Cut Tax Rates, Increase Tax Revenues From High-Income Groups; Isn't That a "Tax Hike for the Rich?"

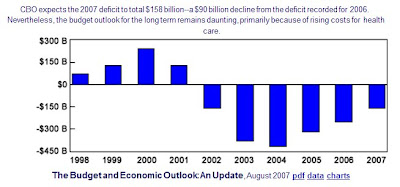

The Shrinking Budget Deficit:

From today's WSJ editorial:

From today's WSJ editorial:The Congressional Budget Office reported yesterday that the famously fearsome budget deficit is plummeting almost as fast as Congress's approval ratings (see top chart above, click to enlarge). The deficit this fiscal year is expected to be $158 billion, a meager 1.2% of GDP. Since the Bush tax cuts of 2003, the budget deficit has fallen by $217 billion mostly because of a continuing torrid pace of revenue growth.

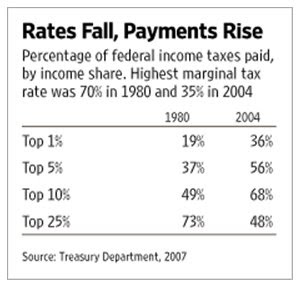

More surprisingly, the richest 1%, 5% and 10% of the taxpayers are shouldering a larger percentage of the income tax burden at the federal level than the tax estimators said they would had the Bush tax cuts never materialized (see middle chart above).

With a few exceptions, tax rates in America have been steadily falling for the past 25 years starting with the Reagan tax cuts of 1981. When Ronald Reagan entered the Oval Office in 1981, the highest tax rates on income, capital gains and dividends were roughly twice as high as today. The top marginal income tax rate in 1981, for example, was 70% compared to 35% today. These tax rate reductions haven't meant that the rich have escaped paying their "fair share" of taxes or that the burden has shifted to the middle class. The opposite has occurred. Over the past 25 years tax payments by the wealthy have continually risen almost in inverse proportion to the tax rates, as shown by the surprising results in the bottom chart above.

The supply-side revenue effects on the rich are remarkable: Tax rates on higher incomes have been halved, but the federal tax share of the top 1% has nearly doubled. And the budget deficit has fallen. That's what happens when tax policy gets the incentives right.

With a few exceptions, tax rates in America have been steadily falling for the past 25 years starting with the Reagan tax cuts of 1981. When Ronald Reagan entered the Oval Office in 1981, the highest tax rates on income, capital gains and dividends were roughly twice as high as today. The top marginal income tax rate in 1981, for example, was 70% compared to 35% today. These tax rate reductions haven't meant that the rich have escaped paying their "fair share" of taxes or that the burden has shifted to the middle class. The opposite has occurred. Over the past 25 years tax payments by the wealthy have continually risen almost in inverse proportion to the tax rates, as shown by the surprising results in the bottom chart above.

The supply-side revenue effects on the rich are remarkable: Tax rates on higher incomes have been halved, but the federal tax share of the top 1% has nearly doubled. And the budget deficit has fallen. That's what happens when tax policy gets the incentives right.

1 Comments:

Can you tell me how is it possible that the 25% wealthiest pay less taxes than the 5 or 10% wealthiest? Doesn't the 25% include the 5%? Something is wrong with this chart.

"[Warren] Buffett offered a million dollars to any fellow magnate who could prove he had higher tax rates than his secretary." Link

Nobody claimed for the million dollars yet. Now Mark, tell me how the rich pay their share of taxes.

Post a Comment

<< Home