Real GDP vs. Real Disposable Income

Robert Hall, Stanford University economist:

Robert Hall, Stanford University economist:"Our command over resources in the world is measured by our real income, not real GDP. Improved terms of trade--cheaper imports--raises our real income even if it does not affect productivity or output. The goal of economic policy should be to maximize the present value of real income. It's just as important to give US consumers access to cheap foreign goods as it is to make real GDP bigger."

Business Week blogger Michael Mandel:

"Now, this is a fascinating alternative perspective, since it seems to imply that real income growth should be the headline number for economic policy, and not real GDP growth."

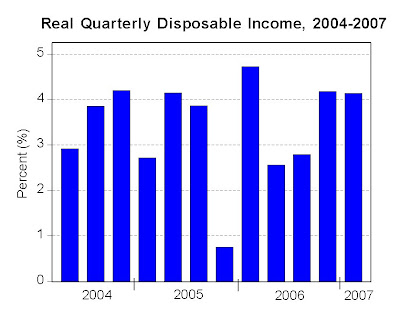

The graphs above show: a) real GDP growth, which was only 0.70% in the first quarter of 2007, and was 2-2.5% in the last three quarters of 2006, and b) the annualized growth rate of monthly real disposable income over the same period, which has grown at above 4% for the last two quarters. Over the last 10 quarters, real GDP growth has averaged 2.9% compared to 3.4% for real disposable income, or at a half percent higher rate.

Bottom Line: According to real disposable income, the U.S. economy is doing quite well and is growing at a healthy 4% rate this year, but that economic health and vitality is apparently not being captured by real GDP growth, which measures production. We should pay more attention to real income growth, and less attention to real GDP growth.

0 Comments:

Post a Comment

<< Home