Tax Revenues Rising, Budget Deficit Shrinking

New York Sun, "Incredible Shrinking Deficit:

The New York Times's Paul Krugman, in December, wrote that President Bush "plunged the budget deep into deficit by cutting taxes on dividends and capital gains even as he took the country into a disastrous war." Senator Clinton went to the Senate floor in February of this year to speak of the "fiscal recklessness" of the Bush administration, which she charged had contributed to "record deficits." In March, Senator Schumer, who is now the chairman of Congress's Joint Economic Committee, spoke of "budget excesses of the past six years" that have brought us "a mounting debt to the rest of the world."

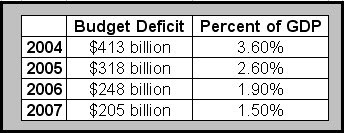

But as the shrinking figures above show, in fact the deficit is shrinking. When you look at it as a percentage of GDP, the decline is even more striking (see chart above, click to enlarge).

Wall Street Journal, "Down Goes the Deficit:

In 2003, Mr. Bush and Congress cut taxes on investment and high earners, and the happy result has been revenues aplenty.

And buoyant tax revenues are the major reason for this deficit reduction. So far this year tax receipts are up 7.5%, and that follows two years of double-digit increases. Federal tax receipts since 2004 are up by nearly $700 billion -- the largest ever revenue gain over a similar period. Tax collections have been so resilient that many private forecasters and the Congressional Budget Office are predicting a budget deficit well under $200 billion by year's end.

The New York Times's Paul Krugman, in December, wrote that President Bush "plunged the budget deep into deficit by cutting taxes on dividends and capital gains even as he took the country into a disastrous war." Senator Clinton went to the Senate floor in February of this year to speak of the "fiscal recklessness" of the Bush administration, which she charged had contributed to "record deficits." In March, Senator Schumer, who is now the chairman of Congress's Joint Economic Committee, spoke of "budget excesses of the past six years" that have brought us "a mounting debt to the rest of the world."

But as the shrinking figures above show, in fact the deficit is shrinking. When you look at it as a percentage of GDP, the decline is even more striking (see chart above, click to enlarge).

Wall Street Journal, "Down Goes the Deficit:

In 2003, Mr. Bush and Congress cut taxes on investment and high earners, and the happy result has been revenues aplenty.

And buoyant tax revenues are the major reason for this deficit reduction. So far this year tax receipts are up 7.5%, and that follows two years of double-digit increases. Federal tax receipts since 2004 are up by nearly $700 billion -- the largest ever revenue gain over a similar period. Tax collections have been so resilient that many private forecasters and the Congressional Budget Office are predicting a budget deficit well under $200 billion by year's end.

5 Comments:

Yea,

what world are you living in???

Are you "Bubble Boy"?

Revenues aplenty??? Now, I feel good, just,please, will somebody please buy me a gallon of gasoline??? Or pay my property taxes and house insurance??

Oh now! YOU calling someone else, "bubble boy"!...LOL!

So anonymous #1 what planet are you living on? Is it with 80 million lightyears of reality?

I've often wondered what a supporter of the SILK PONY must be like... If this is an indicator, well....

anoymous #2 says: "please buy me a gallon of gasoline"...

I feel your pain but maybe we should talk to the TAX MAN ...

How can we say that the budget deficit is shrinking when Bush's 100's of billions for his Iraqmire costs aren't included in the budget?

If tax revenues are rising it is because the top .01% are making billions, and so, yes, paying more taxes.

The Blackstone guy made some $27 billion in one day.

But as we have recently learned, many of the hundreds of billions in deals aren't taxed at all.

The "article" that the writer links is a far-right WSJ editoral opinion piece, not a factual report as he would have us believe.

Post a Comment

<< Home