Producer Price Food Inflation: Crude vs. Consumer

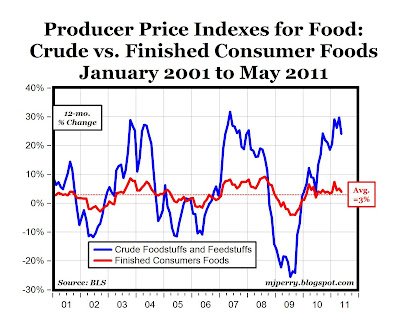

The chart above shows the annual inflation rates for: a) crude foodstuffs and feedstuffs (e.g. wheat, corn, animals for slaughter, peanuts, cottonseed, and soybeans), and b) finished consumer foods (pasta products, processed meats, bakery products, fresh fruits and vegetables, tree nuts, and eggs), based on today's BLS report on Producer Price Indexes through May.

It's interesting to note the following:

1. Inflation for crude foodstuffs and feedstuffs is much more volatile (monthly standard deviation of almost 14% over the last ten years) than inflation for finished consumer foods (standard deviation of 3%).

2. Double-digit inflation (0r deflation) rates in crude food items (like we've had for the last 11 months now starting last July) never translate into double-digit inflation (deflation) rates for finished consumer food products.

3. The current 12-month inflation rate of 4.0% through May for finished consumer foods is only slightly higher than the 3% average over the last ten years (see red line above).

4. The annual inflation rates in May of 24.1% for crude foodstuffs and 4% for finished consumer foods were both lower than the recent peaks of 29.1% for crude foodstuffs and 7.4% for finished consumer foods in February of this year.

MP: Based on the May PPI data for food, I think it's still hard to make a strong case for inflationary pressures building in the U.S. economy.

27 Comments:

Inflation?

With unit labor costs going down, not up, and commercial rents of all kinds--retail, office, industrial--are soft to falling?

How do you get inflation when 70 percent of business costs are falling?

Why is Richard Fisher, Dallas Fed Chief, such a dumb ass?

We had a recent round of commodities inflation, and a lot of speculative fever. Guess what? Commodities prices cannot keep going up for years at a stretch, ala stocks.

Consumers alter their behavior.

The commodities story is over.

Inflation is a non-story, a diversion.

Quote from Benjamin: "How do you get inflation when 70 percent of business costs are falling?"

By having the correct definition of inflation, which is the increase in the money supply. Costs do not set prices. Demand sets prices.

Aggregating higher commodity prices and government spending with flat wages, unemployment and falling housing costs does not equal zero in anybody's economic reality (except for clueless macro-economists).

If goods from China are helping keep U.S. prices down then, will the U.S. avoid Chinese inflationary pressures?

Speaking of food, it seems that Chairman Obama has set another record. How's that hopey-changey stuff workin' out for you?

benji-

you are contradicting yourself.

commodities are reflecting debasement of the dollar. they have been in a massive bull market since 2000 because we have had such loose money.

you champion this policy as conducive to exports.

yet you fail to see that so long as it goes on, dollar denominated commodities will continue to increase in price.

regarding this notion that these prices don't flow through to ppi, that's a reflection of ppi methodology, not a failure to pass prices on.

i talk to dozens of companies a week. most are raising prices.

consider:

both imports and exports in the US are up over 11% in price from a year ago.

that's 3.25 tn of the economy right there. add in the similar goods that we consume at home and you're easily at 1/3 of gdp.

1/3 x 11% = 3.6% inflation for the economy as a whole right there.

add in the rest of the economy, and it's awfully difficult to argue that inflation is under 5 or 6%.

far from being a diversion, inflation is THE story.

mistaking inflation for productivity is why the two recoveries since 1992 have been the slowest since ww2 in terms of employment.

it's not that the labor market has changed, it's that we are overstating real growth and calling the recessions shallower and shorter than they were.

Geoih:

The increase in the money supply is not inflation--unless there is not increase in real output. We have plenty of capital, labor and facilities laying around ready to be deployed when demand warrants.

Some GOP'ers (does GOP stand for Grifters on Parade?) saying we could have 5 percent GDP growth for many years, if only the feds would do things right. I actually agree with them.

Morgan- You keep on your Chicken Inflation Little hat. Maybe you can get a job at the Bank of Japan. Maybe some companies are raising prices, but others are dropping theirs. Try renting an office in downtown Los Angeles--you pay the sames as in 1981. Run a job ad on Craigslist and you will be inundated.

