontrollably inflationary.” For America, it has meant cheaper iPods, lower interest rates, reduced mortgage payments, a lighter tax burden. The average cash income for workers in a big factory is about $160 per month. On the farm, it’s a small fraction of that. Most people in China feel they are moving up, but from a very low starting point.

This is the bargain China has made—rather, the one its leaders have imposed on its people. They’ll keep creating new factory jobs, and thus reduce China’s own social tensions and create opportunities for its rural poor. The Chinese will live better year by year, though not as well as they could. And they’ll be protected from the risk of potentially catastrophic hyperinflation, which might undo what the nation’s decades of growth have built. In exchange, the government will hold much of the nation’s wealth in paper assets in the United States, thereby preventing a run on the dollar, shoring up relations between China and America, and sluicing enough cash back into Americans’ hands to let the spending go on.

Peakie,

You have a point althought one cannot help but enjoy the delicious irony of the phrase "virtuous U.S. cycle, of consumption and investment".

Returning to the subject at hand, do you think the "stimulus" will help the U.S. economy and if so, why?

QT, contractionary fiscal policy preceeded the last three recessions, since the U.S. became an open economy around 1980. U.S. consumers exchanged dollars for foreign goods, while foreigners (e.g. export-led economies) exchanged dollars mostly for U.S. Treasury bonds. This imbalance needs to be corrected by U.S. fiscal policy, e.g. raising taxes when a U.S. expansion is underway, and cutting taxes to prevent a recession, coordinated with monetary policy.

I think a timely increase in government spending can spur demand in the short-run, to utilize some idle resources, although a tax cut, e.g. $2,000 per worker (including increasing unemployment benefits), is more effective.

Hey QT thanks for the link to Fiscal Stimulus, Fiscal Inflation, or Fiscal Fallacies?...

Interesting ideas to ponder...

Thank you Heritage Foundation: Huge bailouts a drop in bucket next to unpaid bill for retirees

I'm not buying into that Keynesian nonsense for a second...

Post a Comment

<< Home