Two Stories of Retail Sales

Bloomberg--Retail sales in the U.S. unexpectedly fell in February, indicating that declines in payrolls and home values and a surge in energy costs have pushed the economy into a recession.

Bloomberg--Retail sales in the U.S. unexpectedly fell in February, indicating that declines in payrolls and home values and a surge in energy costs have pushed the economy into a recession. First Trust Portfolios--Retail sales declined 0.6% in February while retail sales excluding autos declined 0.2%. The consensus had expected each to increase 0.2%. Total sales are up 2.6% versus last year, 4.4% excluding autos. Today’s data are consistent with sluggish growth in Q1, but not recession. If core retail sales (excluding autos, building materials, and gas) remain unchanged in March they will still be up at a 1.1% annual rate in the first quarter (versus the fourth quarter). In turn, given the boom in exports and rebound in inventories, this is consistent with our forecast of 2% real GDP growth in Q1.

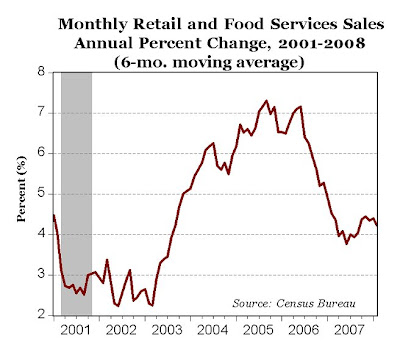

Comment: See my chart above of monthly retail sales, displayed as the percentage change from the same month in the previous year, which are still above 4% on a 6-month moving average basis. Although certainly below the peak levels in 2005 and 2006, retail sales growth is still above the recessionary levels of 2001 and 2002; like First Trust Portfolios suggest, this is more consistent with a period of sluggish consumer spending, not a recession.

4 Comments:

Yes, Mr. Professor, you can gulp your humble pie.

It's here (has been for months. The dreaded R word that you and many economists with republican agendas refuse to admit. How come most of us in "real" America without economic degrees have a better grasp of the sick eoncomy than you number crunchers?

From WSJ:

The U.S. has finally slid into recession, according to the majority of economists in the latest Wall Street Journal economic-forecasting survey, a view that was reinforced by new data showing a sharp drop in retail sales last month.

"The evidence is now beyond a reasonable doubt," said Scott Anderson of Wells Fargo & Co., who was among the 71% of 51 respondents to say that the economy is now in a recession.

How long have you been in recession, anonymus? I would guess since 1984.

A survey does not a recession make.

Where are 2 or more quarters of negative growth/decline in GDP or have you simply redefined the word recession?

Real retail sales paint a different picture. Hamilton states:

The 0.8% year-to-year real drop calculated in this conservative manner is the worst observation since 2002

Post a Comment

<< Home