You cannot have sustained inflation if unit labor costs keep going down.

You rely on crank-frauds, like Shadowstats, for your info, and then bray about inflation.

What does your astrologer say about the DJIA for the second half of the year?

benji-

your economic ignorance never ceases to astound.

"You cannot have sustained inflation if unit labor costs keep going down."

sure you can.

that's an absurd statement.

what's more, you are still making a methodological mistake and reasoning in a circular fashion.

you need to use inflation to calculate unit labor costs.

therefore, you cannot use unit labor costs to claim anything about inflation.

econ degree huh?

this kind of reasoning would get you flunked out of econ 101.

you do this all the time.

it just highlights that you have no idea what you are talking about.

regarding the dow, weren't you the big bull 700 points higher?

nice call bubble baby.

Morganovich says: "both imports and exports in the US are up over 11% in price from a year ago.

that's 3.25 tn of the economy right there. add in the similar goods that we consume at home and you're easily at 1/3 of gdp.

1/3 x 11% = 3.6% inflation for the economy as a whole right there."

It should be noted, the dollar depreciated roughly 10% over the past year, which makes imports more expensive and exports cheaper.

So, it's a wash, i.e. the rise in import prices were offset by the rise in export prices, except we imported more than exported, e.g. $500 billion trade deficit, which is a little over 3% of GDP (in a $15 trillion economy).

Of course, much or most of the import price rise was from commodities.

Also, I may add, I say it's a wash, because, as you say, prices rose 11% (from imports) and income rose 11% (from exports).

U.S. trade deficit grew 33 pct in 2010

February 11, 2011

The United States ran a trade deficit of $497.8 billion in 2010, an increase of 32.8 percent over the previous year.

At $40.58 billion, the December 2010 trade deficit was in line...Excluding petroleum imports, the December 2010 deficit would have been $15.3 billion.

The U.S. trade deficit with China rose 20.3 percent last year to $273.06 billion, accounting for 43 percent of the overall gap between exports and imports.

So, Morganovich, if I trade you $1 for $1, and next year I trade you $1.11 for $1.11, did my inflation rate really go up (or my purchasing power really go down)?

Quote from Benjamin: "The increase in the money supply is not inflation--unless there is not increase in real output."

As I said, your definition is wrong. You're confusing objective causes (increased money supply) with subjective symptoms (changes in prices and costs).

Increasing the money supply is inflation. It benefits those who are at the front of the chain that receive the new money first (e.g., the state and the state's cronies) at the expense of those at the end of the chain (e.g., most tax payers).

All the macro-economic gymnastics to justify increasing the money supply are just apologies for the state and its cronies. Keynesianism, monetarism, etc., are about politics, not economics.

"So, Morganovich, if I trade you $1 for $1, and next year I trade you $1.11 for $1.11, did my inflation rate really go up (or my purchasing power really go down)?"

peak-

you are missing the point. exports do not cause deflation (in fact they tend to cause inflation by making commodities scarcer at home). your whole mathematical assumption here is wrong. the "wash" you claim would only be relevant to trade balance, not domestic prices.

if we export corn, and corn is up 20% in price, what do you think happened to the price of corn that we consumed here? it's a global market. the domestic prices for items we export are going to be similar to those of the ones we sell abroad.

that is how i am using it as a gauge for domestic inflation.

(and btw, exports were up 9% and imports up 12.5, that 11 is an average)

Morganovich, you're making the assumptions that high export and import prices suggest the real inflation rate is understated and are a larger part of the economy.

However, international trade has a small net effect on the general price level, in part, because:

1. The U.S. may export a high inflationary good, e.g. food, and import another high inflationary good, e.g. oil, and international trade is a relatively small part of the economy.

2. The high inflation goods, e.g. raw materials and energy, are a small part of input costs.

The PPI has a more powerful effect on consumer prices than export and import prices:

Producer Prices Remain a Worry for Manufacturers

June 14, 2011

"Producer prices are up 7.2 percent year-over-year, with businesses continuing to cite rising energy and raw material costs as a major concern.

Over the last year, producer prices for manufactured goods have increased 8.9 percent.

The falling prices for energy and food will help to ease a tension that has squeezed both consumers and businesses over the past few months.

With that said, manufacturers continue to experience growth in raw material prices, and the buildup in these costs is a major challenge that is squeezing their profits."

peak-

you are still missing this.

you are thinking in terms of trade balance, not inflation.

food exports from the US were up 30% year to year.

that means that our own food prices were up the same.

we didn't only mark up the exports.

your whole reasoning is flawed.

if you get paid 10% more and prices go up 10%, that is 10% inflation, not zero.

i'm using import and export prices because they are a better data series that CPI. they are better documented and they are not subjected to all the BLS's adjustments.

the price of our food went up every bit as much as that we exported, just like our capital equipment did etc.

the price of things we made here went up as much as those we imported as well. markets balance like that. it's not exact, but it tends to even out.

seriously, ask yourself this:

in what plausible scenario can out import prices be up 12.5%, or export prices be up 9%, and yet our domestic price level is only up 2%?

there is simply no way that is possible.

Morganovich says: "in what plausible scenario can out import prices be up 12.5%, or export prices be up 9%, and yet our domestic price level is only up 2%?"

Consumer prices can remain low from the following:

1. Wages or labor costs, which remain depressed, are about two-thirds of production costs.

2. Higher producer, export, or import prices can be offset by the high levels of profit and productivity.

Morganovich says "if you get paid 10% more and prices go up 10%, that is 10% inflation, not zero."

Technically, inflation went up, only because the money supply went up. However, purchasing power is unchanged, e.g. exchanging my good at twice the price for your good at twice the price.

"However, purchasing power is unchanged, e.g. exchanging my good at twice the price for your good at twice the price."

no. that is not true at all.

what if you had savings? that purchasing power would be down 10%.

you are describing terms of trade, not inflation.

consider ti this way:

your salary is $100k.

you buy goods and services every year = $100k.

those prices go up 10% and so does your salary. that leave that buying power unchanged.

but, if you have even $1 in a checking account, you lost buying power.

to look at it in national terms if the price of corn we sell and oil we buy are both up 30%, that may cancel out in terms of trade,

but it's still inflation. both cost more. income in the us is not up proportionally. our domestic oil and corn are up in price. our savings buy less of them as do our incomes.

you can't just cancel out imports and exports and claim no inflation.

we consumer much more food here than we export. that 30% inflation is happening in the US.

"1. Wages or labor costs, which remain depressed, are about two-thirds of production costs."

in manufacturing? not even close. you need to check your numbers. that is pure fiction and contrary to the arguments you guys are making about capital equipment driving productivity.

you are also wrong that wages are not up. they are not up a great deal, but they are up 2% year on year.

http://www.bls.gov/news.release/eci.nr0.htm

so, 2% wage increases, and 30% food cost hikes.

12.5% import cost hikes.

12.5% cost hikes in all the goods we import, but also produce here (cars, furniture, whatever)

9% hikes in the price of all the goods we export but also produce here (like food, or capital goods or medicine)

we are seeing a massive erosion of buying power here.

MP: Based on the May PPI data for food, I think it's still hard to make a strong case for inflationary pressures building in the U.S. economy.

It is hard to make the case only if you do not drive, buy insurance, pay for tuition, health care, or eat. Those of us that do can see the inflation quite clearly.

"you can't just cancel out imports and exports and claim no inflation."

If you trade something that's 9% more expensive for something that's 12% more expensive, your inflation rate isn't 9% or 12%.

"12.5% cost hikes in all the goods we import."

Petroleum is over 60% of imports, not over 60% of U.S. GDP.

"what if you had savings? that purchasing power would be down 10%."

If I exchanged my good for your cash and saved it (instead of trading my good), I'd lose if prices rise more than interest rates, or if my home currency appreciates (because I'd need more dollars for one unit of my currency).

VangelV says "It is hard to make the case only if you do not drive, buy insurance, pay for tuition, health care, or eat. Those of us that do can see the inflation quite clearly."

The only price rise I've seen over the past year is gasoline. My income has also gone up.

Housing, auto payments, food, insurance, health care co-payments, etc. have been unchanged or flat.

I know the state has been aggressive in raising and collecting taxes, and raising and imposing fines (in many ways).

I also know, many unemployed, who haven't found decent jobs, are suffering.

To follow up on my statement: If you trade something that's 9% more expensive for something that's 12% more expensive, your inflation rate isn't 9% or 12%.

If $1 becomes $1.09 and import prices rise 12%, your inflation rate is effectively a little over 3%, or a deterioration in terms-of-trade.

The only price rise I've seen over the past year is gasoline. My income has also gone up.

You are telling me that you don't eat? Or that you did not notice the fact that your fruits, vegetables, grains, meat, etc., are all more expensive? Did your kids' tuition go down or stay flat? Most universities increased tuition by around 4 to 8 per cent. Health insurance costs were reported up by around 9% last year. Energy prices were up around 20%. The price of gold is up around 23% from this time last year and even after the correction silver is still up by 90%. Corn prices have almost doubled. Wheat prices were up around 75%. Cotton prices went up.

You may not notice the increases as much in the final product because companies are quite good at using packaging changes to hide the price increases. If you drop the size of a tin of tuna by 20% you do not have to show much of a price increase that will be noticed by consumers. If a loaf of bread has 23% less flour the slight price increase will not look as large to a consumer who has not noticed the change. If your jeans use a different weight cotton you can keep the price of the jeans the same without signalling to the customer that the price has gone up.

The days when China was able to push deflation into the US market have run their course. We have now entered a period during which the USD is vulnerable as are all fiat currencies and we see major increases for many essential goods and services even as prices for overbuilt housing keeps going lower. But rents are not heading lower. Insurance is not falling. Food and energy costs are not going down. Tuition is not falling. For those who live in the real world inflation is a serious problem. For the BLS statisticians it is hardly noticeable because they make little effort to see things as they are.

VangelV, one thing I've learn from women is to buy on sale, and I stock up when there are sales.

I've noticed prices have gone up and down, not just up.

To be quite honest, I've noticed nothing has gone up, that I buy, except gasoline.

And I buy fruits and vegetables, grains, can food, dried foods, meat & fish, etc., and my other living expenses haven't gone up.

Also, I may add, milk is still cheaper than gasoline.

To reply to some of your specific comments, the solid white can tuna is often on sale (and still very cheap, although perhaps in a smaller can), and I buy the new Oroweat sandwich thins, which I don't end up throwing away a lot of bread when it expires anymore.

I've completed school. Tuition was also going up when I was in school.

I noticed, perhaps it was a couple of years ago, there was a period, e.g. a few months, when there were fewer sales at supermarkets, but that hasn't been the case recently.

VangelV, one thing I've learn from women is to buy on sale, and I stock up when there are sales.

I agree. This makes sense no matter how much money you have.

I've noticed prices have gone up and down, not just up.

I agree again. The price of some items such as electronics and digital media have fallen substantially. But the non-loss-leader price of basic items have not fallen.

To be quite honest, I've noticed nothing has gone up, that I buy, except gasoline.

Your experience is different than the majority of people on Main Street. They have seen their health care costs go up, tuition and insurance go up, food prices go up, gold and silver prices go up. Etc., etc., etc.

And I buy fruits and vegetables, grains, can food, dried foods, meat & fish, etc., and my other living expenses haven't gone up.

I buy in Canadian dollars and have seen prices go up. How is it that people who buy in American dollars, which have gone down in purchasing power, can see the price of grains, fruits and vegetables, etc., go down? Even the BLS does not claim this to be true and has been showing increases.

Also, I may add, milk is still cheaper than gasoline.

Thank subsidies for farmers and taxes on gasoline for that.

To reply to some of your specific comments, the solid white can tuna is often on sale (and still very cheap, although perhaps in a smaller can), and I buy the new Oroweat sandwich thins, which I don't end up throwing away a lot of bread when it expires anymore.

My point is still valid. Go look at a place like Costco, where prices track the wholesale markets very closely and see the trends. You will see prices per unit of weight rising, not falling.

I've completed school. Tuition was also going up when I was in school.

In 1981 it cost you $6,000 in tuition to attend Harvard. You paid an additional $1,090 for room and $1,590 for board. Add student service fees and it added up to $9,170. Twenty years later the figures stood at $23,439 for tuition, $4,190 for room, $3,792 for board, $1,689 for student fees for a total of $33,110. Today we have tuition at $36,305, room at $7,811, board at $4,990 and student fees at $2,360, for a total of 51,466. In the previous decades it was possible to justify the increases in tution fees because of the increases in salary expectations. But that is no longer true when Harvard graduates are working at meaningless jobs that require no degree and begin with a hundred grand or more in student debt.

I also believe that Mark may have covered this. If not, take a look at the trends.

Post a Comment

<< Home